- United States

- /

- IT

- /

- NYSE:GDDY

GoDaddy (GDDY) Enhances Online Business Management With AI-Powered Innovations

Reviewed by Simply Wall St

GoDaddy (GDDY) recently announced a range of AI-driven features aimed at boosting small business capabilities, underscoring its commitment to innovation. Over the last week, GoDaddy's stock experienced a 1% price increase, which aligns closely with the market's overall rise. These product enhancements likely reinforced the broader positive market sentiment, despite being less pronounced compared to significant movements in other companies like MongoDB and Nvidia. Overall, GoDaddy's developments supported the generally upward market trend, paralleling gains seen across the major indexes, even as investors focused on broader technological advancements and earnings reports.

You should learn about the 3 warning signs we've spotted with GoDaddy.

The introduction of AI-driven features at GoDaddy could reinforce the company's narrative of expanding its offerings for small businesses through innovative solutions. These advancements are designed to enhance customer retention and order value, factors crucial to maintaining and growing recurring revenue streams. Over the past three years, GoDaddy's total shareholder return, including both stock price and dividends, has been 93.27%, highlighting a strong longer-term performance. This context contrasts with recent one-year underperformance against the US IT industry and market, where GoDaddy lagged returns of 14.1% and 15.5% respectively.

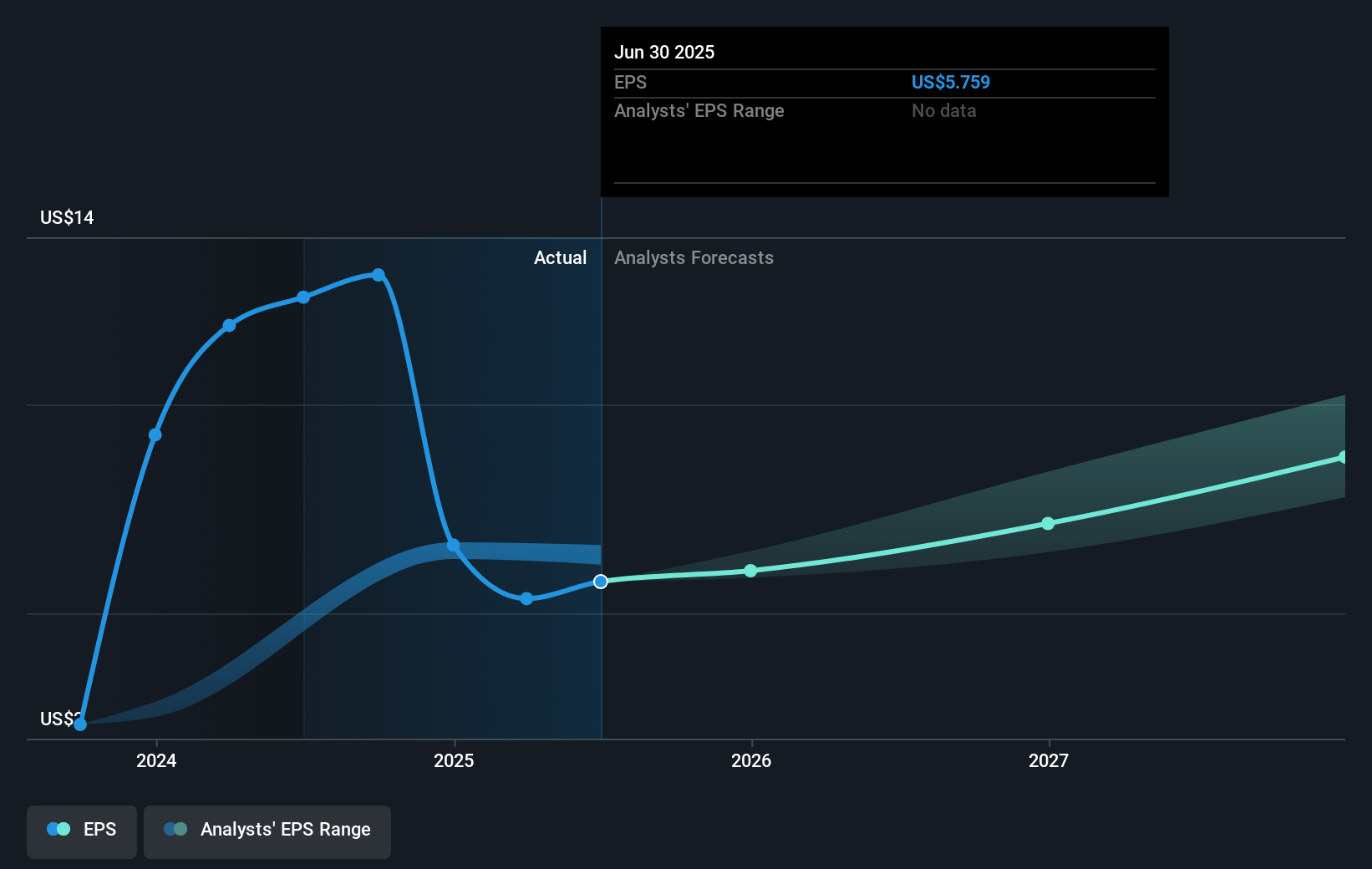

Analyzing the potential impact on revenue and earnings, recent AI enhancements could bolster GoDaddy's ability to cross-sell and increase average revenue per user, supporting sustained top-line growth and profitability. Analysts forecast earnings growth with a median price target of US$192.53, a 31.6% increase from the current share price of US$146.25. Despite the share price being below analyst targets, collaborative efforts in digital integration could align with market expectations, provided GoDaddy can navigate execution risks and competitive pressures effectively.

Assess GoDaddy's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GDDY

GoDaddy

Engages in the design and development of cloud-based products in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)