- United States

- /

- Software

- /

- NYSE:FICO

Has FICO’s Long Term Surge Pushed Its Valuation Too Far in 2025?

Reviewed by Bailey Pemberton

- If you are wondering whether Fair Isaac is still worth the premium after its huge multi year run, or if the story has finally gotten ahead of itself, this breakdown is for you.

- The stock has pulled back about 1.9% over the last week but is still up 6.8% over the past month, and despite being down 11.7% year to date and 25.8% over 1 year, it has risen roughly 187.3% over 3 years and 253.7% over 5 years.

- This kind of long term rise has been associated with investors steadily bidding up high quality software names tied to data, analytics and credit decisioning, particularly as AI optimism has grown and automation has become mission critical for lenders and enterprises. At the same time, broader market rotation into profitable, entrenched platforms has kept names like Fair Isaac in focus, even when shorter term sentiment cools.

- All of this makes its current valuation score of 0 out of 6, meaning it screens as undervalued on none of our checks, especially important to unpack. In the sections that follow, we walk through the usual valuation tools, then finish with a more holistic way to think about what Fair Isaac may be worth.

Fair Isaac scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Fair Isaac Discounted Cash Flow (DCF) Analysis

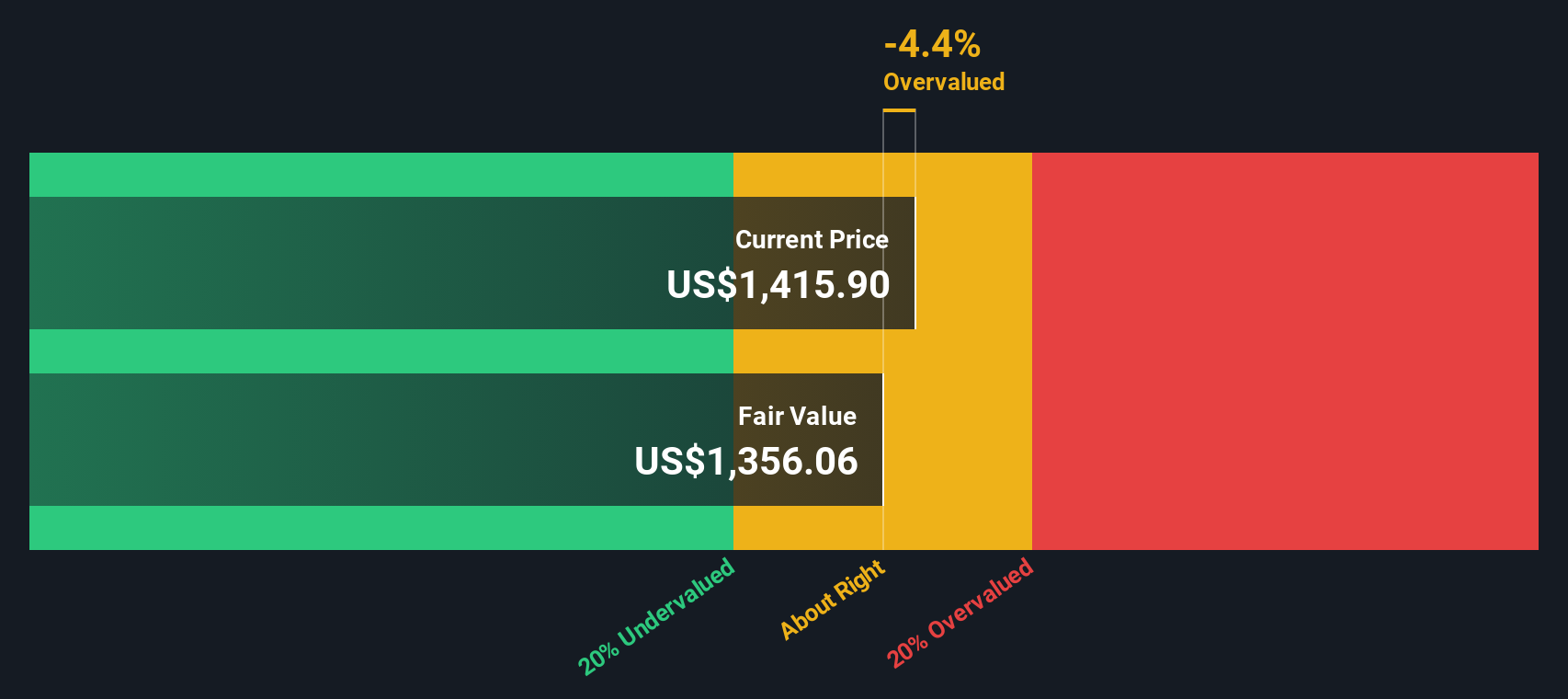

A Discounted Cash Flow model estimates what a company might be worth by projecting its future cash flows and discounting them back to today in dollar terms. For Fair Isaac, the model starts with last twelve month free cash flow of about $768.1 million and then layers on analyst forecasts and longer term projections.

Analysts expect Fair Isaac's free cash flow to rise to around $1.01 billion by 2026 and $1.55 billion by 2030, with the later years extrapolated from earlier growth trends rather than directly forecast by analysts. These 2 Stage Free Cash Flow to Equity projections are then discounted to reflect the risk and time value of money, producing a total estimated intrinsic value of roughly $960.8 per share.

When this intrinsic value is compared with the current share price, the DCF implies the stock is about 83.4% overvalued. In other words, the market is paying far more than what these projected cash flows support today, even assuming strong growth continues.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Fair Isaac may be overvalued by 83.4%. Discover 915 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Fair Isaac Price vs Earnings

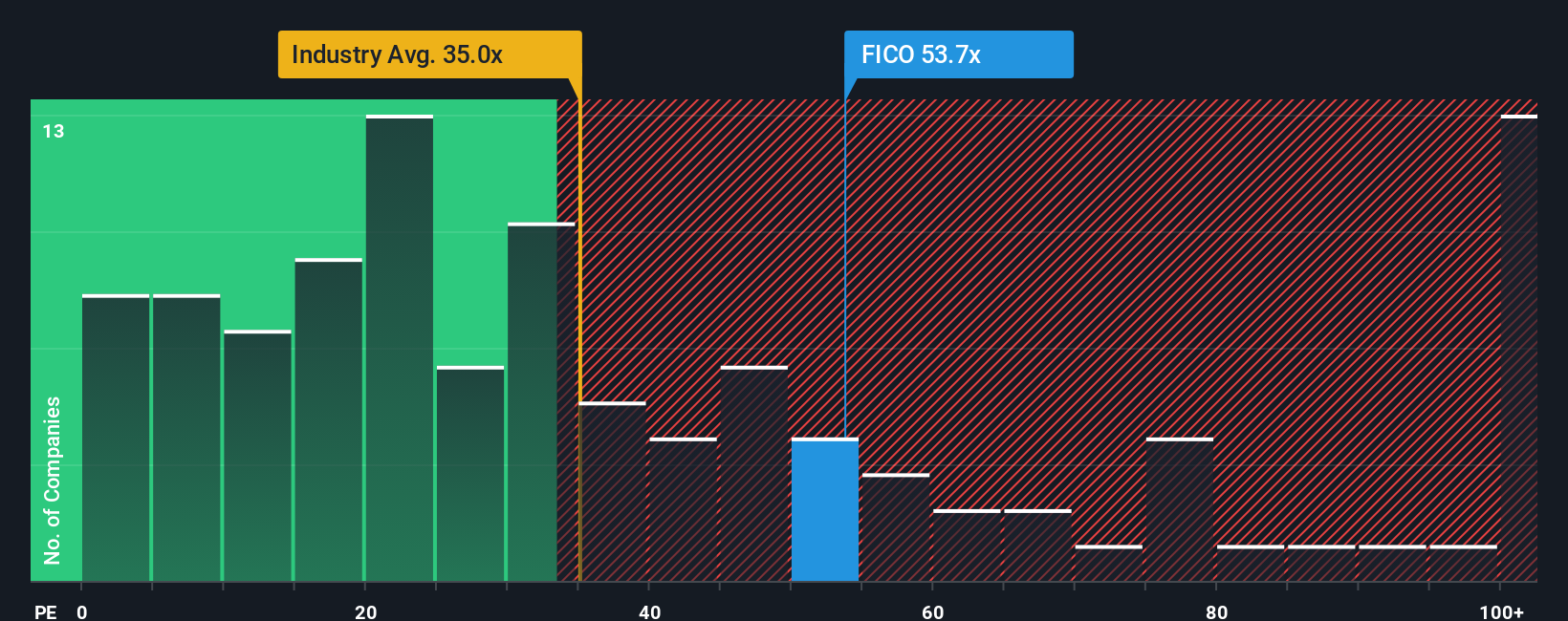

For profitable companies like Fair Isaac, the price to earnings (PE) ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. It naturally reflects the market's expectations for future growth and the perceived risk of those earnings continuing.

In general, faster growing and lower risk companies tend to have a higher, or premium, PE multiple, while slower growth or riskier names tend to trade on a discount. Fair Isaac currently trades on a PE of about 64.1x, which is well above both the wider Software industry average of around 31.7x and the peer group average of roughly 46.0x. This suggests the market is already pricing in strong, durable growth.

Simply Wall St's Fair Ratio framework estimates what PE multiple would be reasonable for Fair Isaac given its earnings growth profile, margins, industry, market cap and risk factors, and arrives at a Fair Ratio of about 38.5x. Because this approach is tailored to the company rather than relying on broad peer or industry comparisons, it offers a more nuanced view. Comparing the current 64.1x PE to the 38.5x Fair Ratio indicates that Fair Isaac screens as materially overvalued on this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fair Isaac Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives, an easy way for you to connect your view of Fair Isaac's story to specific forecasts for its future revenue, earnings and margins, and then to a clear fair value that you can compare with the current share price to decide whether to buy or sell.

On Simply Wall St, Narratives live in the Community page and work like structured, living investment theses. You or other investors outline what you think will drive the business, translate that into numbers, and the platform automatically calculates a fair value that updates dynamically as new data, news or earnings arrive.

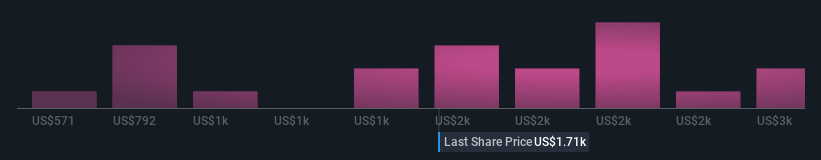

For Fair Isaac, one investor might build a bullish Narrative that leans into accelerating SaaS adoption, stronger margins and resilient credit scoring demand to justify a fair value near the top end of analyst targets around $2,300. A more cautious investor could instead emphasise regulatory risk, slower software growth and rising competition to anchor a fair value closer to the low end near $1,230, giving you a practical range of outcomes to benchmark your own view against.

Do you think there's more to the story for Fair Isaac? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Provides analytics software in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026