- United States

- /

- IT

- /

- NYSE:BBAI

BigBear.ai (BBAI): Assessing Valuation After Strong Multi‑Year Gains and Recent Share Price Pullback

Reviewed by Simply Wall St

BigBear.ai Holdings (BBAI) has been on a wild ride, with the stock up roughly 55% year to date and more than 150% over the past year, despite lingering net losses.

See our latest analysis for BigBear.ai Holdings.

The recent pullback, including a 1 month share price return of minus 11.0 percent from a 90 day gain of 26.1 percent and a standout 3 year total shareholder return of 678.1 percent, suggests momentum is cooling, but the longer term narrative remains powerful.

If BigBear.ai has you thinking about where else rapid growth could emerge, now is a good time to explore high growth tech and AI stocks as potential next wave candidates.

With shares still hovering near analyst targets despite hefty historical gains and ongoing losses, investors now face a key question: is BigBear.ai quietly undervalued ahead of its next leg higher, or is the market already factoring in all that future growth?

Most Popular Narrative: 4.3% Undervalued

With BigBear.ai closing at $6.38 against a narrative fair value of $6.67, expectations lean slightly higher and set the scene for ambitious growth assumptions.

With a healthy backlog of $385 million and increased emphasis on multiyear programs, BigBear.ai is positioned to build a stable revenue stream, supporting sustainable growth and improved net margins.

Curious what kind of revenue runway and margin lift could defend such a steep future earnings multiple, far above typical IT names? The narrative reveals the bold math behind that premium valuation, including how gradual growth, shifting profitability and share dilution are all expected to line up.

Result: Fair Value of $6.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, revenue lumpiness and delays in government procurement could quickly undermine the growth narrative if new contracts and funding fail to materialize as expected.

Find out about the key risks to this BigBear.ai Holdings narrative.

Another View: Lofty Sales Multiple Raises Questions

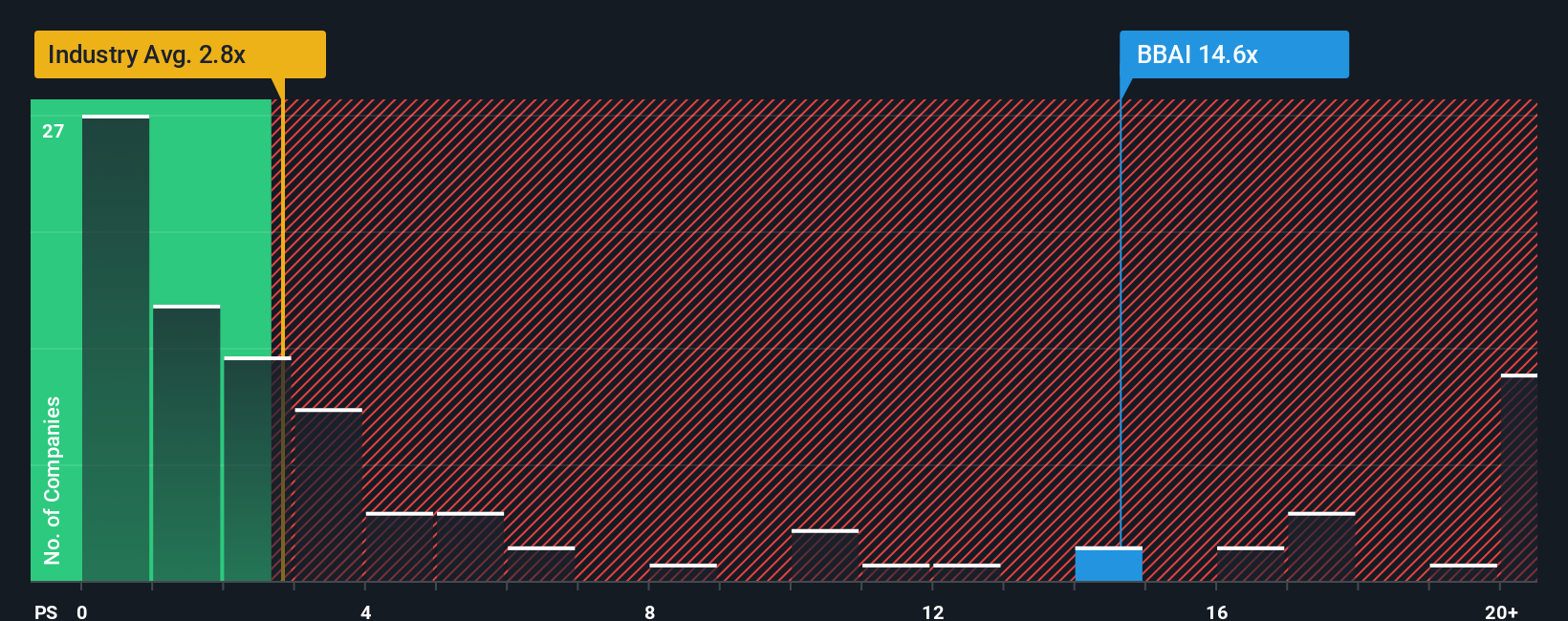

While the narrative fair value suggests BigBear.ai is modestly undervalued, its price to sales ratio of 19.3 times sits far above the US IT industry at 2.4 times, peers at 0.6 times, and an estimated fair ratio of 2.5 times. This leaves little room for execution missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BigBear.ai Holdings Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a personalized perspective in just a few minutes: Do it your way.

A great starting point for your BigBear.ai Holdings research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Before you move on, make your research count by scanning fresh opportunities on the Simply Wall St Screener, where data backed ideas meet real market potential.

- Capture potential multi baggers early by targeting fast growing names through these 3606 penny stocks with strong financials before the broader market catches on.

- Position yourself at the heart of the AI shift by screening for these 26 AI penny stocks that pair innovation with solid fundamentals.

- Lock in value focused opportunities by filtering for these 907 undervalued stocks based on cash flows that may be trading at a discount to their long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if BigBear.ai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBAI

BigBear.ai Holdings

Provides artificial intelligence-powered decision intelligence solutions.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)