- United States

- /

- IT

- /

- NYSE:GLOB

How Globant’s (GLOB) Expanded AWS Partnership and Share Buyback Are Shaping Its Investment Story

Reviewed by Sasha Jovanovic

- Globant announced a multi-year strategic collaboration agreement with Amazon Web Services (AWS), broadening their partnership to accelerate global client adoption of cloud and generative AI solutions across industries including media, entertainment, financial services, and automotive.

- Alongside this, Globant's board authorized a US$125 million share repurchase program to be executed through fourth quarter 2026, reflecting board confidence in its long-term expansion and its focus on bolstering shareholder value.

- We'll examine how the AWS collaboration and sizable share repurchase shape Globant's updated investment narrative and growth outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Globant Investment Narrative Recap

To be a Globant shareholder today, you need to believe in the company's ability to reignite top-line growth by capitalizing on accelerating demand for AI and digital transformation, while navigating recent revenue softness and macro uncertainty. The expanded AWS partnership and the new US$125 million share repurchase program send a signal of long-term confidence, but neither fundamentally alters the immediate revenue growth challenge driven by elongated sales cycles, which remains the biggest short-term catalyst and risk.

The most relevant recent announcement is Globant’s partnership expansion with Amazon Web Services. By strengthening its cloud and generative AI offerings across industries, Globant is directly addressing the pressing need for enterprise digital transformation, yet near-term demand fragility still weighs on how quickly these catalysts can translate into revenue acceleration.

Yet, even as the company makes bold moves, investors should be aware of the unpredictable nature of deal closures, as...

Read the full narrative on Globant (it's free!)

Globant's outlook anticipates $3.0 billion in revenue and $242.1 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 6.1% and an earnings increase of $131.8 million from current earnings of $110.3 million.

Uncover how Globant's forecasts yield a $104.05 fair value, a 73% upside to its current price.

Exploring Other Perspectives

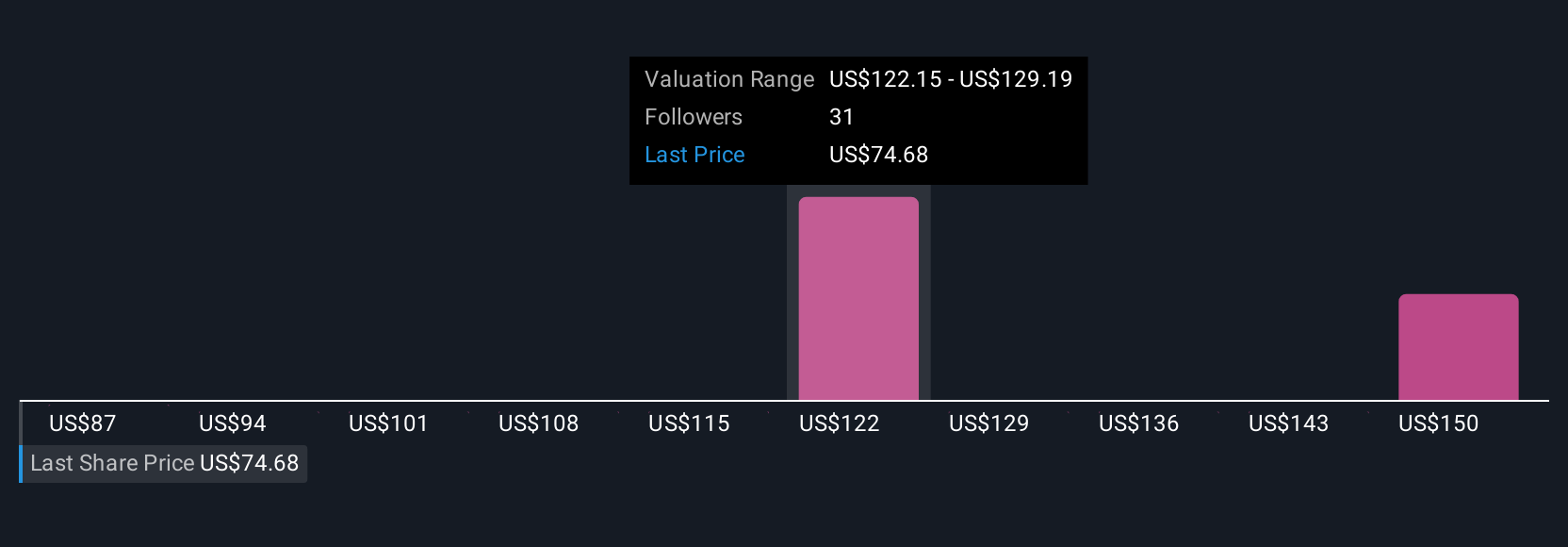

Private fair value estimates from 4 individuals in the Simply Wall St Community span US$68.20 to US$117.35 per share. With near-term growth still subdued and client spending hesitant, it is clear different views exist on Globant’s earnings potential, consider how these diverging opinions reflect uncertainty around key catalysts.

Explore 4 other fair value estimates on Globant - why the stock might be worth as much as 95% more than the current price!

Build Your Own Globant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Globant research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Globant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Globant's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLOB

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)