- United States

- /

- Software

- /

- NYSE:HUBS

Evaluating HubSpot After Shares Slide 10.8% and AI Expansion Headlines

Reviewed by Bailey Pemberton

If you're on the fence about what to do with HubSpot stock, you're not alone. The company has been on a wild ride lately, with the share price taking a noticeable hit over the past week, dropping 10.8%, and losses stretching out to nearly 5% over the last month. Year to date, the story has been even rougher, with HubSpot shares down by more than a third. That sounds grim, but if you zoom out, a different picture emerges. Over the past three years, the stock is up almost 70%, and even looking at five years, it’s delivered a healthy 43.6% total return. Clearly, HubSpot’s long-term growth story isn’t over yet, even if the market's mood has shifted.

So, what’s behind these swings? Part of it comes down to broader market dynamics and shifting sentiment about software-as-a-service businesses amid changing interest rate expectations. Investors seem to be recalibrating their risk tolerance, which is hitting growth names like HubSpot especially hard. But as any experienced stock-watcher knows, a pullback just might open up an opportunity, especially for a company that consistently executes.

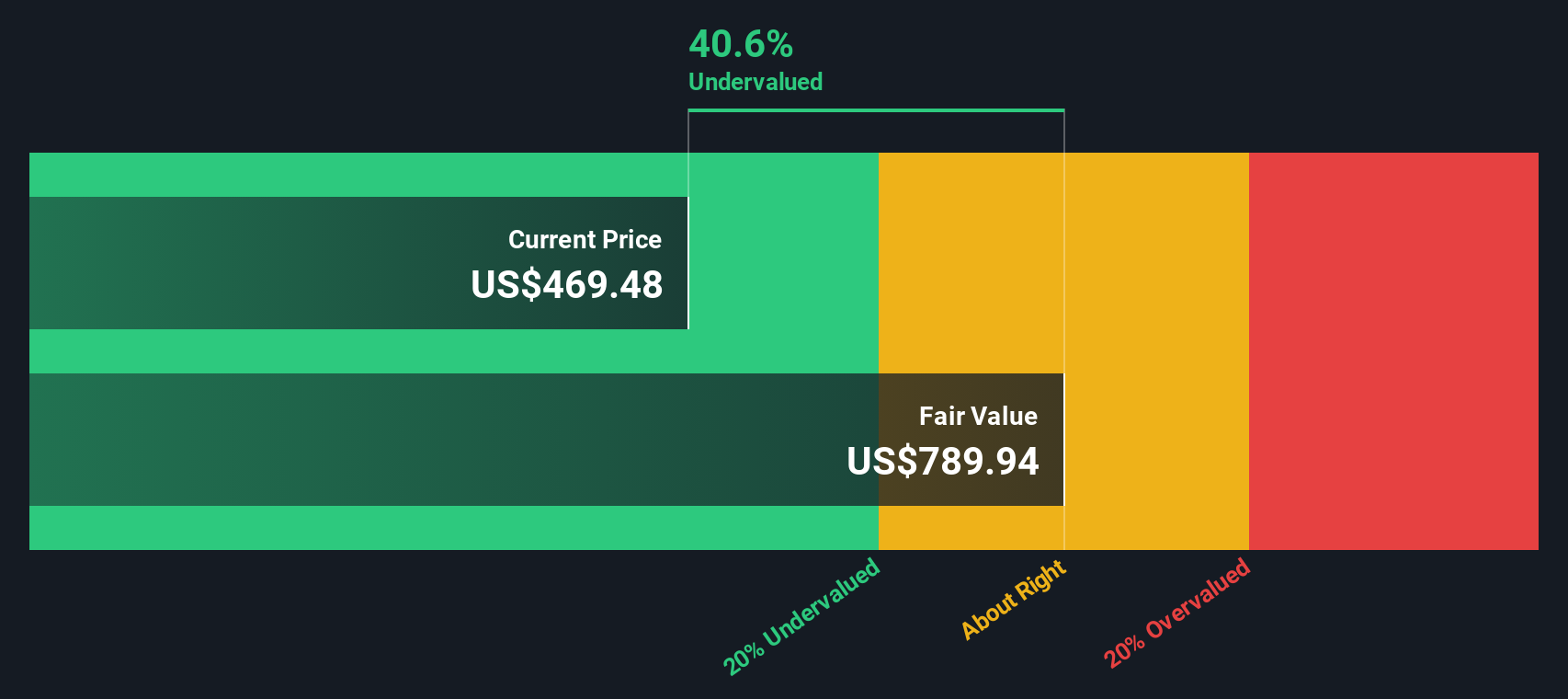

With all of this in mind, it’s only natural to wonder how HubSpot measures up on valuation. To be specific, our data shows HubSpot scores a 4 out of 6 on checks for being undervalued, suggesting potential upside if the market’s latest negativity is overdone. Up next, we will break down those valuation methods, see where HubSpot stands by the numbers, and, if you stick around, reveal one powerful way of judging value that’s often overlooked.

Why HubSpot is lagging behind its peers

Approach 1: HubSpot Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and then discounting those cash flows back to today's dollars. This method allows investors to see what a business could be worth based on its ability to generate free cash flow into the future.

For HubSpot, the most recent data shows trailing twelve-month free cash flow at $533.7 Million. Analysts project this number to climb over time, reaching $1.39 Billion by the end of 2029. It is worth noting that while analysts typically forecast about five years out, Simply Wall St goes a step further and extrapolates additional years to capture longer-term growth. This approach provides a more comprehensive view of HubSpot's valuation trajectory.

Based on these cash flow projections and using a 2 Stage Free Cash Flow to Equity model, the intrinsic value per share for HubSpot lands at $573. Compared to current prices, the analysis suggests HubSpot is roughly 19.1% undervalued according to the DCF model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests HubSpot is undervalued by 19.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

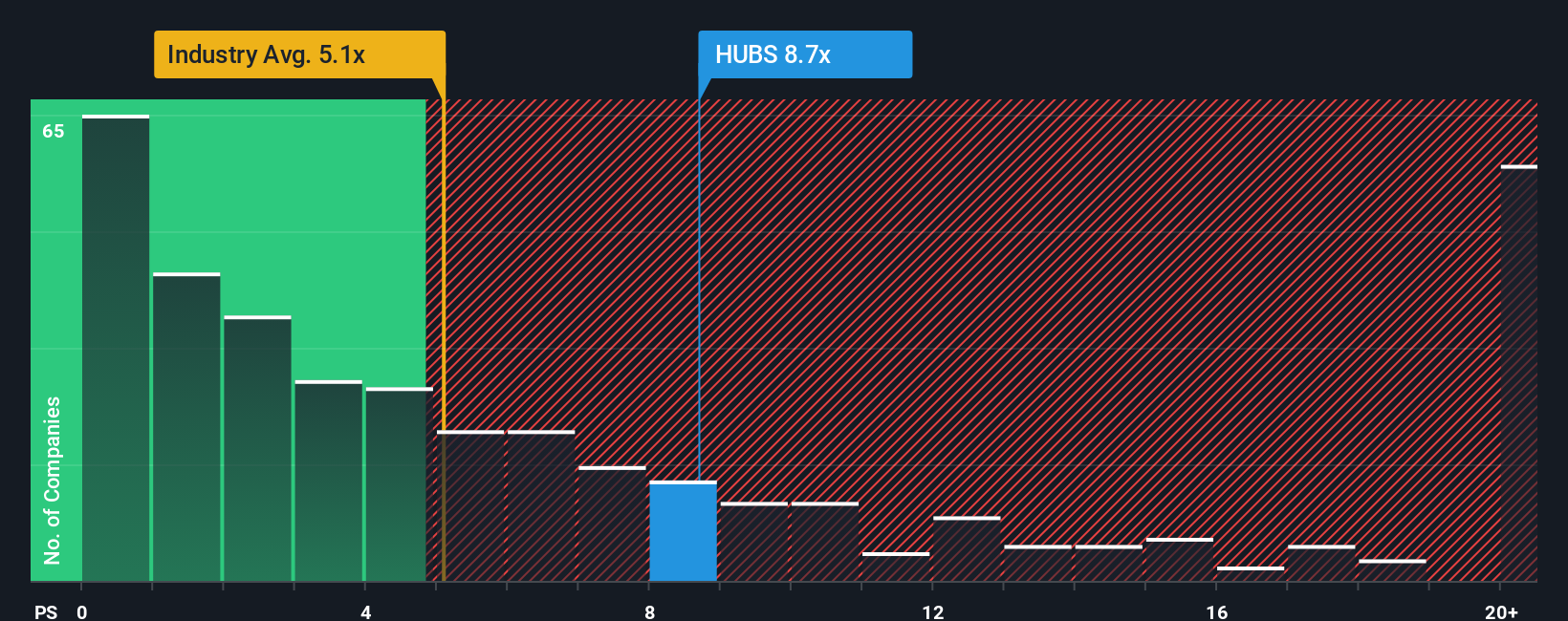

Approach 2: HubSpot Price vs Sales

Using the Price-to-Sales (P/S) ratio offers a useful way to value growth-focused software companies like HubSpot, especially when profits are modest or inconsistent but revenue growth remains strong. The P/S multiple is frequently favored for software firms because top-line sales are typically less volatile and harder to manipulate than profits, making it a more stable benchmark. Expectations for rapid growth and higher risk will usually push a "normal" or "fair" P/S ratio higher, while slower growth or increased uncertainty will pull it down.

HubSpot currently trades at a P/S ratio of 8.58x. That sits below the peer group average of 12.57x and is above the broader Software industry average of 5.28x. At first glance, this looks relatively reasonable, especially compared to peers with loftier valuations.

This is where Simply Wall St's Fair Ratio comes in. The Fair Ratio, calculated here at 11.71x, is a forward-looking benchmark that takes into account not just industry comparisons but also HubSpot's revenue growth, profit margin, risk profile, and market capitalization. Unlike a simple peer or industry comparison, the Fair Ratio delivers a more personalized view of value for HubSpot specifically, aligning the multiple with all the unique attributes of the business.

With the current P/S multiple of 8.58x trailing the Fair Ratio of 11.71x, HubSpot stock appears to offer some value relative to its fundamentals and outlook.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your HubSpot Narrative

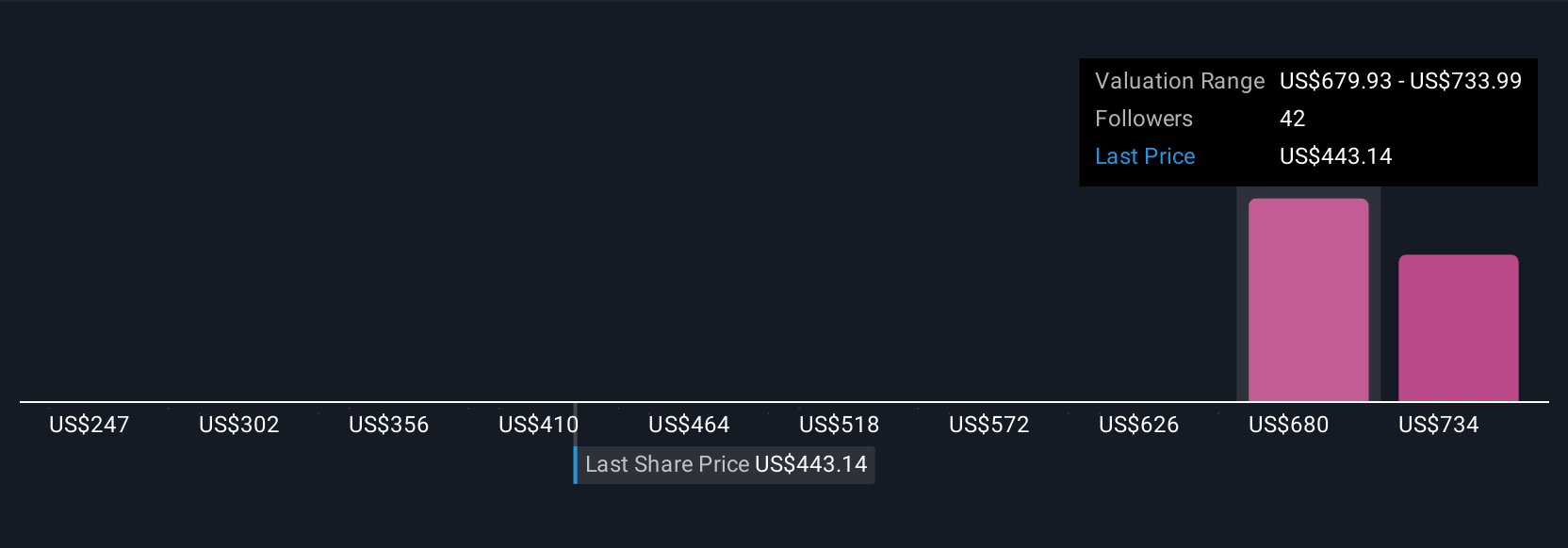

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a straightforward but powerful tool for framing your investment decisions around HubSpot.

In simple terms, a Narrative is the story you use to explain your view of what a company like HubSpot could achieve, and how that story ties back to critical numbers such as future sales, earnings, margins, and ultimately, fair value. Instead of just relying on multiples or forecasts, a Narrative connects your perspective on HubSpot’s growth drivers, risks, and future potential directly to a financial forecast. This approach helps make your reasoning clear and actionable.

Available on Simply Wall St’s Community page, Narratives are easy to create and use, enabling any investor to build and share their own view of fair value. Millions of users leverage Narratives to decide when to buy, hold, or sell HubSpot by comparing their own fair value to today's price and by seeing how others are thinking.

The best part is that Narratives are dynamic. They automatically update when new information comes in, such as earnings, news, or industry changes, helping you stay ahead.

For example, some investors believe HubSpot’s expansion in integrated cloud and AI will drive revenue to $4.6 billion by 2028 and support a fair value of $910 per share. Others see risks from AI disruption and assign a more conservative fair value around $590, showing how Narratives reflect real differences in outlook and conviction.

Do you think there's more to the story for HubSpot? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives