- United States

- /

- Diversified Financial

- /

- NYSE:FIS

3 Stocks Estimated To Be Undervalued In October 2025

Reviewed by Simply Wall St

As the Dow Jones Industrial Average reaches an all-time high amidst a flurry of corporate earnings reports, investors are keenly observing the broader U.S. market's performance against a backdrop of ongoing government shutdown and trade discussions with China. In this environment, identifying undervalued stocks becomes crucial for those looking to capitalize on potential opportunities that may arise from discrepancies between current stock prices and their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $7.08 | $13.53 | 47.7% |

| Phibro Animal Health (PAHC) | $40.62 | $77.67 | 47.7% |

| Perfect (PERF) | $1.91 | $3.64 | 47.6% |

| McGraw Hill (MH) | $13.00 | $25.60 | 49.2% |

| GeneDx Holdings (WGS) | $127.03 | $248.76 | 48.9% |

| First Busey (BUSE) | $23.29 | $45.91 | 49.3% |

| First Advantage (FA) | $14.15 | $27.20 | 48% |

| e.l.f. Beauty (ELF) | $127.42 | $249.88 | 49% |

| Corpay (CPAY) | $286.05 | $547.88 | 47.8% |

| Constellium (CSTM) | $15.95 | $31.81 | 49.9% |

Let's dive into some prime choices out of the screener.

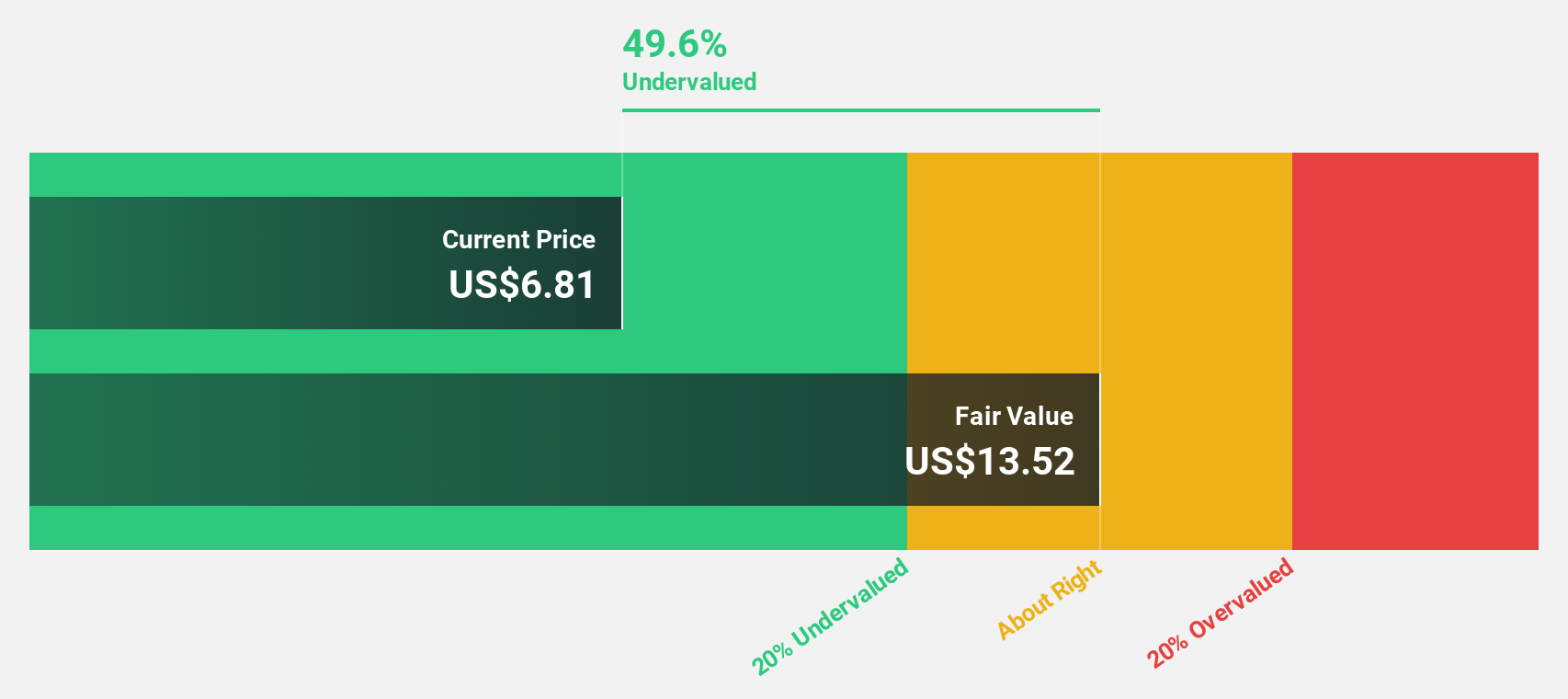

Udemy (UDMY)

Overview: Udemy, Inc. is a learning company that operates a global marketplace platform for skill development, with a market cap of approximately $1.06 billion.

Operations: The company's revenue segments consist of $282.23 million from consumer sales and $513.31 million from enterprise sales.

Estimated Discount To Fair Value: 47.7%

Udemy appears significantly undervalued, trading at $7.08 compared to a fair value estimate of $13.53, representing a substantial discount. The company recently announced a $50 million share repurchase program, signaling confidence in its financial health and future prospects. Although revenue growth is projected at 5.3% annually—below the broader market average—earnings are expected to grow robustly by 58.28% per year, positioning Udemy for profitability within three years amidst strategic expansions and leadership changes.

- Insights from our recent growth report point to a promising forecast for Udemy's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Udemy.

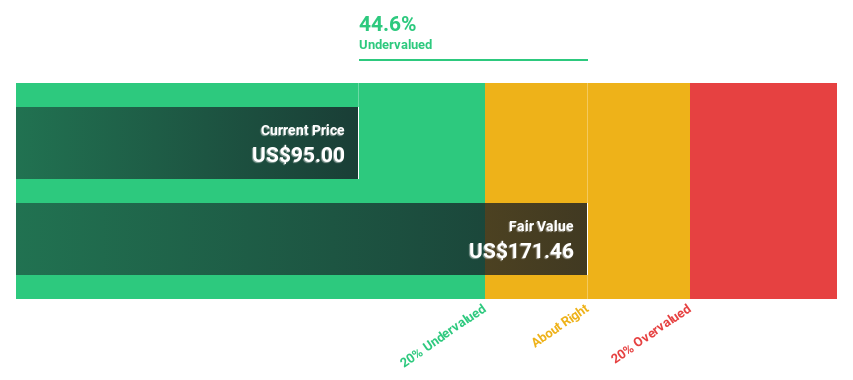

Elastic (ESTC)

Overview: Elastic N.V. is a search AI company that offers software platforms for hybrid, public, private, and multi-cloud environments globally, with a market cap of $8.91 billion.

Operations: Elastic's revenue primarily comes from its Software & Programming segment, which generated $1.55 billion.

Estimated Discount To Fair Value: 40%

Elastic is trading at US$83.83, significantly below its estimated fair value of US$139.67, suggesting it may be undervalued based on cash flows. The company has announced a US$500 million share repurchase program, reflecting strong financial confidence. Despite insider selling in recent months, Elastic's earnings are forecast to grow 55.18% annually with expected profitability within three years and revenue growth outpacing the broader U.S. market at 12% per year amidst strategic product expansions like Elastic Inference Service and managed OTLP endpoint enhancements.

- The analysis detailed in our Elastic growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Elastic stock in this financial health report.

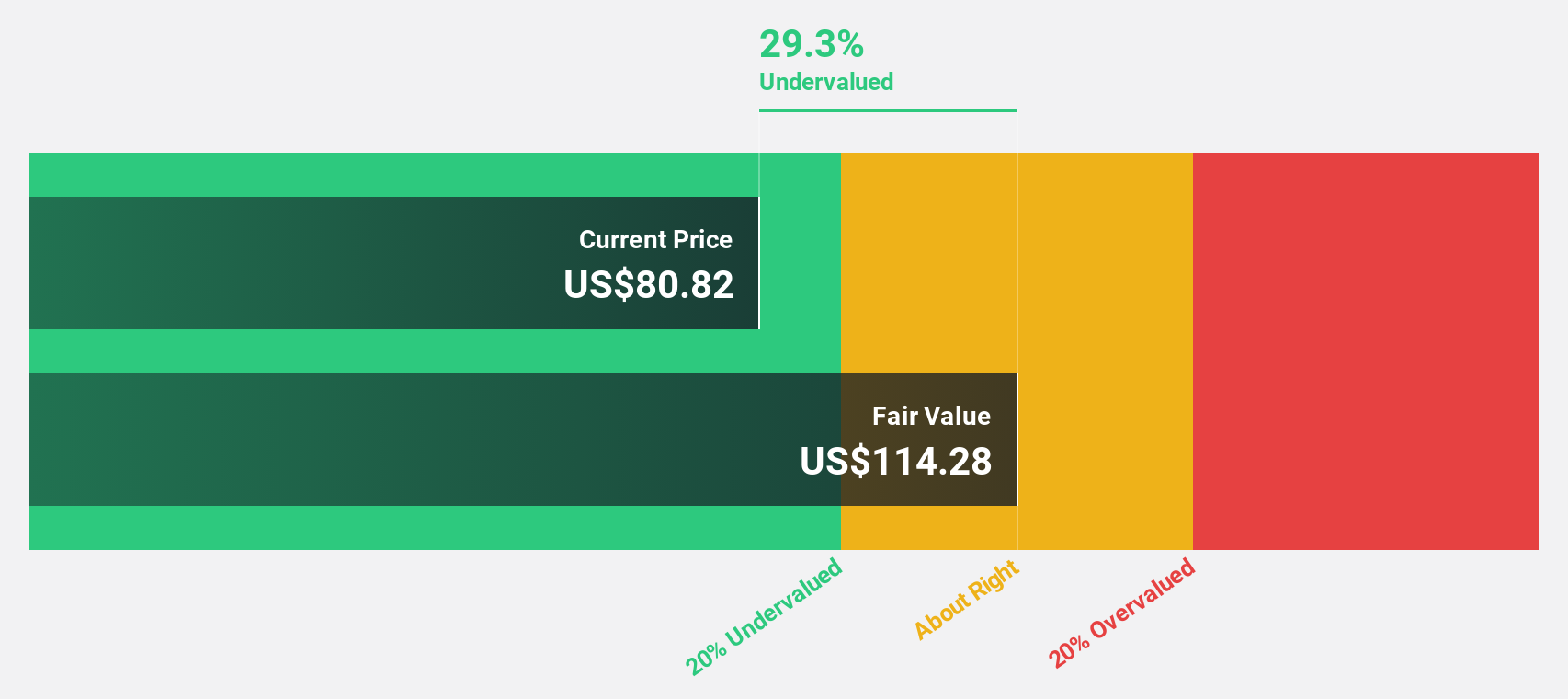

Fidelity National Information Services (FIS)

Overview: Fidelity National Information Services, Inc. (FIS) provides technology solutions for financial institutions and businesses, with a market cap of approximately $35.49 billion.

Operations: FIS generates revenue through its Banking Solutions segment at $7.02 billion and Capital Market Solutions at $3.08 billion.

Estimated Discount To Fair Value: 35.7%

Fidelity National Information Services is trading at US$67.94, well below its estimated fair value of US$105.62, highlighting potential undervaluation based on cash flows. Recent innovations like Smart Basket and Neural Treasury demonstrate strategic advancements in payment solutions and treasury management, though the company faces challenges with a net loss of US$470 million last quarter. Despite these hurdles, FIS's earnings are projected to grow significantly faster than the market over the next three years.

- Upon reviewing our latest growth report, Fidelity National Information Services' projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Fidelity National Information Services' balance sheet health report.

Where To Now?

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 179 more companies for you to explore.Click here to unveil our expertly curated list of 182 Undervalued US Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIS

Fidelity National Information Services

Fidelity National Information Services, Inc.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion