- United States

- /

- IT

- /

- NYSE:IBM

IBM (IBM): Assessing Valuation as Shares Mark Modest Moves and Momentum Builds

Reviewed by Kshitija Bhandaru

International Business Machines (IBM) shares have shifted slightly in recent trading, reflecting modest moves over the past week. Investors watching IBM may be weighing recent returns as well as longer-term trends in revenue and net income growth.

See our latest analysis for International Business Machines.

This year, momentum has clearly been building for IBM, with a strong year-to-date share price return of 26% and an impressive 22% total shareholder return over the past twelve months. While the past few days saw some profit-taking, longer-term investors have enjoyed powerful compounding gains of nearly 160% over three years. This reinforces IBM’s renewed growth narrative.

If you find IBM’s trajectory interesting, it could be the perfect time to expand your search and discover fast growing stocks with high insider ownership

With IBM’s recent gains and just a slight discount to analyst targets, investors now face a key question: Is this momentum underappreciated, or has the market already factored in all of IBM’s future growth potential?

Most Popular Narrative: 1.2% Undervalued

With International Business Machines closing at $277.82 and the most-followed narrative assigning a fair value of $281.32, expectations for just a modest upside are being set by this consensus. The market’s attention is turning to the main catalysts and quantitative drivers that underpin this near-fair valuation.

IBM's focused strategy on hybrid cloud and AI is driving solid revenue growth, providing cost savings, productivity gains, and scalability for clients. This is expected to continue supporting their revenue trajectory. The launch of the z17 mainframe with enhanced AI acceleration and energy efficiency is anticipated to drive significant customer adoption. This can potentially impact infrastructure revenue and net margins due to differentiation and pricing power.

What bold financial forecasts did analysts use to craft this price target? Growth in key segments, future margin expansion, and a not-so-conservative profit multiple all play starring roles. Eager to uncover the assumptions that make or break this valuation? Discover the mechanisms behind why the narrative sees IBM as nearly fairly valued.

Result: Fair Value of $281.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, consulting revenues could stall if macro uncertainty delays client projects. In addition, heavy reliance on consumption-based software may make growth vulnerable to downturns.

Find out about the key risks to this International Business Machines narrative.

Another View: Multiples Tell a Different Story

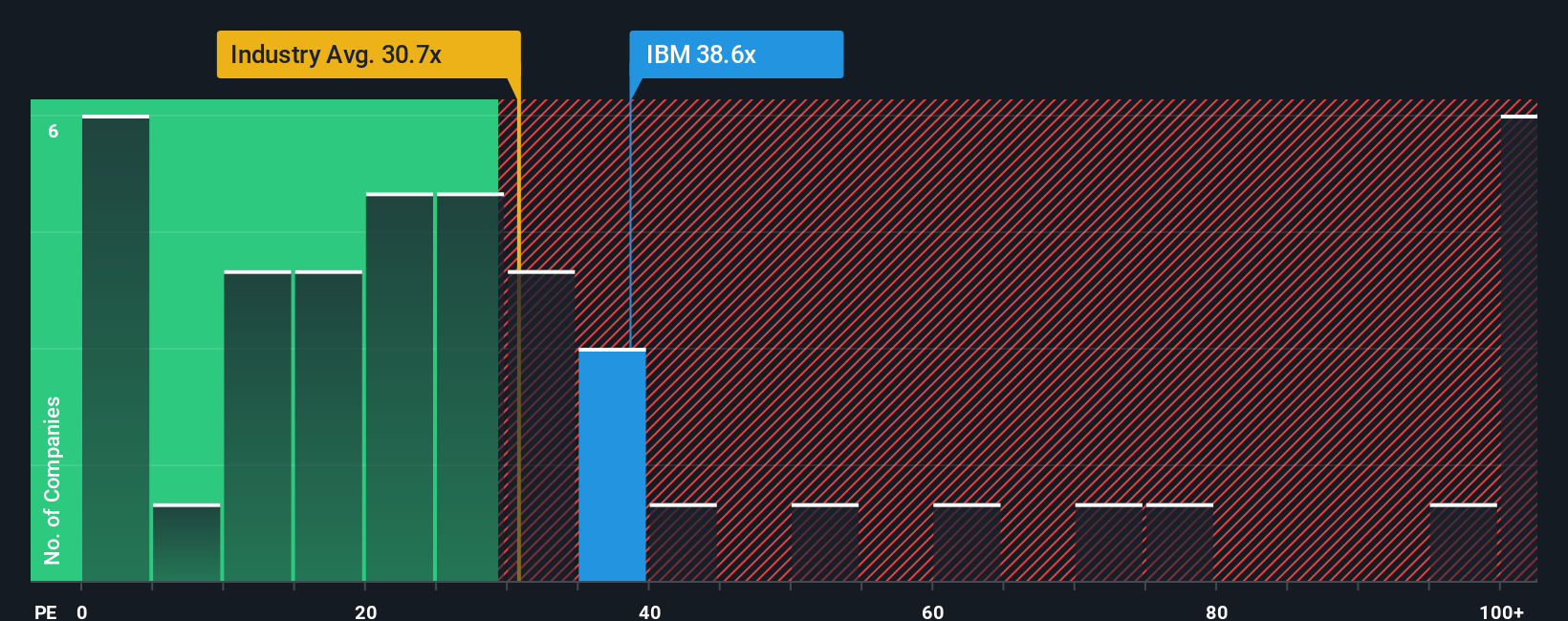

While analysts see IBM at just a slight discount to fair value, the valuation based on its price-to-earnings ratio offers a starker contrast. IBM trades at 44.2 times earnings, which is significantly higher than both the US IT industry average of 30.7 and its peers at only 19.6. Even our fair ratio peg is 43.4.

This relatively high multiple might signal over-optimism or valuation risk unless earnings growth far exceeds expectations. Does IBM really justify a bigger premium than almost all of its competitors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own International Business Machines Narrative

If you’re not convinced by the prevailing view or prefer to dig into the numbers yourself, the tools are there. It takes under three minutes to craft your own take. Do it your way

A great starting point for your International Business Machines research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Opportunities?

Don’t let your momentum stop with IBM. Make your next great move by finding companies positioned for growth and income with these powerful screening tools:

- Grow your portfolio faster by checking out these 24 AI penny stocks, which are transforming entire industries with cutting-edge artificial intelligence and automation.

- Unlock reliable income streams by tapping into these 19 dividend stocks with yields > 3%, which offers yields above 3 percent and strong financial health.

- Jump ahead of the crowd and uncover hidden value in these 899 undervalued stocks based on cash flows that the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives