- United States

- /

- IT

- /

- NYSE:IBM

International Business Machines (NYSE:IBM) Collaborates With Juniper Networks To Enhance AI-Driven Network Solutions

Reviewed by Simply Wall St

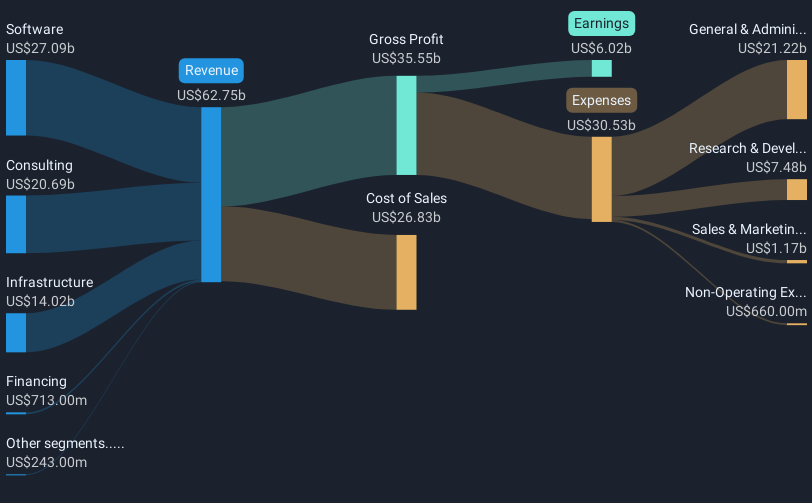

International Business Machines (NYSE:IBM) recently announced an expanded collaboration with Juniper Networks focused on AI integration and enhanced network management, likely contributing to the 12% rise in IBM's stock price last month. Despite a generally volatile market, with the Nasdaq experiencing a 5.5% monthly decline and the S&P 500 down 3%, IBM's initiatives in AI-driven network management and expanded client partnerships, such as those with Penn State and Telefonica Tech, positively impacted the company's market perception. IBM's recent earnings report, which showed a modest revenue increase paired with a decrease in net income, contrasted with broader earnings trends but did not deter investor interest amidst new AI applications. The broader market saw fluctuations with tech stocks particularly hit by earnings and policy uncertainties; however, IBM's focus on AI solutions provided a buffer against these broader market challenges.

Click here and access our complete analysis report to understand the dynamics of International Business Machines.

Over the past five years, IBM has delivered a total shareholder return of 157.27%, which highlights its resilient performance despite a modest 0.1% annual profit growth in the same period. Notably, the expansion of IBM's AI capabilities and initiatives such as the introduction of IBM Quantum innovations in late 2021 have played key roles in driving investor confidence. The collaboration with major companies, including the 2020 agreement with Coca-Cola European Partners to transition to a hybrid cloud environment, further underscores IBM's commitment to innovation and client satisfaction in the tech sector.

Despite facing challenges such as a one-time loss of US$3.9 billion impacting its financial results up to December 2024, IBM's stock performance remained strong. The consistent payment of quarterly dividends, as seen in recent declarations including a US$1.67 per share payout in 2025, has also been a significant factor in attracting long-term investors. Over the past year, IBM's return exceeded both the US IT industry and the broader market, reflecting its ability to adapt and thrive through industry shifts and economic uncertainties.

- Get the full picture of International Business Machines' valuation metrics and investment prospects—click to explore.

- Uncover the uncertainties that could impact International Business Machines' future growth—read our risk evaluation here.

- Already own International Business Machines? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the United States, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Adequate balance sheet average dividend payer.