- United States

- /

- IT

- /

- NYSE:IBM

International Business Machines (IBM) Reports Revenue Increase & Affirms Dividend

Reviewed by Simply Wall St

International Business Machines (IBM) recently released its second-quarter results, showing notable revenue and net income growth. The company's share price rose 23% last quarter, significantly higher than the broader market's 2% rise. IBM’s ongoing commitment to dividends, with a declared $1.68 per share payout, underscores its focus on shareholder returns. Strategic partnerships, like those with Agassi Sports Entertainment Corp. for AI in sports and collaborations in security and cloud solutions, further enhance IBM's technological capabilities. These initiatives have likely bolstered investor confidence, contributing to the positive price movement and aligning with broader market trends.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

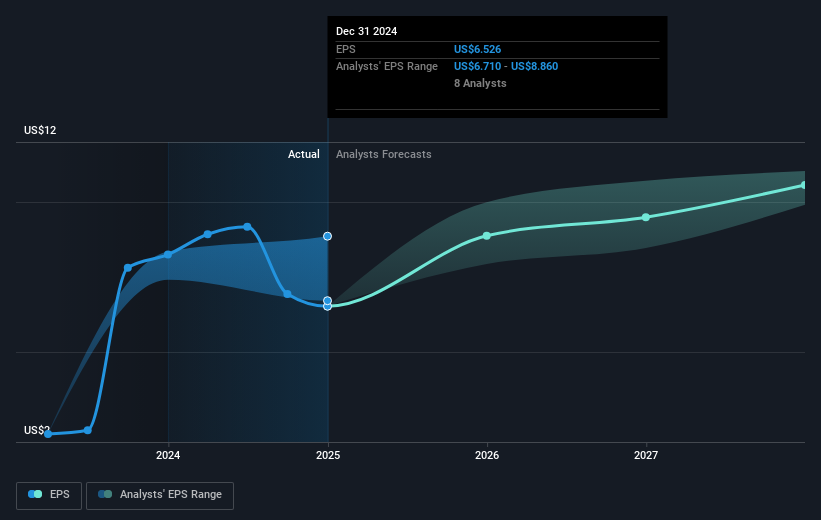

The recent news of IBM’s quarterly results and strategic collaborations could have a meaningful impact on its long-term narrative. The company's focus on enhancing its technological capabilities through partnerships, particularly in AI and cloud solutions, aligns with its revenue growth intentions despite potential headwinds in these sectors. The 23% share price rise last quarter exemplifies investor confidence, though the current price of US$282.01 exceeds the consensus price target of US$273.36, suggesting market expectations might be outpacing analyst projections. Moreover, despite a strong five-year total shareholder return of 194.20%, it indicates a significant appreciation, diverging from the market's lower annual gain of 17.7% last year.

Relative to the US IT industry, which achieved a 31.2% increase over the past year, IBM's performance suggests it has outpaced broader market trends. However, considering the conservative revenue and earnings forecasts, any unexpected economic instability or sectoral slowdown might pose risks to revenue and earnings growth. The ongoing revenue concerns hinge on IBM's capability to manage industry fluctuations and consultative service demand, potentially challenging forecasted growth rates if economic uncertainties persist. Despite these challenges, IBM’s proactive measures, along with its solid dividend payouts, underscore its commitment to enhancing shareholder returns, balancing its higher current valuation against competitive pressures.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)