- United States

- /

- Software

- /

- NYSE:HUBS

Does HubSpot’s (HUBS) Ecosystem Expansion and Profit Outlook Redefine Its Investment Case?

Reviewed by Simply Wall St

- In early August 2025, HubSpot announced strong second quarter results with revenue reaching US$760.87 million and a narrowing net loss year-over-year, while partner FormAssembly independently revealed its integration launch in the HubSpot App Marketplace with new no-code form automation tools for users.

- Alongside improved earnings guidance and a share repurchase completion, ongoing ecosystem expansion through third-party integrations continues to broaden HubSpot's solutions and appeal among businesses seeking advanced workflow and data automation.

- With HubSpot projecting a move to profitability for the remainder of 2025, we'll examine how this outlook update and ecosystem growth could influence its investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 28 companies in the world exploring or producing it. Find the list for free.

HubSpot Investment Narrative Recap

To back HubSpot as a shareholder right now, you'd need to believe in its potential to grow recurring revenue as businesses shift to cloud-based, integrated marketing and sales platforms. While the company’s strong Q2 results and improved profit guidance reaffirm the importance of upmarket growth and product expansion as short-term catalysts, the risk of churn from SMB customers in a tougher economic climate remains significant. The recent news on ecosystem integrations and earnings is constructive, but it does not materially shift the main risks or accelerators in the short term.

Among the latest developments, HubSpot’s completion of a US$125 million share repurchase program stands out, reflecting management’s confidence during a period of profitability guidance and ongoing operational improvements. This action comes as the company continues to attract users through new integrations and advanced automation, but sustaining net margins as operating leverage improves is still a watch point.

However, investors should also keep in mind that while integration and revenue expansion are encouraging, the competitive risk from larger SaaS vendors and AI-powered challengers could...

Read the full narrative on HubSpot (it's free!)

HubSpot's outlook anticipates $4.6 billion in revenue and $386.6 million in earnings by 2028. This implies a 17.1% annual revenue growth rate and an earnings increase of $398.5 million from the current earnings of -$11.9 million.

Uncover how HubSpot's forecasts yield a $695.80 fair value, a 58% upside to its current price.

Exploring Other Perspectives

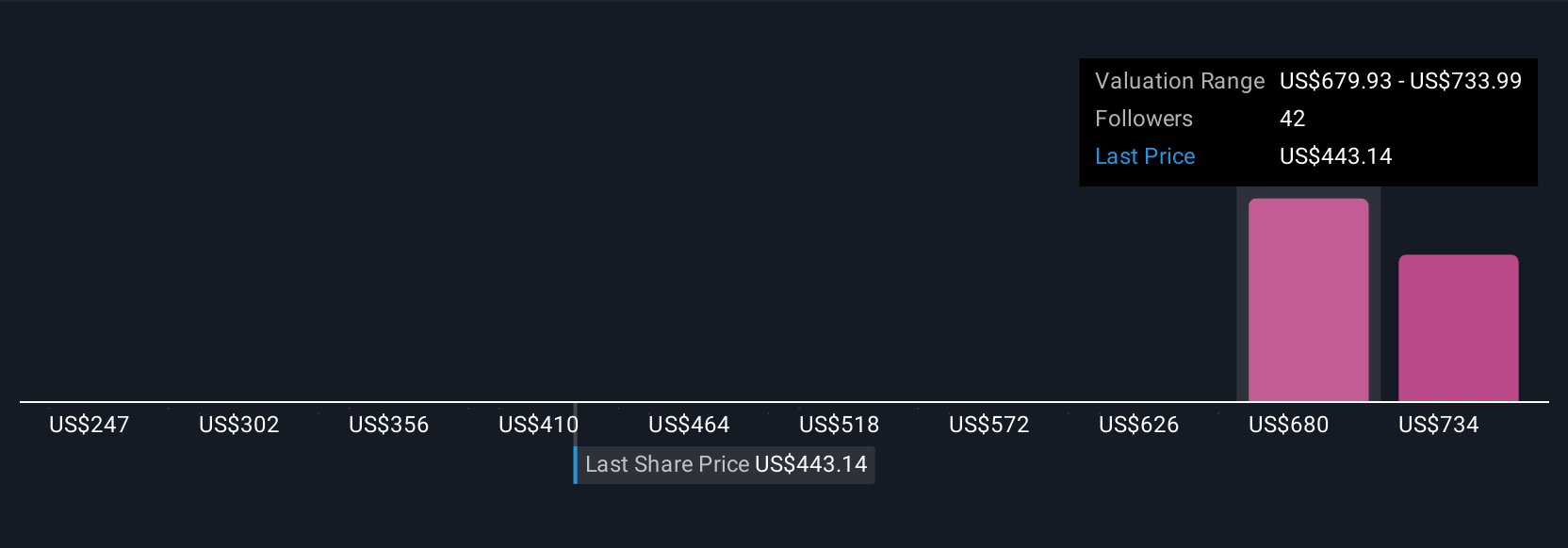

Five fair value estimates from the Simply Wall St Community range between US$247 and US$787, reflecting diverging outlooks on the shares. With many participants weighing quick product evolution against threats from bigger SaaS competitors, it's clear that differing views on HubSpot's risk profile can significantly influence expectations.

Explore 5 other fair value estimates on HubSpot - why the stock might be worth as much as 79% more than the current price!

Build Your Own HubSpot Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HubSpot research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free HubSpot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HubSpot's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives