- United States

- /

- IT

- /

- NYSE:IBM

IBM (IBM): Revisiting Valuation After a Strong 3-Month and Year-to-Date Share Price Rally

Reviewed by Simply Wall St

International Business Machines (IBM) has climbed roughly 22% over the past 3 months and more than 40% year to date, a move that has investors rethinking how this old-guard tech name is being valued.

See our latest analysis for International Business Machines.

That surge has not come out of nowhere, with investors rewarding steady cloud and AI execution as recent earnings and guidance resets have shifted the narrative toward profitable growth. Even after short term share price wobbles, IBM’s strong multi year total shareholder returns suggest momentum is still building rather than fading.

While IBM’s run has been impressive, it is worth seeing how other large tech names are shaping up by exploring high growth tech and AI stocks as potential additions to your watchlist.

With IBM now trading above analyst targets and showing double digit earnings growth, the key question is whether investors are overpaying for this AI and cloud pivot or if the market still underestimates its next leg of growth?

Most Popular Narrative Narrative: 6.3% Overvalued

With International Business Machines closing around $309.24 versus a narrative fair value near $290.89, the story leans toward a premium built on future execution.

The analysts have a consensus price target of $281.316 for International Business Machines based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $350.0, and the most bearish reporting a price target of just $198.0.

Want to see why modest revenue growth, fatter margins and a rich future earnings multiple still add up to a premium valuation? The key assumptions may surprise you.

Result: Fair Value of $290.89 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer software growth or delayed quantum commercialization could quickly challenge these optimistic assumptions and force investors to reassess IBM’s premium valuation.

Find out about the key risks to this International Business Machines narrative.

Another View: Valuation Through Earnings

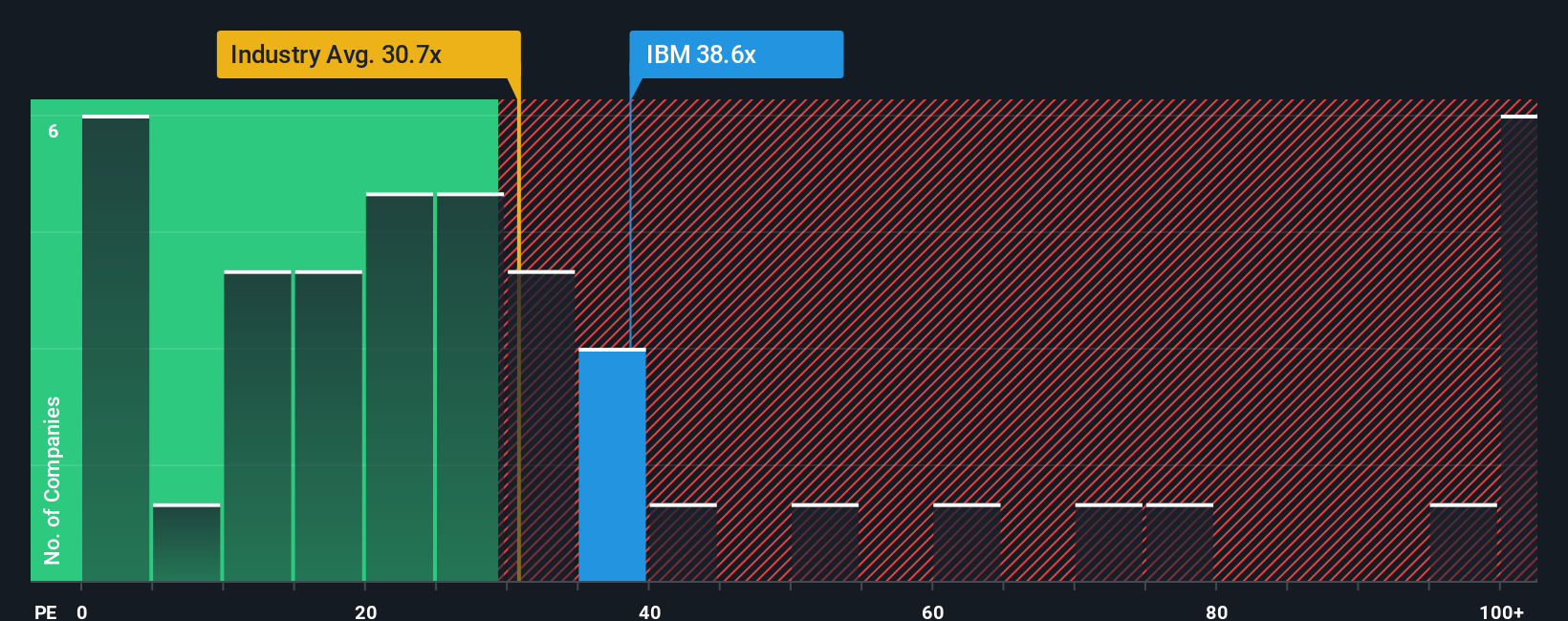

While the narrative fair value points to IBM being about 6% overvalued, its current price to earnings ratio of 36.5x looks stretched versus the US IT industry at 29.9x and peers at 22x, yet still below a fair ratio of 39.3x. This raises the question of whether this represents a justified quality premium or a late cycle risk for new buyers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own International Business Machines Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a custom view in just minutes, Do it your way.

A great starting point for your International Business Machines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore powerful screeners on Simply Wall St to help you identify opportunities that others might overlook.

- Scan these 3606 penny stocks with strong financials to find potential multi baggers that already have solid financials and room to grow.

- Focus on these 26 AI penny stocks to identify companies involved in AI that combine innovative technology with compelling growth profiles.

- Review these 907 undervalued stocks based on cash flows to discover stocks that appear undervalued based on estimates of future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)