- United States

- /

- Software

- /

- NYSE:FICO

Fair Isaac (NYSE:FICO) Reports Strong Earnings Growth and Reiterates 2025 Revenue Guidance

Reviewed by Simply Wall St

Fair Isaac (NYSE:FICO) recently reiterated its earnings guidance for the fiscal year 2025 and reported a notable increase in both revenue and net income for the second quarter and the first half of the year. During the past month, Fair Isaac's stock price climbed 7%, reflecting confidence in its financial and operational performance. The company's recent partnership announcements and strong earnings release likely added weight to this positive movement, aligning with the market's general resilience, which saw a 5% rise amid mixed economic signals, including a weak GDP report and tech sector fluctuations.

We've spotted 1 weakness for Fair Isaac you should be aware of.

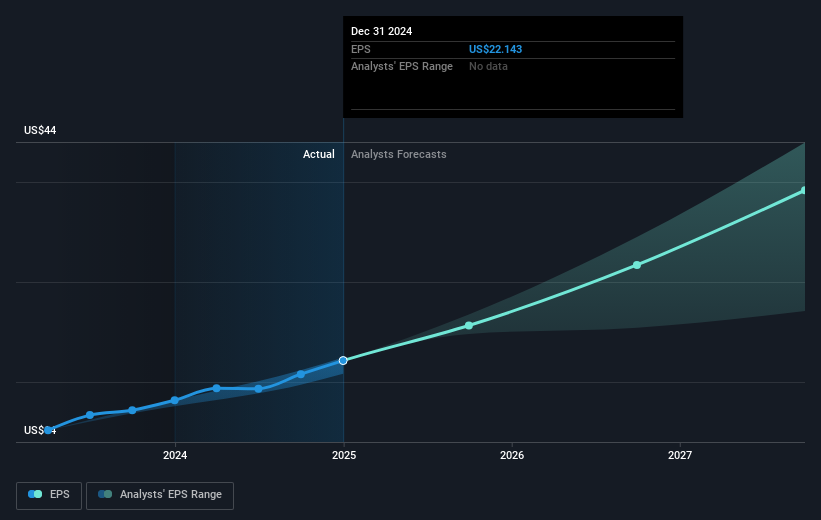

The recent updates from Fair Isaac, including the reiterated earnings guidance for fiscal year 2025 and the revenue and net income growth, could reinforce confidence in its strategic initiatives, particularly in its Scores and Software segments. Over the long term, Fair Isaac's shares have exhibited very large returns, with a total return of 455.02% over the past five years. This historical performance showcases investors' positive sentiment towards the company's operational strengths and strategic moves. Fair Isaac's one-year return has also surpassed the broader US market increase of 9.9%, indicating strong execution despite industry fluctuations.

The company's projected growth in revenue and earnings is likely to be supported by robust activity in its core segments, particularly through increased adoption of the FICO Score 10T. This aligns with its current valuation and share price movement, which, although nearing the consensus analyst price target of US$2055.06, reflects investors' expectations for continued positive performance. The recent 7% increase in Fair Isaac's share price may serve as a catalyst in aligning further with the growth trajectory outlined by analysts. However, existing challenges such as uncertainty in credit score implementation and rising operating expenses could impact future revenue and profit margins and should be monitored closely by stakeholders.

Review our historical performance report to gain insights into Fair Isaac's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Develops software with analytics and digital decisioning technologies that enable businesses to automate, enhance, and connect decisions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives