- United States

- /

- Software

- /

- NYSE:HUBS

HubSpot (NYSE:HUBS) Projects 16% Revenue Growth; Initiates $500 Million Share Buyback

Reviewed by Simply Wall St

HubSpot (NYSE:HUBS) has announced a significant share repurchase program, purchasing up to $500 million of its shares, while also forecasting a 16% year-over-year revenue growth for 2025. Concurrently, major board changes saw Brian Halligan stepping down as Executive Chairperson. Despite reporting a net loss for Q1, these developments appear to have bolstered market confidence, contributing to a 36% rise in its stock price over the past month. This stands out from broader market movements, which have been fairly stagnant amidst fluctuating sentiments surrounding ongoing U.S.-China tariff negotiations.

HubSpot has 2 weaknesses we think you should know about.

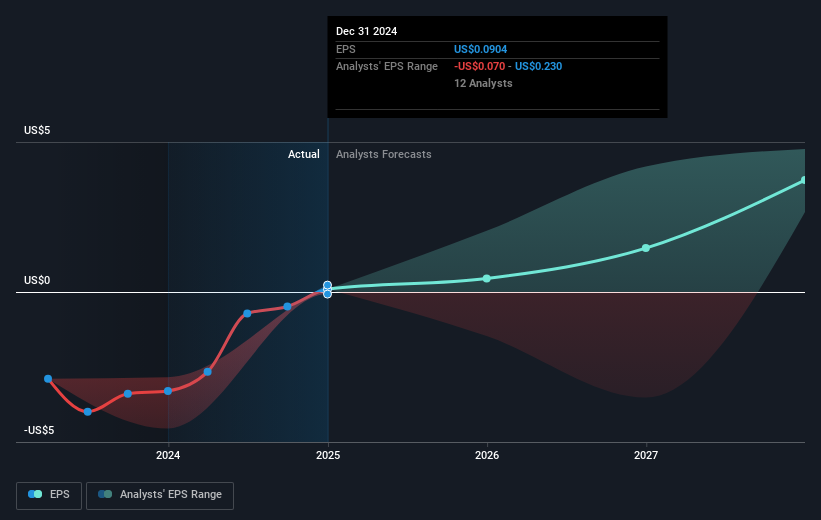

The recent announcements regarding HubSpot's share repurchase program and board changes could potentially impact its long-term strategic trajectory. The introduction of a US$500 million share buyback might support the stock price by reducing the number of outstanding shares, indirectly enhancing earnings per share and potentially attracting more investors. Concurrently, the leadership transition could bring fresh perspectives that might support the company's forthcoming growth strategies and innovations, especially in AI and data integration, as highlighted in their narrative.

Over the past five years, HubSpot's total shareholder return, including dividends, was very large at 264.78%, reflecting significant value creation for long-term shareholders. However, when we look at the shorter term, the stock's performance has been mixed. While it underperformed the US Software industry, which returned 15.2% over the past year, the company's fundamentals suggest potential for future improvement.

The forecasted revenue growth rate of 13.1% annually until 2028, bolstered by AI advancements and the frame.ai acquisition, suggests potential revenue enhancements. Despite current challenges, analysts predict a substantial rise in earnings to US$279.6 million by 2028 from US$4.63 million today. Such forecasts underscore the company's growth potential but also highlight varied analyst expectations. Consequently, the current share price of US$612.69 remains below the consensus price target of US$763.10, reflecting a potential upside of 19.7%, contingent on fulfilling growth expectations and managing risks effectively.

Evaluate HubSpot's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives