- United States

- /

- Software

- /

- NYSE:HUBS

HubSpot (HUBS): Assessing Valuation After Strong Q3 Growth, AI Strategy Update, and Stable Margins

Reviewed by Simply Wall St

HubSpot (HUBS) heads into its upcoming UBS TMT Conference appearance with fresh momentum, after Q3 results showed faster billings growth, steady margins, and AI driven product progress that could matter more than near term earnings noise.

See our latest analysis for HubSpot.

That backdrop helps explain why, despite upbeat Q3 fundamentals and ongoing AI buzz, HubSpot’s 1 month share price return of minus 24.11 percent and year to date share price return of minus 46.47 percent look so harsh. At the same time, the 3 year total shareholder return of 38.13 percent shows the longer term growth story is still intact, but momentum has clearly cooled in the near term.

If HubSpot’s reset has you rethinking your tech exposure, it could be a good moment to explore other high growth names through high growth tech and AI stocks and compare how their stories stack up.

With shares now trading at a steep discount to Wall Street targets and intrinsic value estimates, but growth still solid, is HubSpot quietly turning into a mispriced compounder, or is the market rightly discounting its future expansion?

Most Popular Narrative Narrative: 37.1% Undervalued

Compared with HubSpot’s last close at $373.32, the most followed narrative pins fair value far higher, framing today’s selloff as a potential mispricing.

Rapid adoption and expansion of AI-based functionality such as Customer Agent, Prospecting Agent, and connectors to leading LLMs are driving higher customer engagement, sticky workflows, and early-stage monetization opportunities especially via credit-based AI features, setting the stage for stronger net dollar retention and potentially higher net margins in 2026 and beyond.

Curious how ambitious revenue ramps, margin lift, and a punchy future earnings multiple all come together to justify that upside signal? The full narrative reveals the playbook.

Result: Fair Value of $593.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside view still depends on successful AI monetization and stable SMB demand, both of which are vulnerable to macroeconomic slowdowns and intensifying competition from larger SaaS suites.

Find out about the key risks to this HubSpot narrative.

Another View: Multiples Tell a Tougher Story

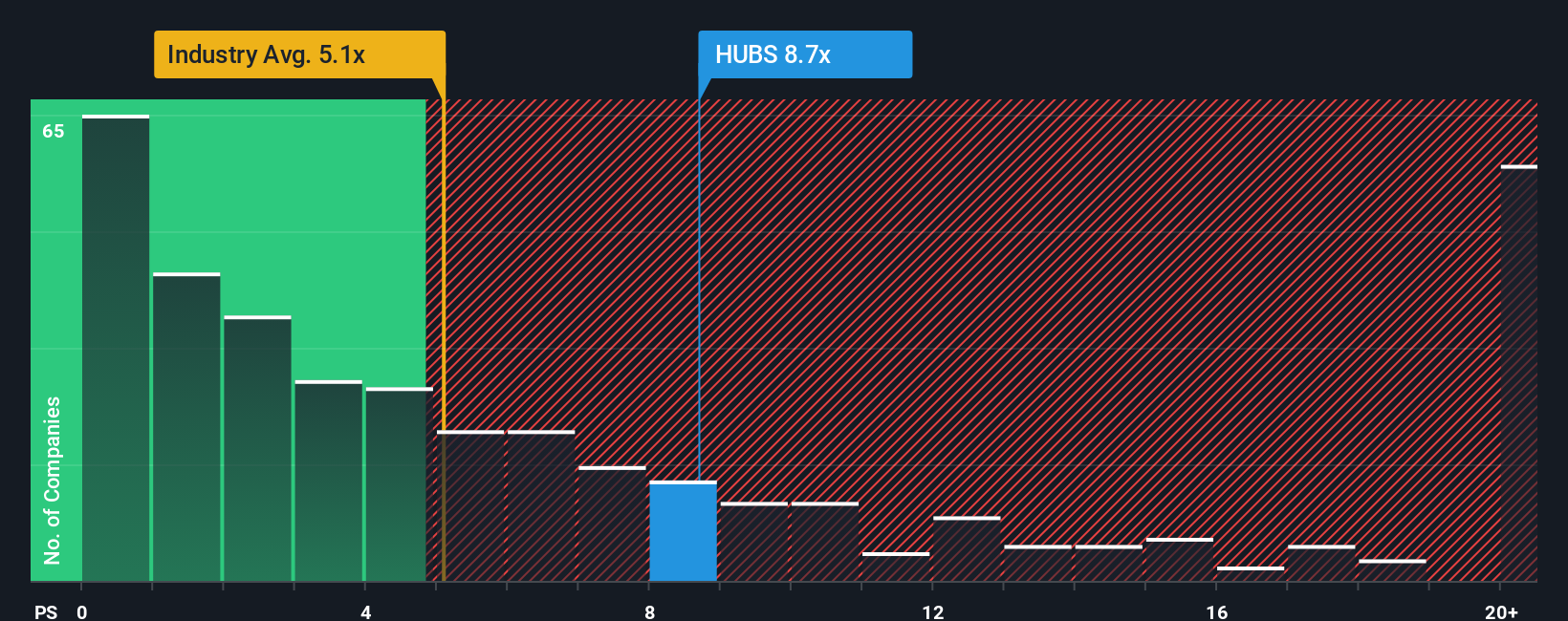

While narrative and intrinsic estimates point to upside, HubSpot’s 6.5x price to sales ratio still looks rich versus the US Software average of 4.8x, even if it screens cheaper than peers at 9.8x and below its 9.9x fair ratio. Is this a sensible premium or a valuation trap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HubSpot Narrative

If you are unconvinced by these views or simply prefer hands on research, you can build a personalized HubSpot narrative in under three minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding HubSpot.

Looking for more investment ideas?

Before the next market swing catches you off guard, consider putting your capital to work in fresh opportunities uncovered by the Simply Wall Street Screener in just minutes.

- Explore potential upside by assessing companies trading below their estimated value through these 925 undervalued stocks based on cash flows, where discounted prices meet solid fundamentals.

- Focus on the next wave of smart automation by targeting innovators powered by machine learning and neural networks using these 24 AI penny stocks.

- Strengthen your portfolio’s income stream by concentrating on companies that have a history of rewarding shareholders with consistent payouts via these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026