- United States

- /

- Software

- /

- NYSE:AI

C3.ai (AI) Valuation Revisited Following Leadership Shakeup, Revenue Decline, and Lawsuit Concerns

Reviewed by Kshitija Bhandaru

C3.ai (AI) has been at the center of attention lately, and not for reasons shareholders would hope. After reporting a major revenue decline on top of an operating loss, the company’s founder and longtime CEO stepped down due to health issues. This leadership change, along with a fresh round of class action lawsuits claiming management wasn’t completely transparent about company growth and the CEO’s health, has shaken any sense of stability investors might have had.

The impact is clear in recent price moves. Shares are down nearly 21% over the past year and have halved in value since the start of 2025, despite some short-term trading spikes. Even with new product launches like the Agentic Process Automation platform and ongoing partnerships with heavyweight firms, the market seems highly focused on C3.ai’s ability to execute a turnaround as skepticism remains front and center.

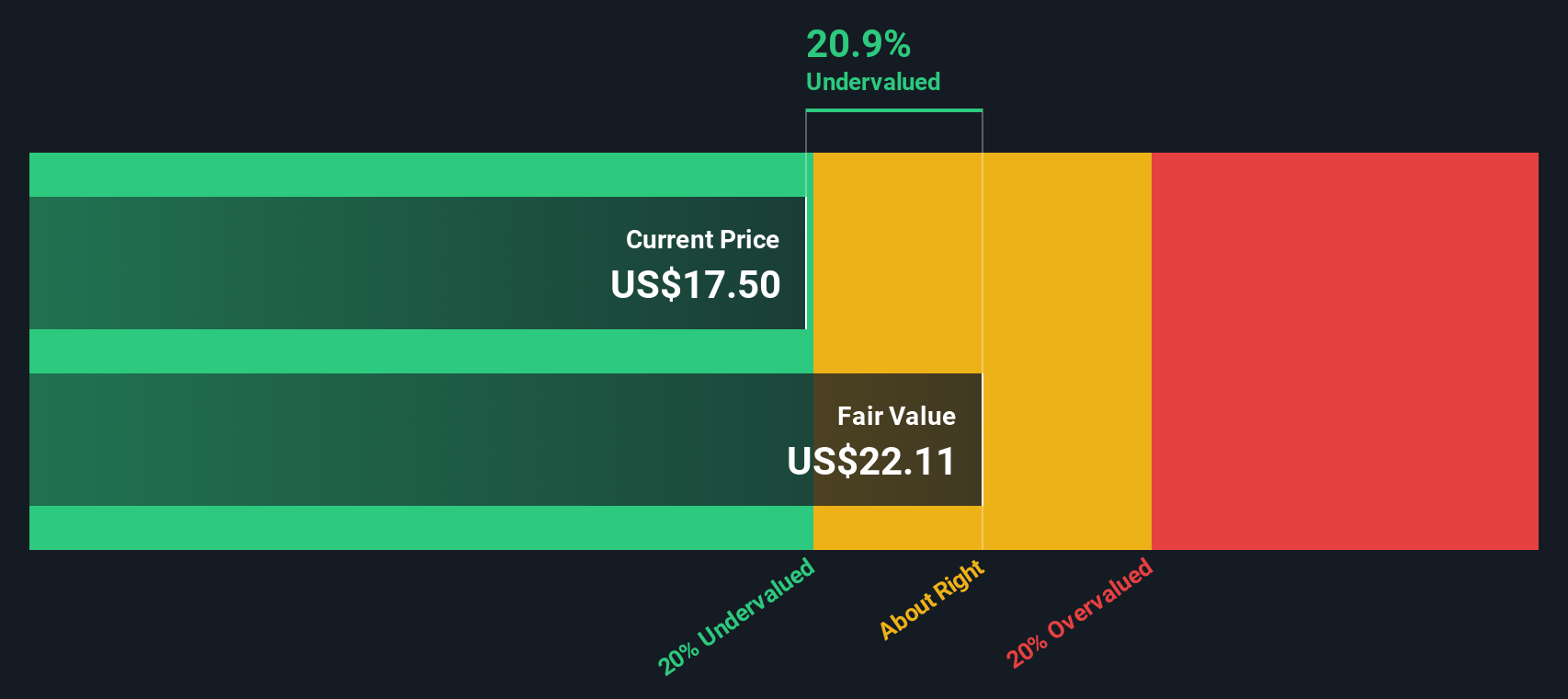

With sentiment soured and the stock trading near its recent lows, the question now is whether there is hidden value for patient investors or if the market is already bracing for more challenges ahead.

Most Popular Narrative: 26% Overvalued

The current valuation sees C3.ai as significantly overvalued relative to its estimated fair value, based on projected earnings and future fundamentals.

The introduction of the Strategic Integrator Program and the open, agentic AI platform positions C3.ai to capitalize on the growing need for scalable, interoperable enterprise AI and regulatory-compliant solutions across industries. This supports both higher win rates and the ability to command premium pricing, benefiting both revenue growth and gross margins.

Do you want to uncover what's really driving this rich valuation? The narrative is built on bold forecasts about future profits and sky-high multiples that rival the best in software. Curiosity piqued? The secret to this overvaluation lies in the aggressive growth projections and margin assumptions the narrative uses to justify C3.ai's current price. Only a look inside will reveal the exact numbers and logic powering this lofty target.

Result: Fair Value of $14.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sharp revenue declines and ongoing dependency on major partners continue to cast uncertainty over C3.ai's ambitious turnaround story.

Find out about the key risks to this C3.ai narrative.Another View: Discounted Cash Flow Offers No Silver Lining

Taking a step back from earnings multiples, our DCF model cannot provide an undervalued signal for C3.ai due to insufficient financial data. When no safety net appears on this metric, the question arises: could risk outweigh reward?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out C3.ai for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own C3.ai Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can easily build your own view in just minutes. Do it your way

A great starting point for your C3.ai research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why just watch from the sidelines when you can seize high-potential opportunities others overlook? Broaden your investment search and get ahead using these powerful tools:

- Uncover untapped potential by targeting early-stage companies with penny stocks with strong financials and spot hidden gems before they go mainstream.

- Supercharge your portfolio with leading innovators at the intersection of AI and healthcare using healthcare AI stocks to track the next wave of medical breakthroughs.

- Position yourself for growth by harnessing undervalued stocks based on cash flows and find solid businesses flying under the radar of most investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AI

C3.ai

Operates as an enterprise artificial intelligence application software company.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives