- United States

- /

- Software

- /

- NYSE:BILL

What Does BILL Holdings' (BILL) Buyback and New Equity Plan Reveal About Its Capital Strategy?

Reviewed by Simply Wall St

- BILL Holdings recently reported its fourth quarter and full year 2025 earnings, issued new revenue guidance for fiscal 2026, completed its US$300 million share buyback program, and filed a US$257.3 million shelf registration for an ESOP-related offering.

- An important development is the combination of returning capital to shareholders through buybacks while also preparing additional equity issuance, highlighting both capital management and employee incentive priorities.

- We'll explore how BILL Holdings' completion of its large buyback initiative could influence the company's evolving investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

BILL Holdings Investment Narrative Recap

For investors considering BILL Holdings, the core belief centers on the company’s ability to deliver sustained revenue growth through product innovation and expanding its payment ecosystem for SMBs. The recent completion of the US$300 million share buyback program and ESOP-related shelf registration do not appear to materially shift the most immediate business catalysts, ongoing product launches and continued platform enhancements. However, key risks from competition and volatile SMB sentiment remain important to monitor in the short term.

Among BILL’s recent announcements, the company’s updated fiscal 2026 revenue guidance stands out given current market focus on forward growth potential. Management expects full-year revenue between US$1,589.5 million and US$1,629.5 million, underscoring the importance of execution on new payment solutions and distribution partnerships as the main drivers of near-term performance.

In contrast, investors should also be aware of revenue volatility from macroeconomic swings affecting SMB activity and spending...

Read the full narrative on BILL Holdings (it's free!)

BILL Holdings' outlook points to $2.3 billion in revenue and $31.0 million in earnings by 2028. This is based on an assumed 16.9% annual revenue growth, but earnings are expected to decrease by $7.5 million from the current $38.5 million.

Uncover how BILL Holdings' forecasts yield a $57.45 fair value, a 23% upside to its current price.

Exploring Other Perspectives

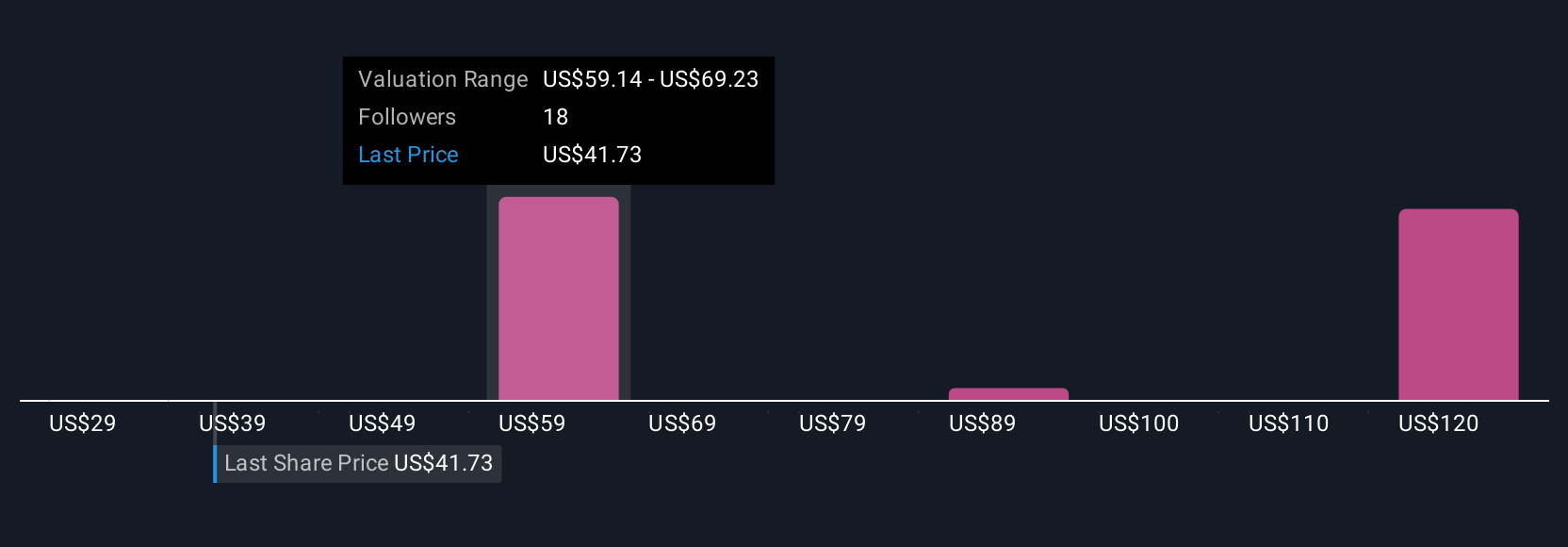

Simply Wall St Community members’ fair value estimates for BILL Holdings span from US$57.45 to US$90 across three viewpoints. With ongoing focus on execution risk from new product rollouts, you can explore a wide range of perspectives on future company performance.

Explore 3 other fair value estimates on BILL Holdings - why the stock might be worth as much as 93% more than the current price!

Build Your Own BILL Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BILL Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BILL Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BILL Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BILL Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BILL

BILL Holdings

Provides financial operations platform for small and midsize businesses worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives