- United States

- /

- IT

- /

- NYSE:BBAI

Evaluating BigBear.ai (BBAI): Institutional Confidence Rises After Major Stake Increases and New Government AI Opportunities

Reviewed by Kshitija Bhandaru

If you have been keeping an eye on BigBear.ai Holdings (BBAI), there has been quite a bit to digest lately. The stock is catching investor attention after some eye-opening disclosures: Goldman Sachs has significantly increased its stake, joining a group of large institutions betting on the company’s expansion in government-backed AI projects. With BigBear.ai’s Shipyard AI aiming to secure a portion of the new multi-billion-dollar federal shipbuilding legislation and steady announcements about defense and logistics contracts, this series of institutional moves suggests a bigger story is developing.

Momentum is certainly building for BigBear.ai. Over the past year, shares have surged nearly 354%, significantly outpacing broader indexes, with especially strong gains in the past month, quarter, and year-to-date. The wider industry has also benefited, in part due to expectations for lower interest rates and renewed focus on AI-powered solutions in government infrastructure. However, even as excitement grows, BigBear.ai’s revenue trends and profitability continue to face scrutiny, especially when compared to larger peers. Still, the ongoing interest from major investors in the stock indicates a shift in risk perception and suggests that growth, rather than hype, could shape the next chapter for BBAI.

With institutional confidence on the rise and the company seeking a share of government spending, some investors may be weighing whether this is an opportunity to participate in BigBear.ai’s momentum or if the market has already priced in much of the upside.

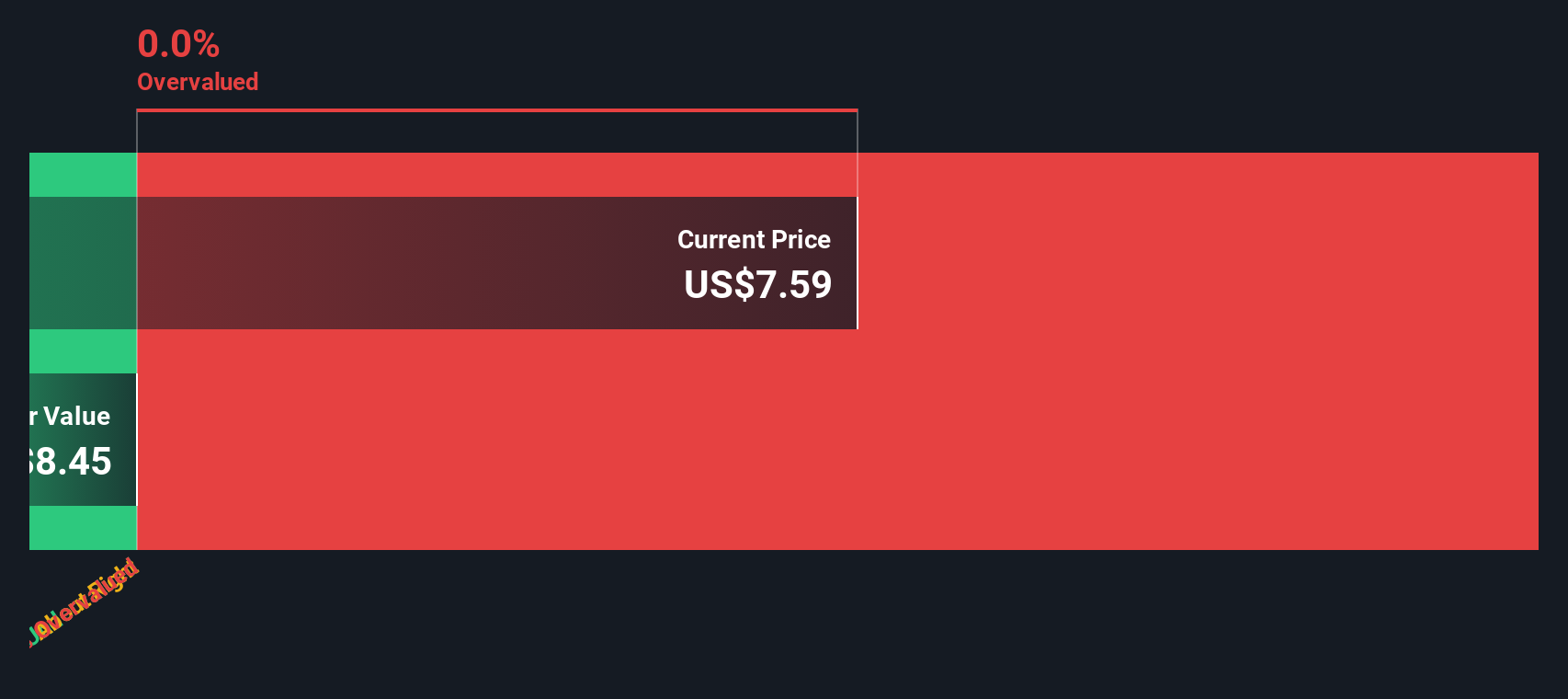

Most Popular Narrative: 21% Overvalued

The most widely followed valuation narrative currently sees BigBear.ai Holdings' stock as trading at a significant premium to its fair value, making it appear overvalued under present assumptions.

With a healthy backlog of $385 million and increased emphasis on multiyear programs, BigBear.ai is positioned to build a stable revenue stream. This supports sustainable growth and improved net margins.

Curious what’s fueling such a bold valuation? The key lies in ambitious financial projections. Just a handful of pivotal growth assumptions separate this target price from reality. Want to uncover what powers this optimistic pricing for BigBear.ai Holdings? Find out which daring forecasts and margin improvements analysts are banking on to make this story work.

Result: Fair Value of $5.83 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent government funding delays or continued revenue volatility could quickly challenge even the most optimistic forecasts for BigBear.ai’s future growth.

Find out about the key risks to this BigBear.ai Holdings narrative.Another View: What Does Our DCF Model Suggest?

While the market sees BigBear.ai Holdings as stretched on traditional valuation multiples, our DCF model finds insufficient data to establish a precise fair value for the stock today. Could this uncertainty mean untapped opportunity, or does it reinforce caution?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own BigBear.ai Holdings Narrative

If you see things differently, or want to dive into the numbers and shape the story yourself, it only takes a few minutes to do your own analysis. Do it your way.

A great starting point for your BigBear.ai Holdings research is our analysis highlighting 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t stop with just one opportunity. Uncover stocks shaping tomorrow’s market using these handpicked routes. Your next big winner could be right here, waiting for you.

- Tap into the fastest-growing tech opportunities, from AI breakthroughs to digital transformation, by seizing a chance with AI penny stocks.

- Boost your portfolio’s stability and potential income by unlocking a curated set of dividend stocks with yields > 3% that offer both consistent returns and growth upside.

- Capture undervalued gems ready for a comeback by seeking out undervalued stocks based on cash flows that the market hasn’t fully recognized. Don’t let these slip by.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BigBear.ai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBAI

BigBear.ai Holdings

Provides artificial intelligence-powered decision intelligence solutions.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives