- United States

- /

- Biotech

- /

- NYSE:ABBV

High Growth Tech Stocks To Explore In November 2024

Reviewed by Simply Wall St

The United States market has experienced a robust performance with a 2.2% climb over the past week and an impressive 32% increase over the last 12 months, while earnings are forecast to grow by 15% annually. In this thriving environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and scalability to capitalize on these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Sarepta Therapeutics | 23.90% | 42.65% | ★★★★★★ |

| Clene | 78.50% | 60.16% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Blueprint Medicines | 25.47% | 68.62% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 250 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

AbbVie (NYSE:ABBV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AbbVie Inc. is a global biopharmaceutical company involved in the discovery, development, manufacturing, and sale of pharmaceuticals with a market cap of $312.70 billion.

Operations: AbbVie generates revenue primarily from its Innovative Medicines and Therapies segment, which accounts for $55.53 billion. The company's focus on pharmaceuticals drives its business operations globally.

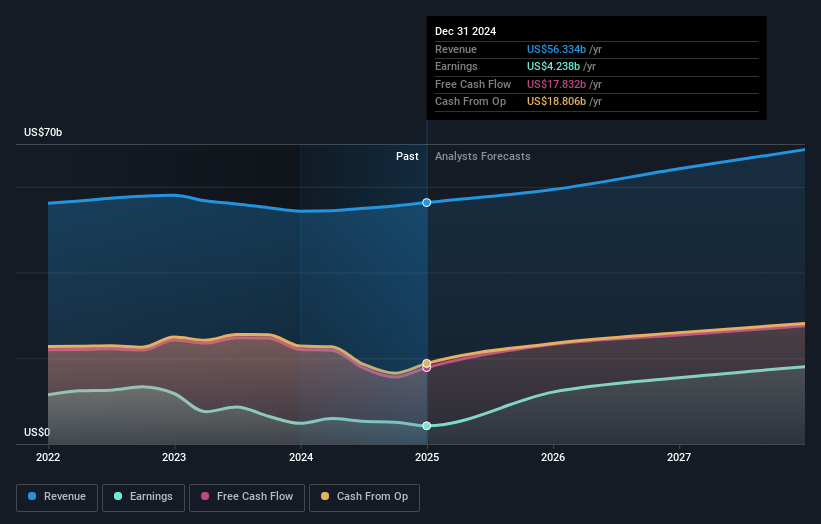

AbbVie, a key player in the biotech sector, is steering towards significant growth with an expected 28.1% annual earnings increase over the next three years, outpacing the US market average of 15.4%. Despite a challenging past year marked by a one-off loss of $8.4 billion and an earnings decline of 21.5%, AbbVie's commitment to innovation is evident in its R&D strategy, which allocates substantial resources to developing breakthrough treatments like ELAHERE for ovarian cancer—recently approved in Europe. This strategic focus not only underscores their resilience but also enhances their potential in high-stakes markets where advanced therapies are crucial.

- Click to explore a detailed breakdown of our findings in AbbVie's health report.

Review our historical performance report to gain insights into AbbVie's's past performance.

HubSpot (NYSE:HUBS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: HubSpot, Inc. offers a cloud-based customer relationship management (CRM) platform for businesses across the Americas, Europe, and the Asia Pacific with a market capitalization of approximately $38.34 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $2.51 billion. It operates a cloud-based CRM platform catering to businesses across multiple regions, focusing on enhancing customer engagement and business growth.

HubSpot, a dynamic player in the tech sector, is showing promising signs of growth with its revenue projected to increase by 14.6% annually. This growth trajectory is bolstered by a significant uptick in earnings, expected to surge by 50.56% per year. Investing heavily in innovation, HubSpot dedicated substantial resources to R&D, aligning with industry trends towards AI and integrated software solutions. The recent launch of Breeze AI and strategic alliances like the one with Amplitude underscore HubSpot's commitment to enhancing user engagement and operational efficiency through advanced technology platforms, positioning it well for future scalability within the competitive tech landscape.

- Unlock comprehensive insights into our analysis of HubSpot stock in this health report.

Explore historical data to track HubSpot's performance over time in our Past section.

ServiceNow (NYSE:NOW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ServiceNow, Inc. offers an intelligent workflow automation platform for digital businesses globally and has a market cap of $218.82 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $10.46 billion. It operates across various regions, including North America, Europe, the Middle East and Africa, and Asia Pacific.

ServiceNow, a key player in the tech landscape, has demonstrated robust financial health with a significant revenue increase to $2.8 billion in Q3 2024 from $2.29 billion the previous year, marking a 16.7% growth rate. This performance is complemented by an impressive forecast of earnings growth at 21.7% annually. The company's strategic focus on R&D is evident as it aligns with its recent initiatives like integrating AI capabilities through partnerships with Microsoft and Censys, enhancing both front-office processes and security frameworks respectively. These collaborations not only strengthen ServiceNow's product offerings but also reinforce its commitment to innovation—critical for sustaining long-term growth in the competitive tech sector.

- Click here to discover the nuances of ServiceNow with our detailed analytical health report.

Understand ServiceNow's track record by examining our Past report.

Next Steps

- Explore the 250 names from our US High Growth Tech and AI Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

AbbVie Inc. discovers, develops, manufactures, and sells pharmaceuticals worldwide.

Reasonable growth potential average dividend payer.