- United States

- /

- IT

- /

- NYSE:GDDY

We Take A Look At Why GoDaddy Inc.'s (NYSE:GDDY) CEO Has Earned Their Pay Packet

Key Insights

- GoDaddy's Annual General Meeting to take place on 6th of June

- Total pay for CEO Aman Bhutani includes US$1.00m salary

- The total compensation is similar to the average for the industry

- GoDaddy's total shareholder return over the past three years was 71% while its EPS grew by 91% over the past three years

We have been pretty impressed with the performance at GoDaddy Inc. (NYSE:GDDY) recently and CEO Aman Bhutani deserves a mention for their role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 6th of June. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

See our latest analysis for GoDaddy

How Does Total Compensation For Aman Bhutani Compare With Other Companies In The Industry?

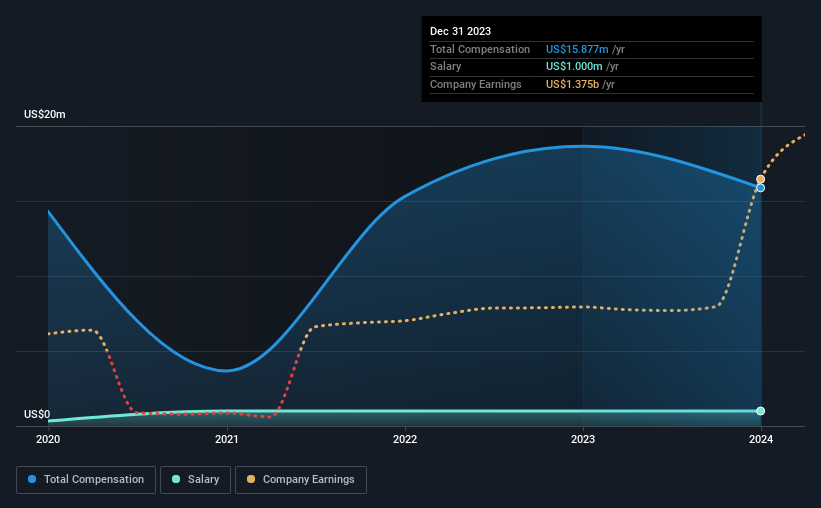

Our data indicates that GoDaddy Inc. has a market capitalization of US$19b, and total annual CEO compensation was reported as US$16m for the year to December 2023. Notably, that's a decrease of 15% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.0m.

For comparison, other companies in the American IT industry with market capitalizations above US$8.0b, reported a median total CEO compensation of US$18m. From this we gather that Aman Bhutani is paid around the median for CEOs in the industry. Furthermore, Aman Bhutani directly owns US$32m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$1.0m | US$1.0m | 6% |

| Other | US$15m | US$18m | 94% |

| Total Compensation | US$16m | US$19m | 100% |

On an industry level, roughly 26% of total compensation represents salary and 74% is other remuneration. GoDaddy pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at GoDaddy Inc.'s Growth Numbers

Over the past three years, GoDaddy Inc. has seen its earnings per share (EPS) grow by 91% per year. Its revenue is up 4.9% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has GoDaddy Inc. Been A Good Investment?

Most shareholders would probably be pleased with GoDaddy Inc. for providing a total return of 71% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 4 warning signs for GoDaddy (2 are concerning!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GDDY

GoDaddy

Engages in the design and development of cloud-based products in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)