- United States

- /

- Marine and Shipping

- /

- NasdaqCM:PANL

Top Growth Companies With Insider Stakes In June 2025

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has seen a notable increase of 9.9% over the past year, with earnings projected to grow by 15% annually in the coming years. In this context, growth companies with significant insider ownership can be particularly appealing as they often align management's interests with those of shareholders, potentially enhancing long-term performance amidst favorable market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Zapp Electric Vehicles Group (ZAPP.F) | 16.1% | 120.2% |

| Super Micro Computer (SMCI) | 16.2% | 39.1% |

| Prairie Operating (PROP) | 34.5% | 75.7% |

| Hesai Group (HSAI) | 21.3% | 45.2% |

| FTC Solar (FTCI) | 27.7% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Eagle Financial Services (EFSI) | 15.9% | 82.8% |

| Credo Technology Group Holding (CRDO) | 12.1% | 45% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 24.1% |

| Astera Labs (ALAB) | 14.8% | 44.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Liquidia (LQDA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Liquidia Corporation is a biopharmaceutical company that develops, manufactures, and commercializes products for unmet patient needs in the United States, with a market cap of approximately $1.16 billion.

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, amounting to $14.14 million.

Insider Ownership: 10.7%

Earnings Growth Forecast: 66.2% p.a.

Liquidia's high insider ownership aligns with its growth potential, as it anticipates a 46.1% annual revenue increase, surpassing the US market's average. The recent FDA approval of YUTREPIA for pulmonary hypertension marks a significant milestone, although legal challenges from United Therapeutics regarding patent infringement could impact commercialization. Despite trading below fair value estimates and expected profitability in three years, Liquidia faces financial losses and ongoing litigation risks that investors should consider.

- Take a closer look at Liquidia's potential here in our earnings growth report.

- Our valuation report unveils the possibility Liquidia's shares may be trading at a premium.

Pangaea Logistics Solutions (PANL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pangaea Logistics Solutions, Ltd. and its subsidiaries offer seaborne dry bulk logistics and transportation services globally to industrial customers, with a market cap of $310.39 million.

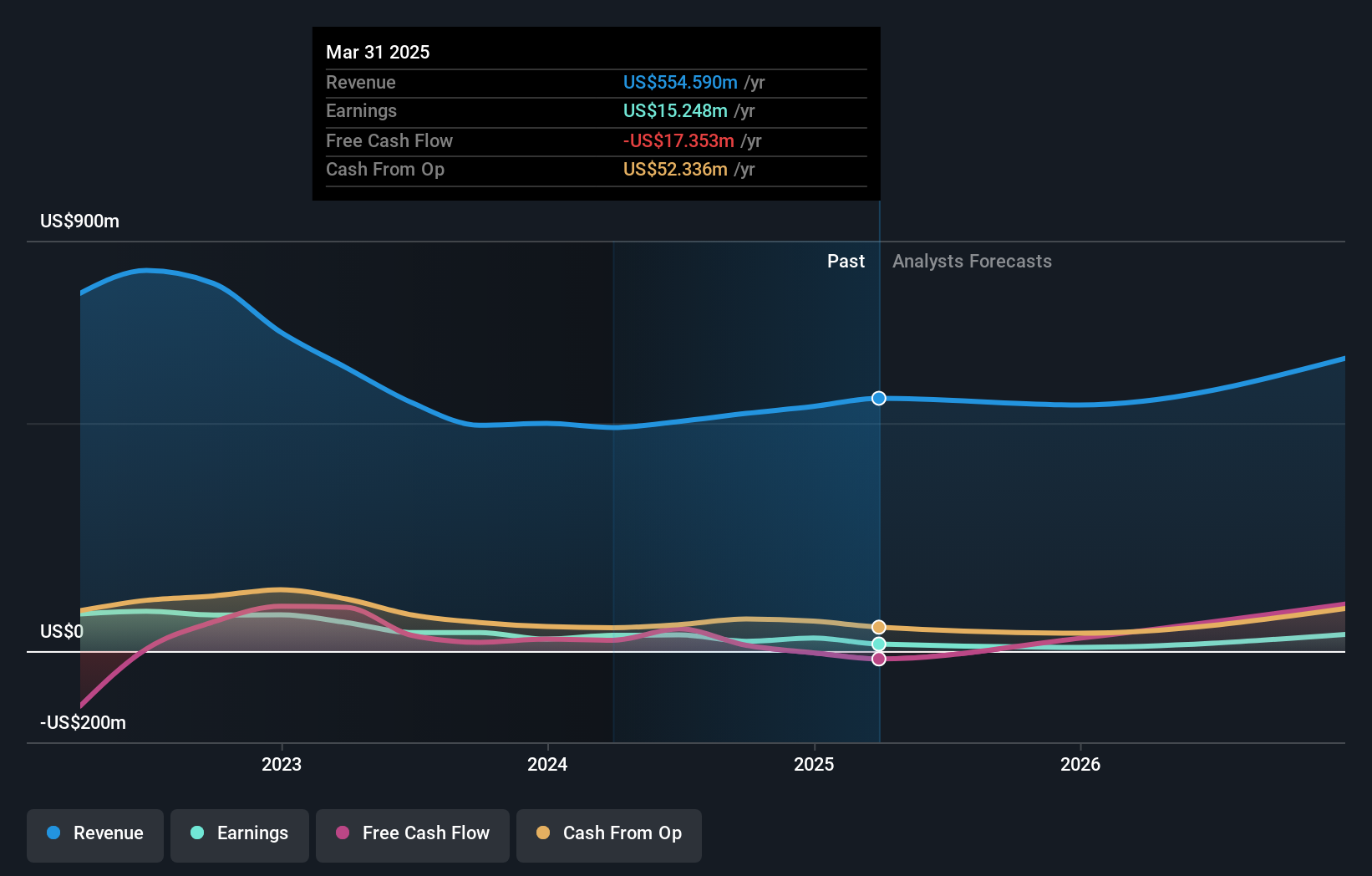

Operations: The company generates revenue primarily from its Shipping segment, amounting to $541.06 million.

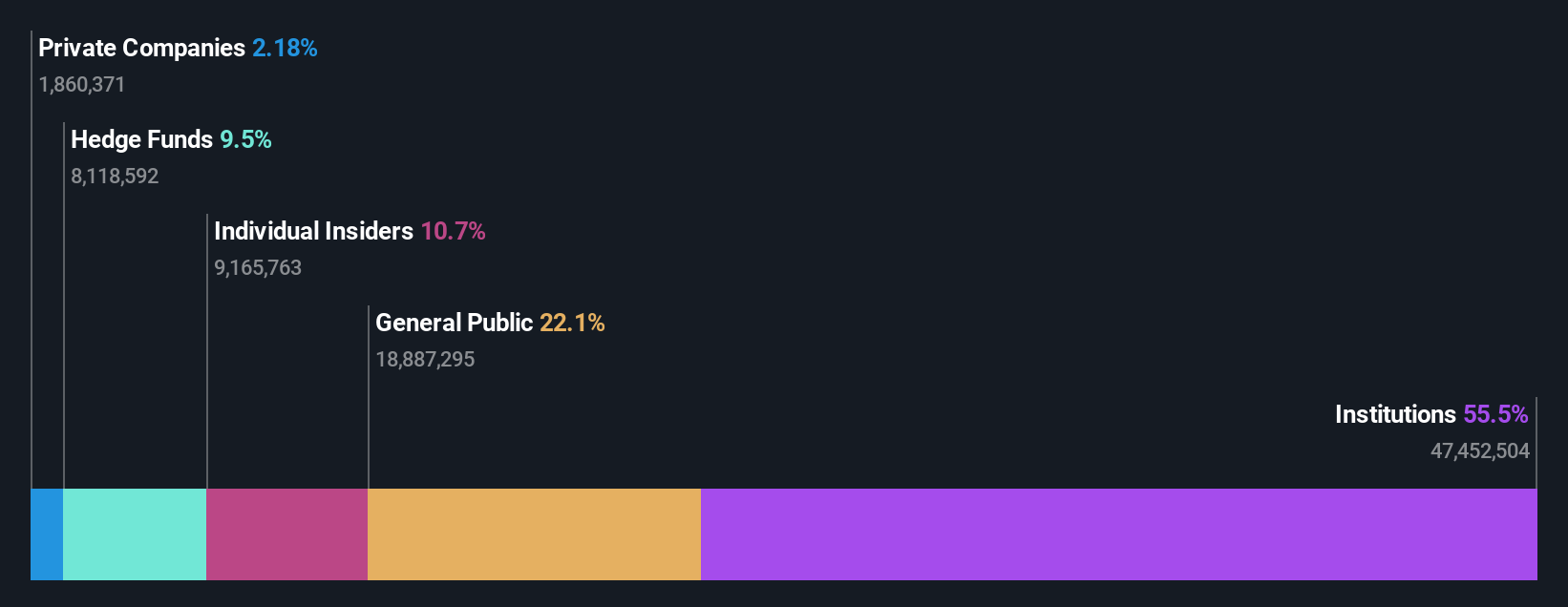

Insider Ownership: 19.4%

Earnings Growth Forecast: 65.3% p.a.

Pangaea Logistics Solutions shows strong insider confidence with substantial insider buying and no significant selling in the past three months. Despite a recent quarterly net loss of US$1.98 million, earnings are forecast to grow significantly at 65.3% annually, outpacing the US market's growth rate. A share repurchase program worth up to US$15 million could enhance shareholder value, although dividends are not well covered by earnings or free cash flows, indicating potential sustainability concerns.

- Unlock comprehensive insights into our analysis of Pangaea Logistics Solutions stock in this growth report.

- Upon reviewing our latest valuation report, Pangaea Logistics Solutions' share price might be too pessimistic.

Elastic (ESTC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Elastic N.V. is a search AI company offering software platforms for hybrid, public, private, and multi-cloud environments globally, with a market cap of $8.87 billion.

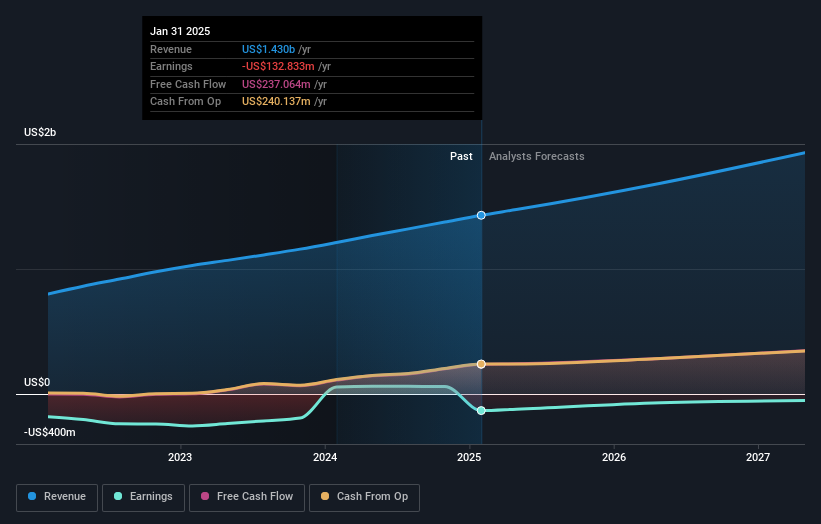

Operations: The company's revenue is primarily derived from its Software & Programming segment, totaling $1.48 billion.

Insider Ownership: 12.5%

Earnings Growth Forecast: 51.5% p.a.

Elastic has seen substantial insider selling recently, contrasting with its forecasted growth trajectory. The company anticipates a revenue increase of 11.3% annually, outpacing the US market average. Recent earnings showed improvement with a reduced net loss of US$16.38 million for Q4 2025, down from US$41.1 million the previous year. A strategic collaboration with AWS aims to enhance AI capabilities and drive innovation, potentially supporting Elastic's growth outlook despite current profitability challenges.

- Click here to discover the nuances of Elastic with our detailed analytical future growth report.

- The analysis detailed in our Elastic valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Gain an insight into the universe of 192 Fast Growing US Companies With High Insider Ownership by clicking here.

- Ready To Venture Into Other Investment Styles? Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PANL

Pangaea Logistics Solutions

Provides seaborne dry bulk logistics and transportation services to industrial customers worldwide.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)