- United States

- /

- Software

- /

- NYSE:CWAN

Clearwater Analytics Holdings (CWAN) Powers Agile Investment Management With Unified Platform

Reviewed by Simply Wall St

Clearwater Analytics Holdings (CWAN) experienced a 1% price move over the last month. This period saw the company make significant strides, including its partnership with Agile Investment Management to provide integrated risk and performance analytics solutions, showcasing its advanced technological capabilities. Additionally, the announcement of a $100 million share buyback program reflected management's confidence in the company's value. While these initiatives may have supported the stock's movement, they aligned with broader market trends where indices such as the Nasdaq and S&P 500 reached record highs, thanks in part to anticipated Federal Reserve interest rate cuts.

The recent partnership with Agile Investment Management and the announcement of a US$100 million share buyback program can enhance Clearwater Analytics Holdings' technological and financial position. These initiatives might boost operational efficiencies and shareholder confidence, aligning with the company's focus on expanding margins through automation and international growth. Over the past three years, Clearwater Analytics Holdings' total return, including share price and dividends, was 19.94%, offering a long-term perspective on its performance. However, when compared to the 25.9% return of the US Software industry over the past year, Clearwater appears to lag behind the broader market and its peers.

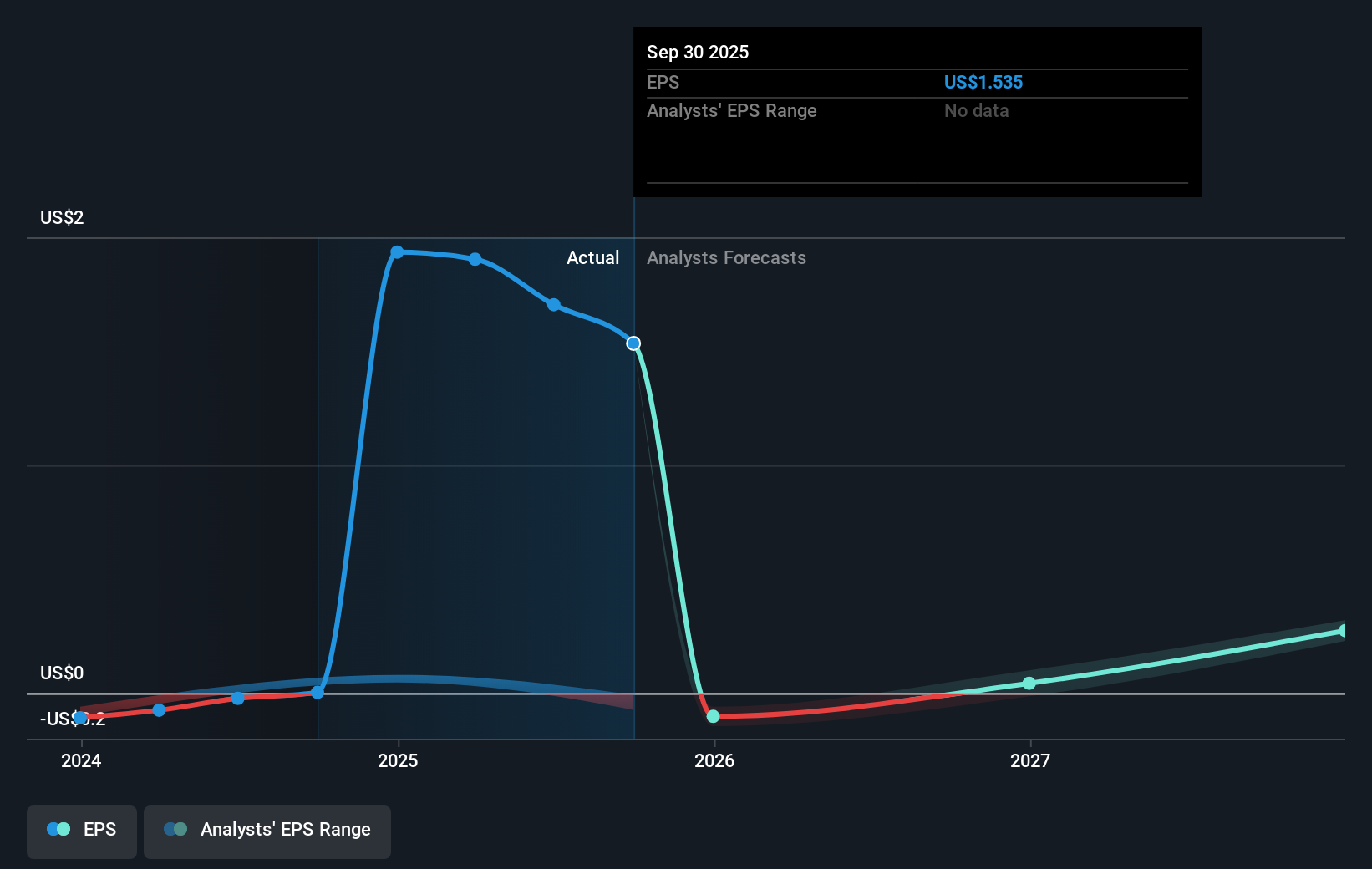

The integration of the recent news with existing growth drivers could impact future revenue and earnings forecasts. Enhancements derived from automation and partnerships like that with Bloomberg may bolster revenue opportunities, particularly in international markets where the company is already making strides. Analysts' price target of US$30.55 suggests a potential upside from the current share price of US$19.61, reflecting optimism about Clearwater's ability to harness these developments. Nonetheless, investors should remain cautious, as integration challenges and market shifts could influence the company's long-term revenue stability and competitive standing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWAN

Clearwater Analytics Holdings

Develops and provides a Software-as-a-Service (SaaS) solution for automated investment data aggregation, reconciliation, accounting, and reporting services to insurers, investment managers, corporations, institutional investors, and government entities in the United States and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>