- United States

- /

- Software

- /

- NasdaqGS:INTU

US High Growth Tech Stocks With Strong Potential

Reviewed by Simply Wall St

The United States market has shown robust performance with a 7.0% increase over the last week and a 7.5% rise over the past year, while earnings are anticipated to grow by 14% annually in the coming years. In this context of strong market momentum, identifying high growth tech stocks with solid potential involves looking for companies that can capitalize on technological advancements and demonstrate resilience in rapidly evolving industries.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.27% | 29.79% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Travere Therapeutics | 28.65% | 66.06% | ★★★★★★ |

| TG Therapeutics | 26.06% | 37.39% | ★★★★★★ |

| Arcutis Biotherapeutics | 26.11% | 58.46% | ★★★★★★ |

| Clene | 62.08% | 64.01% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.08% | 58.85% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Lumentum Holdings | 21.34% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.75% | 59.64% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Intuit (NasdaqGS:INTU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intuit Inc. offers financial management, compliance, and marketing products and services primarily in the United States with a market cap of approximately $174.48 billion.

Operations: Intuit Inc. generates revenue through its Pro-Tax, Consumer, Credit Karma, and Global Business Solutions segments, with the latter contributing $10.16 billion. The company focuses on providing a range of financial management and compliance solutions.

Intuit, a stalwart in the financial software sector, continues to innovate with its recent rollout of Tap to Pay on iPhone for QuickBooks users, enhancing payment flexibility and addressing cash flow challenges for small to mid-market businesses. This feature integrates seamlessly into QuickBooks Online, streamlining transaction management without additional hardware. Despite a competitive market environment, Intuit's commitment to R&D is evident with expenses reaching $1.5 billion last year, representing about 11% of their total revenue which stood at $13.6 billion. The company's strategic focus on expanding digital payment solutions and enhancing user experience through technology like popup forms positions it well amidst evolving market demands. With earnings growth forecasted at 16.3% annually and revenue growth tracking at 11.3%, Intuit is poised for sustained growth leveraging high-quality earnings and robust free cash flow generation strategies.

- Unlock comprehensive insights into our analysis of Intuit stock in this health report.

Gain insights into Intuit's past trends and performance with our Past report.

Wix.com (NasdaqGS:WIX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wix.com Ltd. operates a cloud-based web development platform serving registered users and creators globally, with a market cap of approximately $9.30 billion.

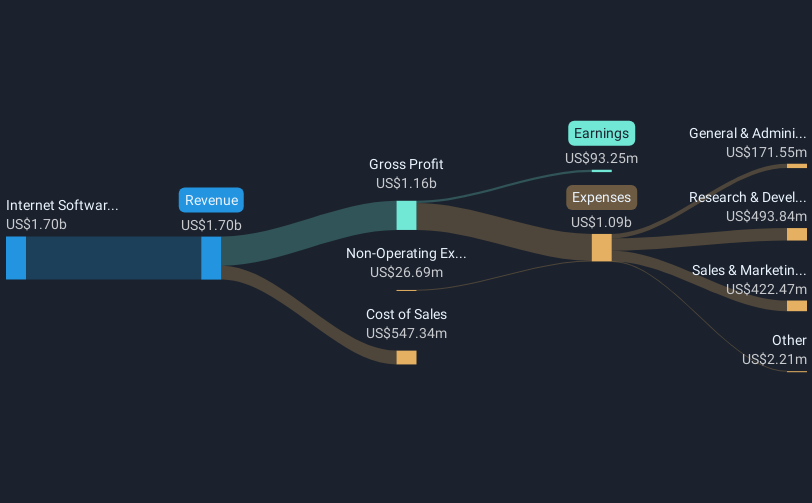

Operations: The company generates revenue primarily from its Internet Software & Services segment, which amounts to approximately $1.76 billion.

Wix.com has demonstrated a robust commitment to innovation, particularly in enhancing user experience through AI-driven tools such as the recently launched Astro and adaptive content applications. These initiatives are pivotal in personalizing user interactions on websites, potentially increasing engagement and conversion rates. Financially, Wix reported a significant uptick in annual revenue to $1.76 billion, up from $1.56 billion the previous year, with net income also rising sharply to $138.32 million from $33.14 million. This financial growth is complemented by R&D investments that are integral to sustaining its competitive edge and fostering future growth within the tech landscape.

- Get an in-depth perspective on Wix.com's performance by reading our health report here.

Examine Wix.com's past performance report to understand how it has performed in the past.

Elastic (NYSE:ESTC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Elastic N.V. is a search artificial intelligence company that provides hosted and managed solutions for hybrid, public or private clouds, and multi-cloud environments globally, with a market cap of approximately $8.79 billion.

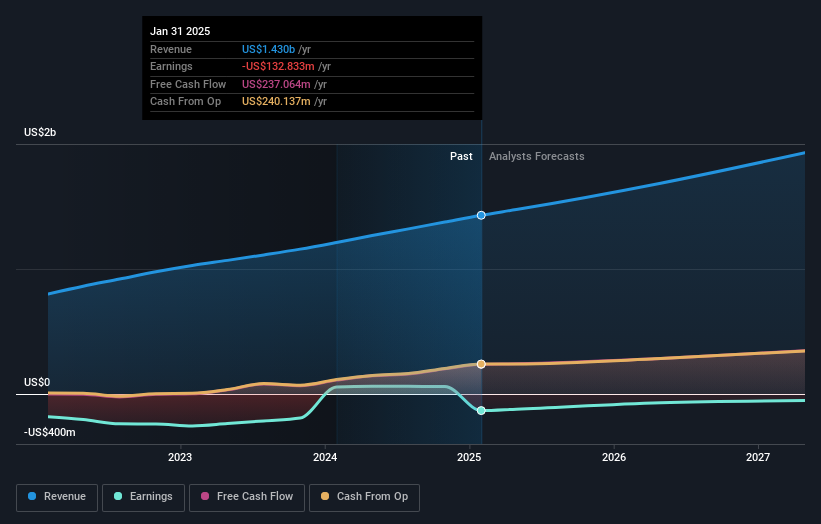

Operations: Elastic focuses on delivering search AI solutions through hosted and managed services across various cloud environments, generating revenue primarily from its Software & Programming segment, which amounts to approximately $1.43 billion.

Elastic's integration with Google Cloud's Vertex AI and its new OpenTelemetry distribution underscore its commitment to enhancing AI observability and infrastructure monitoring, crucial for optimizing tech performance. Despite a challenging fiscal period with a net loss reported in Q3 2025, Elastic anticipates revenue growth of 13% year-over-year by Q4, reflecting resilience and adaptability in its operational strategy. The firm's focus on advanced AI solutions and strategic partnerships positions it well within the high-growth tech sector, even as it navigates market volatility and competitive pressures.

- Click here to discover the nuances of Elastic with our detailed analytical health report.

Assess Elastic's past performance with our detailed historical performance reports.

Summing It All Up

- Navigate through the entire inventory of 233 US High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTU

Intuit

Provides financial management, payments and capital, compliance, and marketing products and services in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion