- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:RCAT

Exploring Three High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, yet it is up 26% over the past year with earnings expected to grow by 15% per annum over the next few years. In this context of robust growth potential, identifying high-growth tech stocks that align with these market dynamics can be crucial for investors seeking to capitalize on technological advancements and innovation.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.95% | 24.32% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 23.98% | 42.48% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 236 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Red Cat Holdings (NasdaqCM:RCAT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Red Cat Holdings, Inc., along with its subsidiaries, offers a range of products, services, and solutions to the U.S. drone industry and has a market cap of $837.68 million.

Operations: Red Cat Holdings focuses on providing specialized products and services within the U.S. drone industry. The company leverages its expertise to cater to various needs in this sector, aiming to enhance operational efficiencies and technological capabilities for its clients.

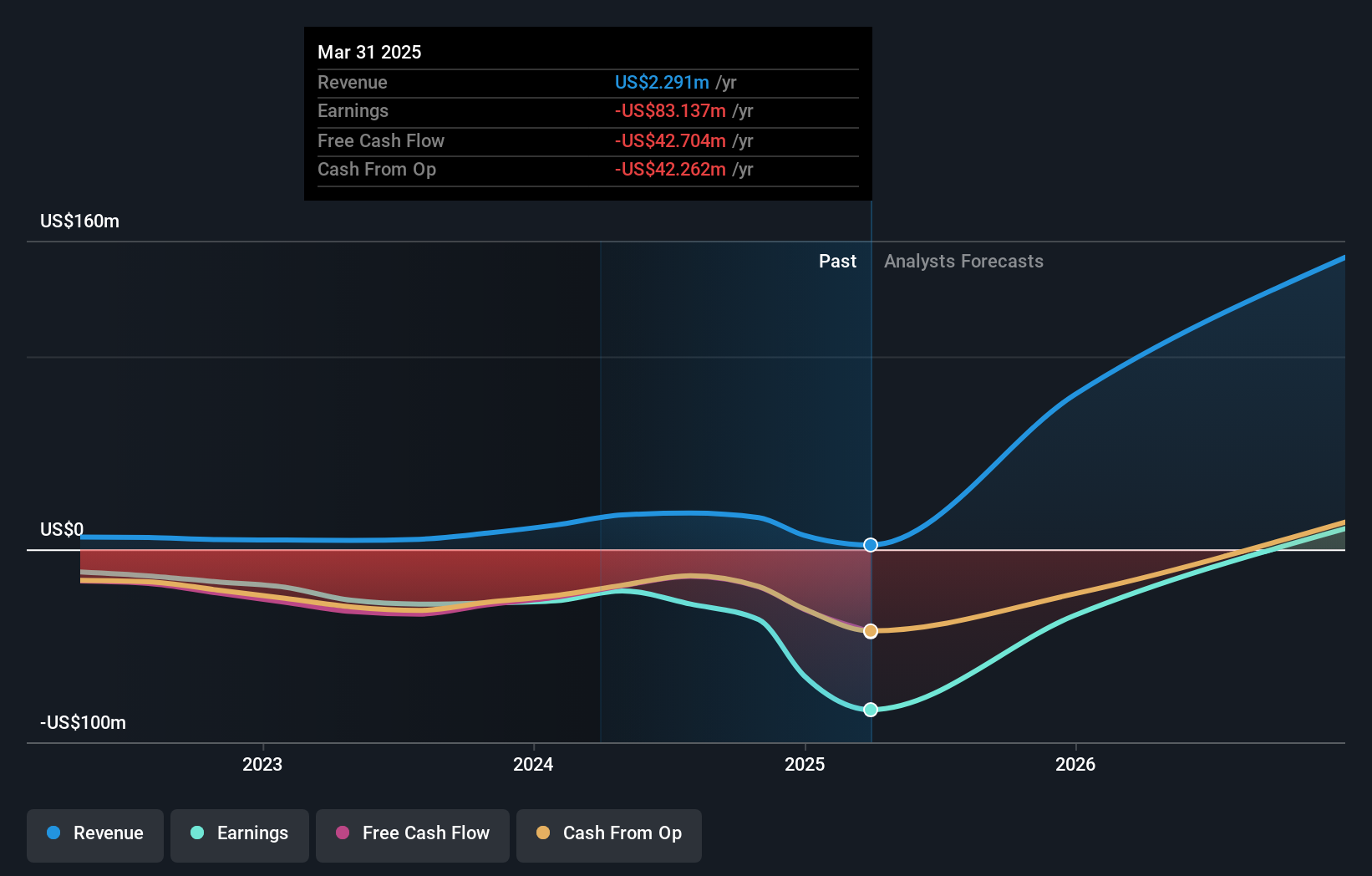

Red Cat Holdings, with a remarkable 87.2% annual revenue growth, is outpacing the broader U.S. market's 9.1% expansion rate, demonstrating its agility in the high-tech sector despite current unprofitability. The company's strategic realignment, including leadership changes aimed at enhancing product development and operational efficiency, underscores its commitment to innovation and market adaptability. Recent earnings reflect challenges with a significant net loss increase; however, Red Cat's aggressive R&D investment positions it for potential future profitability and leadership in unmanned systems technology for defense applications.

Take-Two Interactive Software (NasdaqGS:TTWO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Take-Two Interactive Software, Inc. develops, publishes, and markets interactive entertainment solutions for consumers worldwide with a market cap of approximately $32.87 billion.

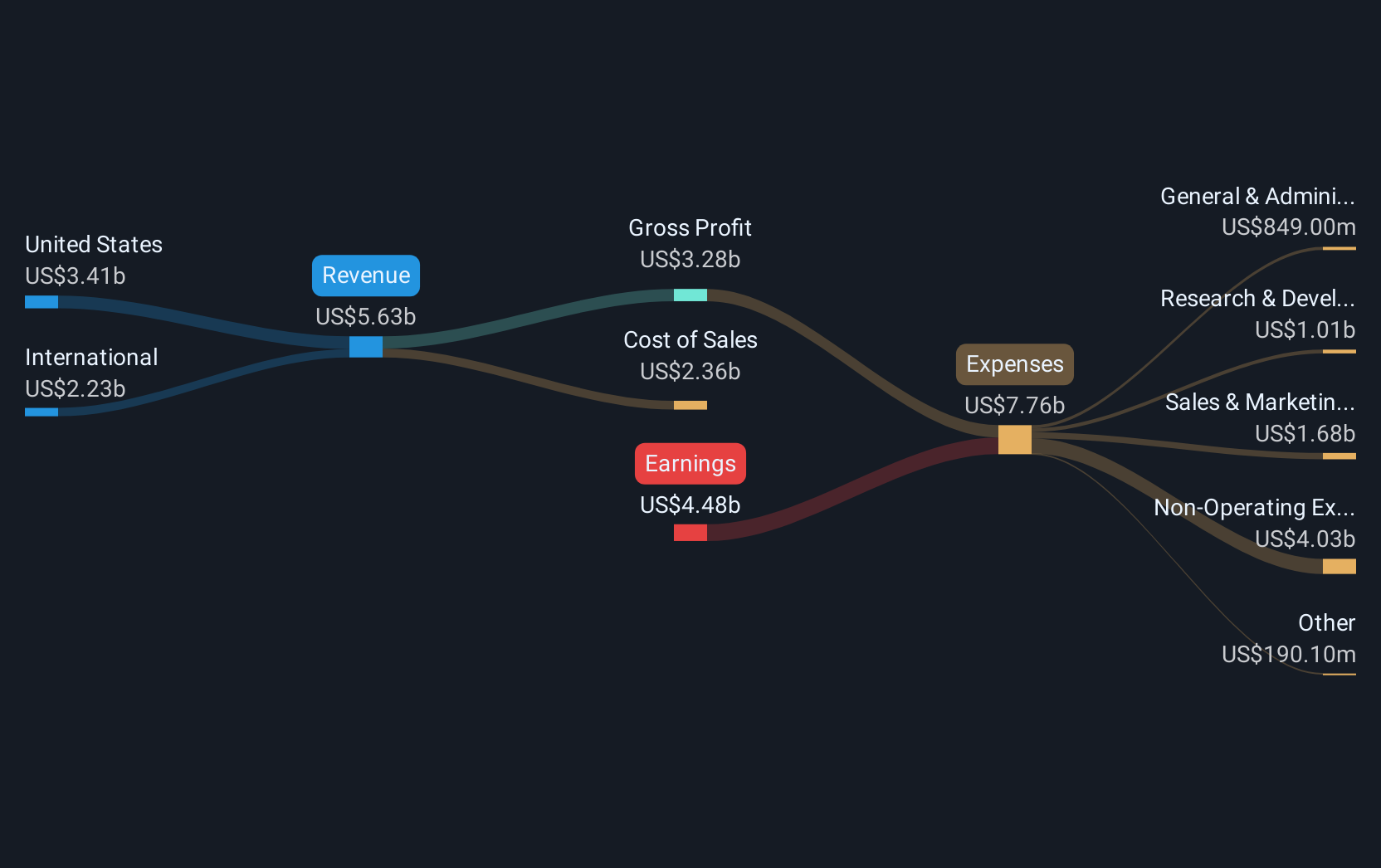

Operations: Take-Two Interactive generates revenue primarily through its publishing segment, which accounted for $5.46 billion. The company focuses on developing and marketing interactive entertainment solutions globally.

Amidst a challenging landscape, Take-Two Interactive Software has demonstrated resilience with a notable revenue uptick to $1.35 billion this quarter, marking a year-over-year increase. Despite current unprofitability, the company's strategic maneuvers—including potential divestiture of its adtech division Chartboost—signal a streamlined focus on core gaming experiences which could enhance future profitability. Moreover, with R&D expenses robustly supporting innovation in blockbuster franchises like NBA 2K and Grand Theft Auto, Take-Two is positioning itself to leverage emerging gaming trends and consumer demands effectively.

Guidewire Software (NYSE:GWRE)

Simply Wall St Growth Rating: ★★★★☆☆

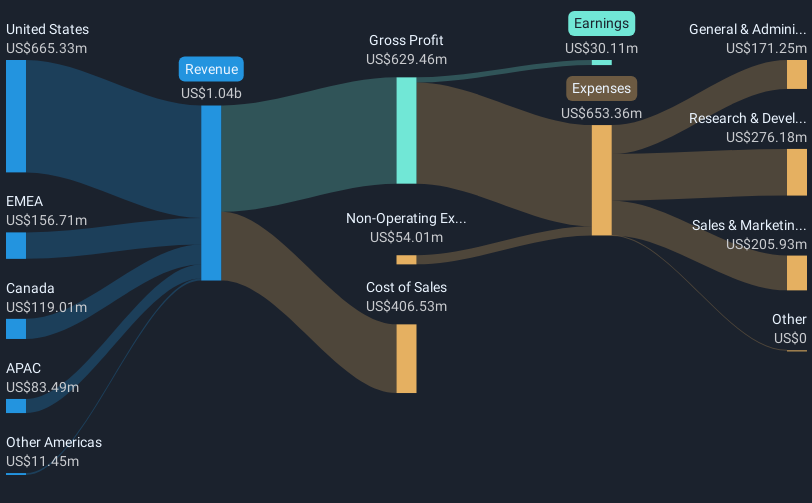

Overview: Guidewire Software, Inc. offers a platform for property and casualty insurers globally and has a market capitalization of $14.32 billion.

Operations: Guidewire Software generates revenue primarily from its Software & Programming segment, amounting to $1.04 billion. The company focuses on providing solutions for property and casualty insurers worldwide.

Guidewire Software has recently showcased strong financial and operational progress, notably transitioning from a net loss to a net income of $9.14 million this quarter, up from a loss of $27.07 million in the same period last year. This turnaround is supported by a robust 26.8% increase in quarterly revenue, signaling effective execution of its growth strategies. Importantly, the company's commitment to innovation is evident in its R&D spending which remains integral to developing cutting-edge insurance technology solutions like Guidewire Cloud and InsuranceSuite—platforms that are increasingly being adopted by major insurers for enhanced data integration and client service capabilities. This strategic focus not only strengthens Guidewire's market position but also aligns with industry trends towards digital transformation and cloud-based solutions, setting the stage for sustained growth.

- Click to explore a detailed breakdown of our findings in Guidewire Software's health report.

Explore historical data to track Guidewire Software's performance over time in our Past section.

Make It Happen

- Unlock our comprehensive list of 236 US High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RCAT

Red Cat Holdings

Provides products and solutions to drone industry in the United States.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives