- United States

- /

- Software

- /

- NYSE:CRM

A Fresh Look at Salesforce (CRM) Valuation After Weaker Revenue Guidance and Questions Around AI Strategy

Reviewed by Simply Wall St

If you’re a Salesforce watcher, the past week has certainly given plenty to digest. The company delivered an earnings beat on both revenue and profit for its recent quarter, but what really caught the market’s attention was a softer outlook for upcoming sales. Even with new wins in government and big investments in AI automation, it is that weaker revenue guidance and questions about how quickly Salesforce can monetize its AI platform that have investors wondering what comes next.

Salesforce shares are down 24% year-to-date, making it one of the poorer performers among large tech names this year. That slide steepened after management’s tepid forecast sparked an almost 5% drop in the aftermath of results. This adds to ongoing concerns over demand and the payoff from heavy AI spending. The company has been streamlining operations, including workforce reductions, while ramping up buybacks and focusing on its Agentforce AI initiative. All of this has shifted the focus to whether growth can accelerate again or if risk is increasing for the stock’s premium valuation.

With the mood turning cautious, is this recent weakness a real buying opportunity or is the market just being realistic about Salesforce’s future growth potential?

Most Popular Narrative: 12% Overvalued

According to Goran_Damchevski, the most widely followed narrative currently views Salesforce as trading above its actual worth, factoring in both industry dynamics and the company’s growth prospects.

“The problem I see with Salesforce’s growth strategy is that when we go through the company’s pre-AI business commentary (1, 2, 3, 4), we see that it relied on increasing the cloud offering to existing customers, further penetration in the enterprise level market, and growth via acquisitions. In other words, aside from selling more of the same, it was hard to see a thought-out growth strategy coming from management before AI broke and saved their story. Now that it has, I believe that it will take advantage of this opportunity and retain leadership.”

What is the foundation for this eye-catching valuation? This narrative points to bold revenue ambitions, aggressive share repurchases, and tough calls on margins. Want to see how these strategic choices all add up to a surprising fair value? The full breakdown reveals the key financial leaps and controversial assumptions you won’t want to miss.

Result: Fair Value of $223.99 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Salesforce could still defy expectations if new enterprise customer wins or innovative AI offerings unlock unexpected growth and sustain its pricing power.

Find out about the key risks to this Salesforce narrative.Another View: Discounted Cash Flow Says Undervalued

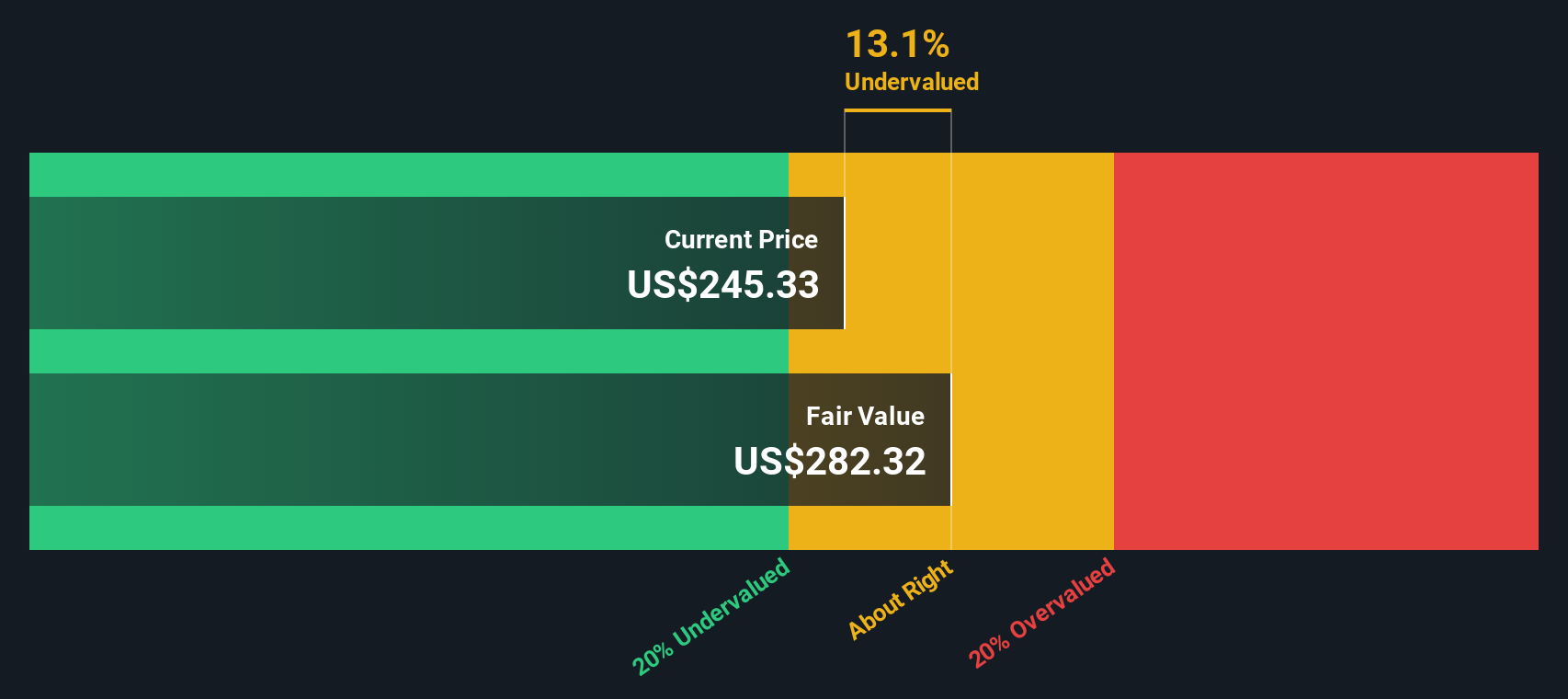

Our DCF model tells a different story by estimating Salesforce is trading below its fair value target. This approach relies on future cash flows, not market multiples, and highlights a clear difference in outlook. Which model will prove right as the year unfolds?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Salesforce Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can quickly craft your own view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Salesforce.

Looking for More Smart Investment Opportunities?

Don’t just watch from the sidelines—take command of your portfolio by searching for companies with game-changing technology, lasting value, or high-income potential. Use Simply Wall Street’s powerful Screener to spot ideas you might otherwise miss.

- Spot emerging companies with strong balance sheets and growth momentum by checking out penny stocks with strong financials.

- Catch the latest innovations in medicine and patient care through healthcare AI stocks, and position yourself at the forefront of healthcare breakthroughs.

- Lock in reliable yields and steady returns by searching for dividend stocks with yields > 3% that deliver consistent, above-average dividends to shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:CRM

Salesforce

Provides customer relationship management technology that connects companies and customers together worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)