- United States

- /

- Biotech

- /

- NasdaqGS:MGTX

High Growth Tech Stocks In The United States Spotlighting Three Leaders

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 3.0%, yet it remains up by 18% over the past year with earnings forecasted to grow by 14% annually. In such a dynamic environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability to capitalize on these promising growth trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 29.79% | 27.57% | ★★★★★★ |

| Travere Therapeutics | 28.04% | 65.55% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Bitdeer Technologies Group | 51.85% | 122.52% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.67% | 58.73% | ★★★★★★ |

| Alvotech | 31.17% | 100.18% | ★★★★★★ |

| Lumentum Holdings | 21.24% | 119.37% | ★★★★★★ |

Click here to see the full list of 227 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Aurinia Pharmaceuticals (NasdaqGM:AUPH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aurinia Pharmaceuticals Inc. is a commercial-stage biopharmaceutical company dedicated to developing and commercializing therapies for diseases with unmet medical needs in the United States, with a market cap of approximately $1.14 billion.

Operations: Aurinia Pharmaceuticals generates revenue primarily from the research, development, and commercialization of therapeutic drugs, totaling $220.36 million.

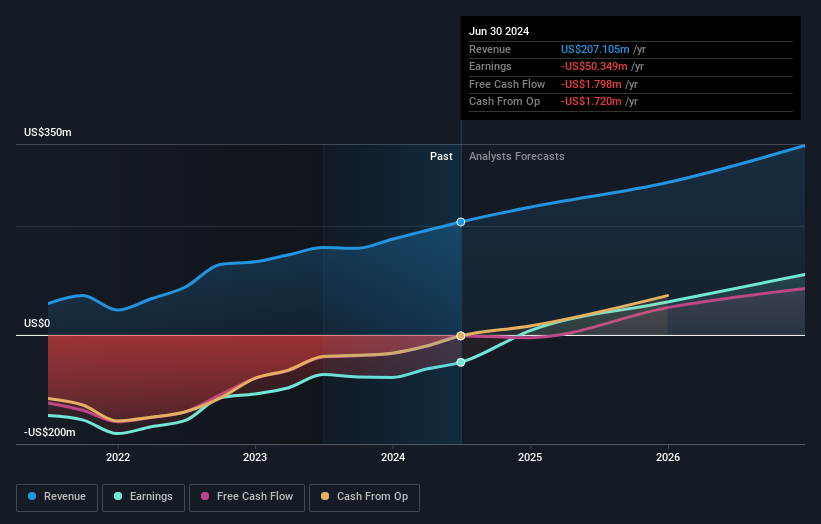

Aurinia Pharmaceuticals, amid a challenging biotech landscape, shows a promising trajectory with its expected revenue growth of 12.7% annually, outpacing the US market average of 8.8%. The company's transition toward profitability is noteworthy; it’s projected to shift from unprofitable status to achieving profit within three years, with earnings anticipated to surge by 38.25% annually. This growth is supported by robust R&D investments that fuel innovation and potential breakthroughs in treatments, positioning Aurinia to capitalize on emerging opportunities in the pharmaceutical sector despite current non-profitability and industry-wide competitive pressures.

- Click to explore a detailed breakdown of our findings in Aurinia Pharmaceuticals' health report.

Understand Aurinia Pharmaceuticals' track record by examining our Past report.

MeiraGTx Holdings (NasdaqGS:MGTX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MeiraGTx Holdings plc is a clinical-stage gene therapy company dedicated to developing treatments for patients with serious diseases, with a market capitalization of approximately $570.52 million.

Operations: The company focuses on biotechnology startups, generating revenue of $13.93 million from this segment.

MeiraGTx Holdings has demonstrated significant strides in the biotech sector, particularly with its recent advancements in gene therapy. The company's revenue is projected to grow at an impressive rate of 41.9% annually, outpacing the US market average significantly. This growth is underpinned by substantial R&D investments, which have facilitated pioneering developments such as their proprietary riboswitch technology and high-yield manufacturing platforms. Recent FDA engagements and multiple Rare Pediatric Disease Designations underscore their potential to expedite novel treatments into the market, positioning MeiraGTx as a dynamic entity within tech-driven biopharmaceuticals despite current non-profitability and operational risks.

CI&T (NYSE:CINT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CI&T Inc. offers strategy, design, and software engineering services to facilitate digital transformation for global enterprises, with a market cap of $978.74 million.

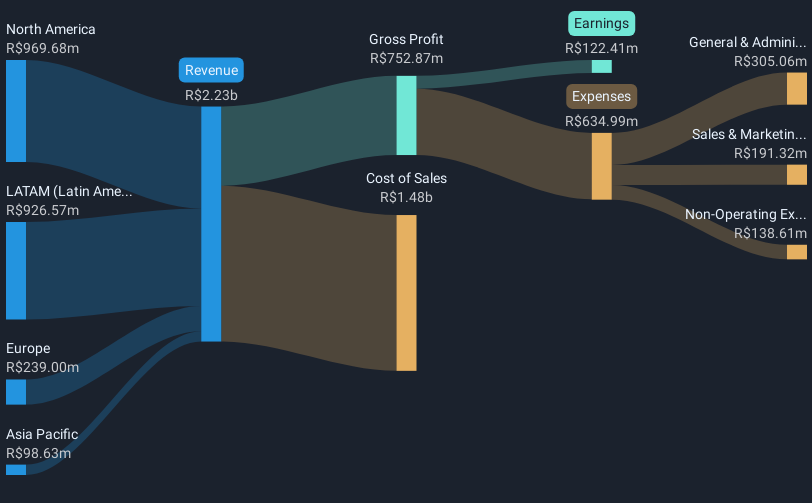

Operations: With a focus on digital transformation, CI&T Inc. generates revenue primarily from its computer services segment, which accounted for R$2.23 billion.

CI&T is carving a niche in the tech landscape with a robust growth trajectory, evidenced by its annual revenue and earnings growth rates of 15.2% and 32.1% respectively. The company's commitment to innovation is underscored by its R&D spending, which consistently aligns with strategic expansions into new markets such as financial services and healthcare through recent high-profile leadership hires. These sectors are poised for digital transformation, offering CI&T ample opportunities to deploy its AI-driven solutions effectively. Moreover, the initiation of a share repurchase program underlines confidence in its financial health and future prospects, enhancing shareholder value amidst expanding operations.

- Click here to discover the nuances of CI&T with our detailed analytical health report.

Examine CI&T's past performance report to understand how it has performed in the past.

Summing It All Up

- Explore the 227 names from our US High Growth Tech and AI Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGTX

MeiraGTx Holdings

A clinical stage genetics medicines company, focusing on developing treatments for patients with serious diseases.

High growth potential low.

Market Insights

Community Narratives