- United States

- /

- Software

- /

- NYSE:CRCL

How Should Investors Value Circle After 40% Drop and New Visa Partnership in 2025?

Reviewed by Simply Wall St

Thinking about what to do with Circle Internet Group stock? You are not alone. Investors have had plenty to consider lately, as CRCL has delivered some dramatic moves. Over the past month, shares have dipped almost 40%, with a notable 17% drop just in the last week. That is the kind of action that grabs attention, and for good reason. Swings like these suggest underlying changes in how the market is evaluating both growth potential and risk around Circle’s story.

Yet, despite the recent volatility, longer-term holders have actually seen the stock rise more than 62% year to date. That upswing has coincided with robust revenue and net income growth, with annual numbers increasing 27% and nearly 79% respectively. Clearly, investors are still wrestling with how to value a company that is growing this quickly, but also continues to report net losses.

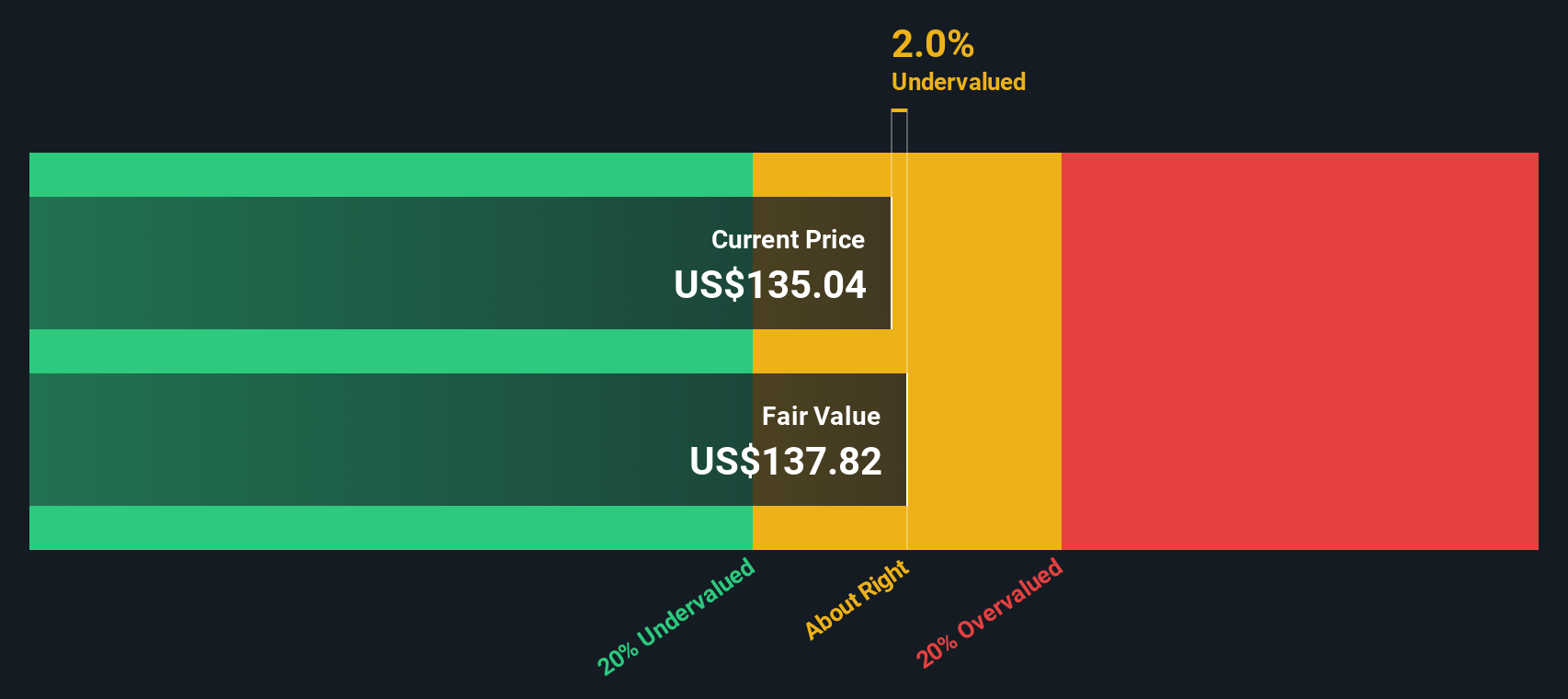

So, how undervalued is Circle Internet Group right now? When we run the stock through our six-point valuation checklist, CRCL scores just 1 out of 6. In other words, it looks undervalued in only one area. That puts it on the lower end compared to some peers, and could be a signal for caution or opportunity depending on your outlook and risk appetite.

With all this in mind, let’s break down exactly how Circle Internet Group stacks up on those different valuation approaches. And if you want to go beyond just checklists, we will wrap up this article with a perspective you might not find anywhere else.

Circle Internet Group delivered 0.0% returns over the last year. See how this stacks up to the rest of the Software industry.Approach 1: Circle Internet Group Cash Flows

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and then discounting them back to today's value. This approach helps investors judge if a stock is trading at a reasonable price compared to what its future cash generation might be worth.

Circle Internet Group's current Free Cash Flow stands at $461 million, with robust projections showing growth reaching $2.58 billion by 2035. Each year, analysts have factored in anticipated increases, and over the next decade, free cash flow is expected to rise steadily, supported by both analyst and internal estimates.

Based on these projections, the DCF analysis values Circle Internet Group’s shares at an intrinsic value of $137.23. Compared to the current market price, this implies that the stock is about 1.5% undervalued. In other words, the stock is trading just slightly below what the DCF suggests its fair value should be.

Result: ABOUT RIGHT

Approach 2: Circle Internet Group Price vs Sales

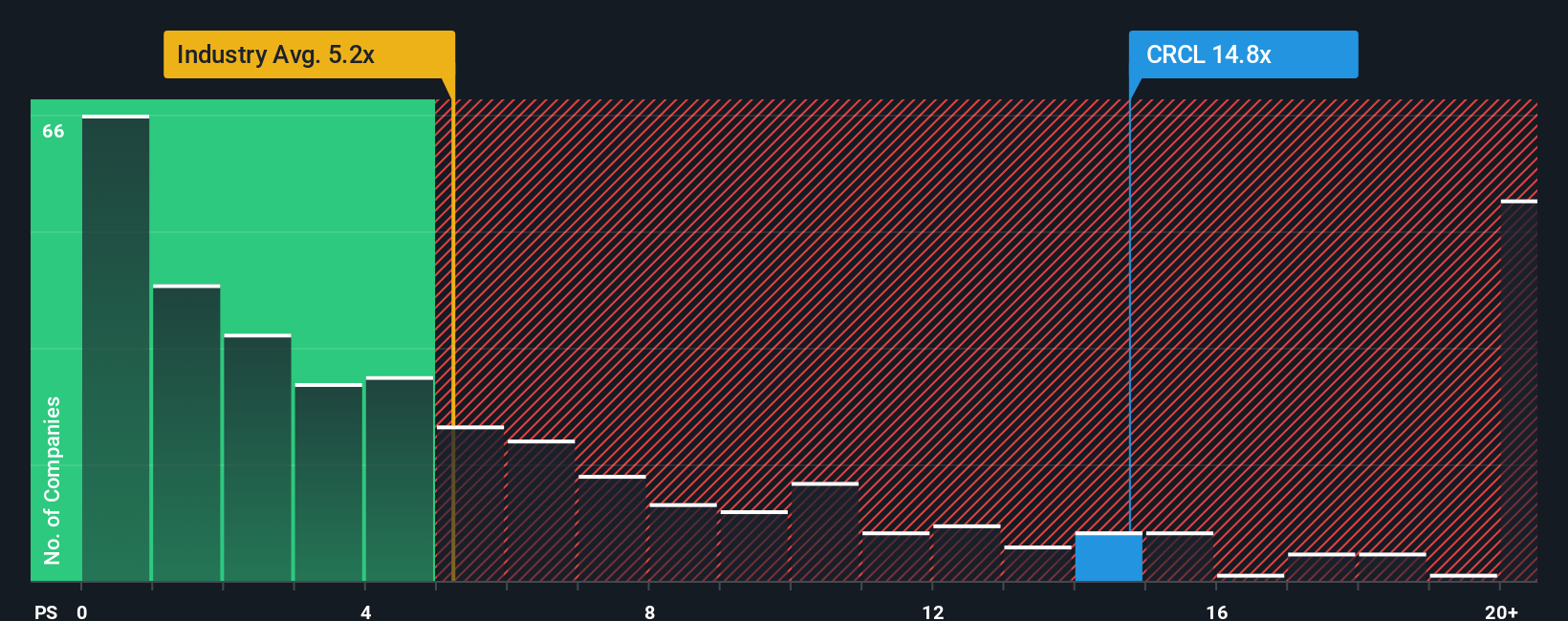

The Price-to-Sales (P/S) ratio is especially useful when analyzing companies that are growing rapidly but may not yet be consistently profitable. For these kinds of businesses, like Circle Internet Group, the P/S ratio can help investors compare valuations more objectively by focusing on revenue. This often provides a better reflection of underlying business momentum than earnings alone.

Growth expectations and risk both influence what appears to be a “fair” P/S ratio for any stock. Higher expected growth rates, strong industry demand, or robust profit margins might justify a premium multiple. In contrast, higher risks or more intense competition could suggest a discount is appropriate.

Currently, Circle Internet Group trades at a P/S ratio of 14.78x. For context, the industry average stands at 4.91x, and its peer group averages a multiple of 13.66x. While this means CRCL is valued at a higher rate than most software names, it is actually in line with similar high-growth peers.

The Fair Ratio is a proprietary measure that considers earnings growth, profitability, risk, and market backdrop to serve as a grounded benchmark for what CRCL’s P/S ratio should be at present. In this case, the Fair Ratio suggests Circle’s current multiple is roughly appropriate, indicating that the stock is neither significantly cheap nor expensive based on revenues.

Result: ABOUT RIGHT

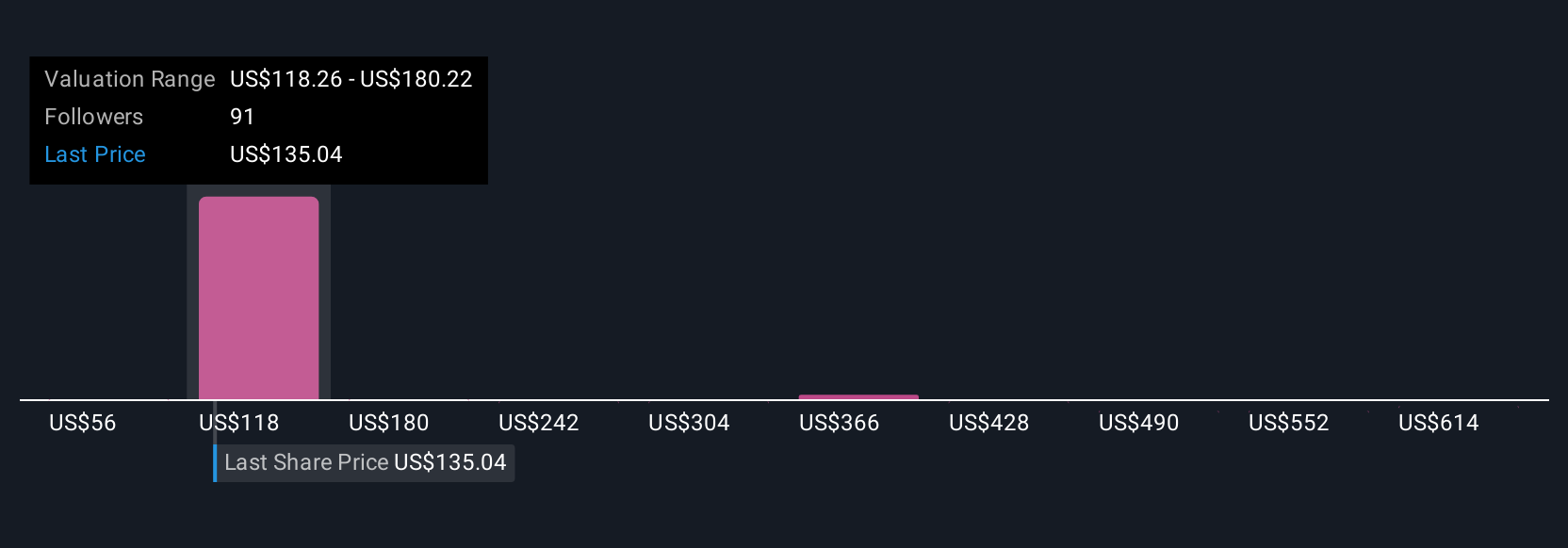

Upgrade Your Decision Making: Choose your Circle Internet Group Narrative

Beyond just numbers, a Narrative is your personal story about Circle Internet Group. It connects what you believe about the company’s future (such as its earnings, revenue, and margins) with a grounded fair value and clear investment implications. Narratives help investors assemble a complete picture, linking their knowledge and expectations about the business into an evolving forecast. This approach guides decisions about when a stock might appear attractive to buy or sell compared to its current price. On the Simply Wall St platform, Narratives are designed to be simple and accessible, empowering millions of investors to map out their unique viewpoints, discuss them, and adapt quickly as new information or earnings are released. Whenever Circle’s story changes, such as after an important earnings report, regulatory update, or partnership announcement, Narratives instantly incorporate the new data into valuations. For example, one investor’s Narrative about Circle Internet Group could be optimistic, forecasting $326 per share based on high growth and favorable regulatory developments. Another investor might take a more cautious approach, estimating $122 per share and considering potential risks and rapidly shifting market dynamics.

Do you think there's more to the story for Circle Internet Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRCL

Circle Internet Group

Operates as a platform, network, and market infrastructure for stablecoin and blockchain applications.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives