- United States

- /

- IT

- /

- NYSE:GLOB

Globant (GLOB) Sees 11% Stock Decline Last Week Amid Modest Earnings Guidance

Reviewed by Simply Wall St

Globant (GLOB) recently announced a promising global partnership with Unity Software Inc., aimed at developing interactive solutions in sectors like digital twins and healthcare. Despite this potentially positive development, Globant's stock saw a 11% decline last week. This movement appears counter to the broader market, which reached record highs amid expectations of Federal Reserve interest rate cuts. Additionally, the company's recent earnings guidance indicates modest growth expectations, which may not have aligned well with investor sentiment in a market environment celebrating stronger performances. The partnership and guidance added weight against the prevailing optimistic market trends.

We've discovered 1 possible red flag for Globant that you should be aware of before investing here.

The recent global partnership with Unity Software Inc. could enhance Globant's footprint in interactive solutions, impacting its growth trajectory in sectors like digital twins and healthcare. This collaboration is likely to support the AI-driven and cloud migration strategies that are pivotal to Globant's proposed revenue transformation into high-margin, recurring models. However, the stock's 11% decline last week may reflect investor caution given the short-term earnings guidance of modest growth, which diverges from broader market optimism.

Over the past five years, Globant's total shareholder return, including dividends, has reported a substantial 67.90% decline. This contrasts with its recent 1-year performance where it underperformed the US IT industry, which delivered a return of 17.1%. The discrepancy highlights ongoing challenges in aligning market expectations with actual delivery, especially as the industry pushes toward more vigorous digital transformation and AI integration.

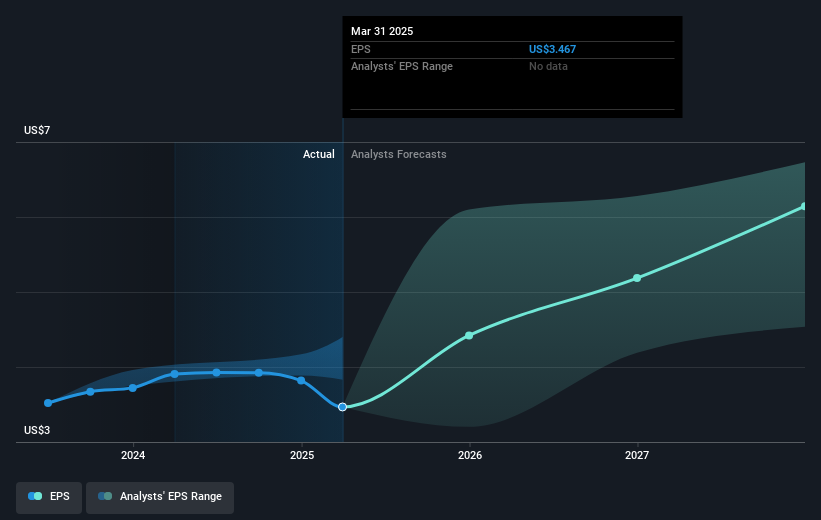

The potential impact of the Unity partnership and the company's earnings guidance shifts expectations regarding future revenue and earnings forecasts. While the analysts' consensus price target stands at US$106.20, representing a considerable upside from the current share price of US$57.15, it hinges on projected earnings and revenue growth materializing as anticipated. Achieving these targets would require Globant to effectively mitigate risks and capitalize on the growing demand for AI-enhanced solutions.

Take a closer look at Globant's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLOB

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)