- United States

- /

- Software

- /

- NYSE:ECOM

We Take A Look At Why ChannelAdvisor Corporation's (NYSE:ECOM) CEO Compensation Is Well Earned

We have been pretty impressed with the performance at ChannelAdvisor Corporation (NYSE:ECOM) recently and CEO David Spitz deserves a mention for their role in it. Coming up to the next AGM on 07 May 2021, shareholders would be keeping this in mind. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

Check out our latest analysis for ChannelAdvisor

How Does Total Compensation For David Spitz Compare With Other Companies In The Industry?

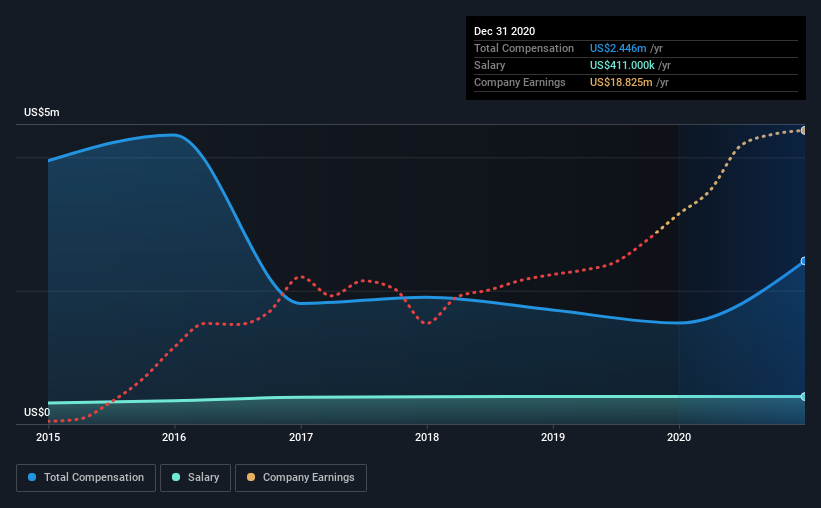

Our data indicates that ChannelAdvisor Corporation has a market capitalization of US$668m, and total annual CEO compensation was reported as US$2.4m for the year to December 2020. That's a notable increase of 62% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$411k.

On examining similar-sized companies in the industry with market capitalizations between US$400m and US$1.6b, we discovered that the median CEO total compensation of that group was US$2.4m. So it looks like ChannelAdvisor compensates David Spitz in line with the median for the industry. Moreover, David Spitz also holds US$3.5m worth of ChannelAdvisor stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$411k | US$411k | 17% |

| Other | US$2.0m | US$1.1m | 83% |

| Total Compensation | US$2.4m | US$1.5m | 100% |

Talking in terms of the industry, salary represented approximately 11% of total compensation out of all the companies we analyzed, while other remuneration made up 89% of the pie. It's interesting to note that ChannelAdvisor pays out a greater portion of remuneration through salary, compared to the industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

ChannelAdvisor Corporation's Growth

ChannelAdvisor Corporation has seen its earnings per share (EPS) increase by 117% a year over the past three years. In the last year, its revenue is up 12%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has ChannelAdvisor Corporation Been A Good Investment?

Boasting a total shareholder return of 63% over three years, ChannelAdvisor Corporation has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 3 warning signs for ChannelAdvisor that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade ChannelAdvisor, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:ECOM

ChannelAdvisor

ChannelAdvisor Corporation, together with its subsidiaries, provides software-as-a-service (SaaS) solutions in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives