- United States

- /

- Software

- /

- NYSE:ESTC

AI-Powered Innovations and Share Buybacks Could Be a Game Changer for Elastic (ESTC)

Reviewed by Sasha Jovanovic

- In October 2025, Elastic announced a US$500 million share repurchase program, launched the GPU-powered Elastic Inference Service for generative AI on Elastic Cloud, and finalized the acquisition of Jina AI to enhance vector search capabilities.

- These developments reinforce Elastic’s commitment to AI innovation, operational efficiency, and show management’s clear confidence in the company’s long-term prospects through significant capital allocation and product investment.

- We'll explore how the launch of GPU-accelerated AI services could reshape Elastic's investment narrative and future growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Elastic Investment Narrative Recap

To own Elastic stock, you need to believe that rapid AI adoption and migration to Elastic Cloud will drive sustained revenue and margin growth, despite fierce competition from cloud giants and the risk of search commoditization. The recent US$500 million buyback and AI service launches likely boost short-term optimism around product innovation and capital allocation, but do not materially shift the main catalyst: accelerating enterprise demand for integrated AI-powered search and analytics. The chief risk remains the potential for pricing pressure and market share loss to larger cloud providers.

Of the recent developments, the launch of the GPU-powered Elastic Inference Service (EIS) is particularly relevant, as it targets generative AI and vector search workflows where competition is heating up. EIS's focus on speed, scalability, and developer simplicity could give Elastic a stronger position with enterprise clients deploying cloud-based AI, directly supporting the main growth catalyst if adoption accelerates.

However, investors should also be aware that as the competitive landscape evolves...

Read the full narrative on Elastic (it's free!)

Elastic's outlook anticipates $2.3 billion in revenue and $50.5 million in earnings by 2028. This implies a 13.9% annual revenue growth rate and a $134 million increase in earnings from the current -$83.5 million.

Uncover how Elastic's forecasts yield a $120.16 fair value, a 39% upside to its current price.

Exploring Other Perspectives

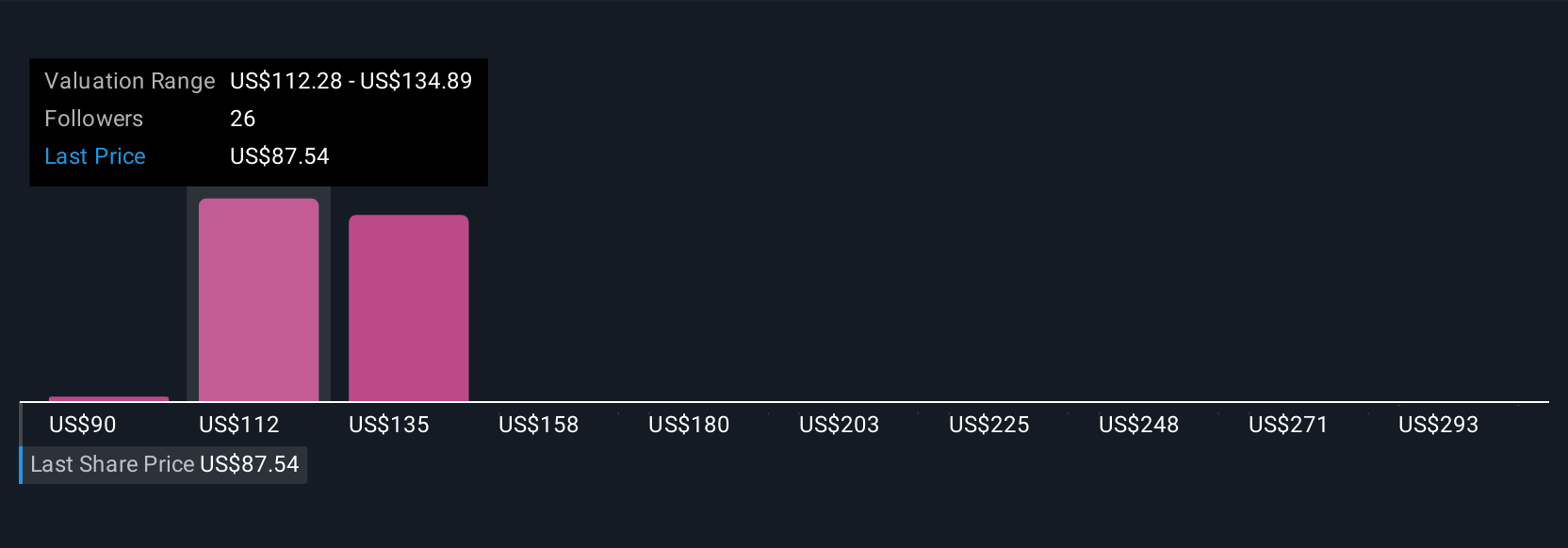

Simply Wall St Community members have published seven individual fair value estimates for Elastic, ranging from US$89.66 to US$315.80 per share. While opinions differ widely, accelerating generative AI adoption remains the key catalyst to watch for the company’s next phase. Explore how your outlook compares with other market participants.

Explore 7 other fair value estimates on Elastic - why the stock might be worth over 3x more than the current price!

Build Your Own Elastic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elastic research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Elastic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elastic's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elastic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESTC

Elastic

A search artificial intelligence (AI) company, provides software platforms to run in hybrid, public or private clouds, and multi-cloud environments in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026