- United States

- /

- IT

- /

- NYSE:EPAM

EPAM NEORIS Unification Might Change The Case For Investing In EPAM Systems (EPAM)

Reviewed by Sasha Jovanovic

- Earlier this month, EPAM Systems announced the unification of its engineering, consulting, and AI-native services in Ibero-America under the EPAM NEORIS brand, combining its global digital expertise with the regional capabilities of NEORIS, Optiva, Vates, and S4N to support Spanish- and Portuguese-speaking markets.

- This move reflects a focused effort to accelerate digital modernization and transformation for clients in the region, leveraging both global scale and specialized local delivery to meet surging demand for digital solutions.

- We'll consider how the consolidation into EPAM NEORIS could influence EPAM’s positioning in high-growth digital transformation markets.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

EPAM Systems Investment Narrative Recap

To own EPAM Systems, an investor must believe that the company's global expansion, focus on AI-native digital transformation, and diverse service portfolio can offset competitive and structural threats amid margin pressure. The recent unification under the EPAM NEORIS brand may strengthen EPAM's regional positioning, yet it does not materially shift the immediate challenge: protecting operating margins against rising wage inflation and heightened competition for specialist IT talent.

Of EPAM's recent announcements, the expanded collaboration with Oracle, aimed at integrating Oracle Cloud Infrastructure and AI services, stands out for its relevance to EPAM's efforts in delivering increasingly complex, mission-critical transformation programs and remaining a trusted digital partner for large enterprises.

However, investors should also consider the implications of intensifying margin pressures, especially as wage costs and talent shortages persist...

Read the full narrative on EPAM Systems (it's free!)

EPAM Systems is expected to reach $6.5 billion in revenue and $582.4 million in earnings by 2028. This outlook assumes an 8.8% annual revenue growth rate and a $181.2 million increase in earnings from the current $401.2 million.

Uncover how EPAM Systems' forecasts yield a $206.80 fair value, a 43% upside to its current price.

Exploring Other Perspectives

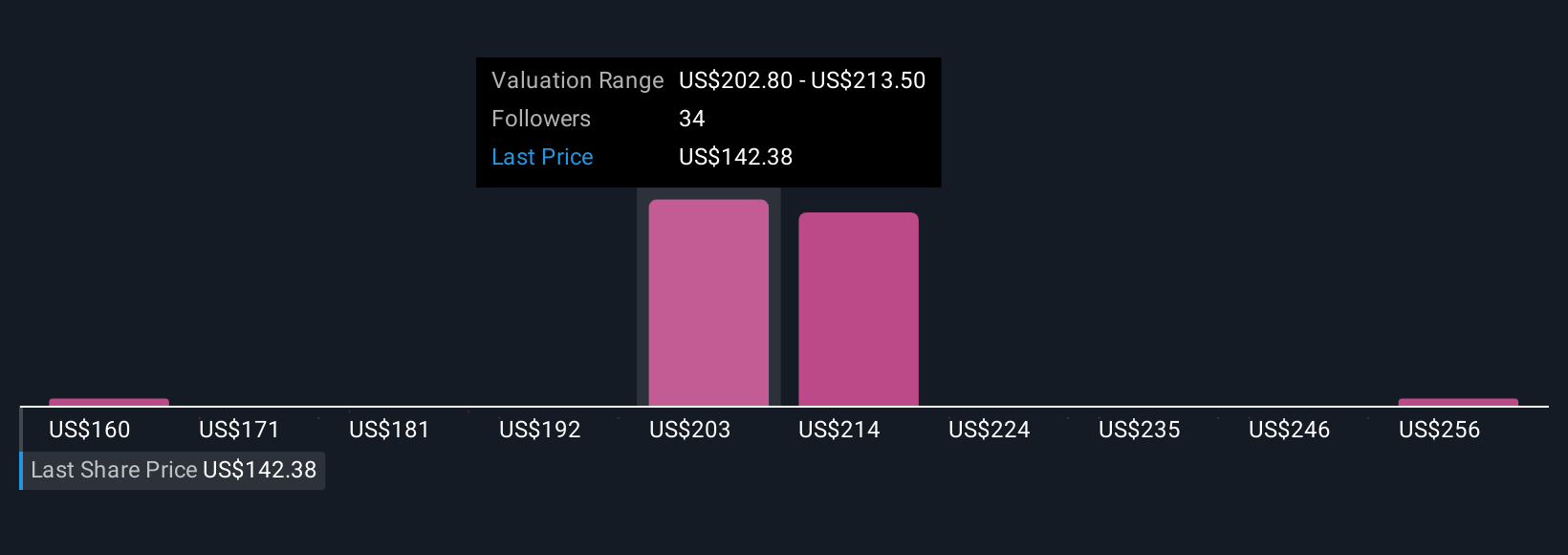

Simply Wall St Community members offer 9 individual fair value estimates for EPAM, ranging from US$160 to US$267 per share. This diversity underscores that while some investors expect long-term transformation to boost returns, you may want to consider how persistent cost and margin risks could affect near-term outcomes.

Explore 9 other fair value estimates on EPAM Systems - why the stock might be worth as much as 85% more than the current price!

Build Your Own EPAM Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EPAM Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EPAM Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EPAM Systems' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if EPAM Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPAM

EPAM Systems

Provides digital platform engineering and software development services worldwide.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)