- United States

- /

- Software

- /

- NasdaqGS:ZS

Zscaler (NasdaqGS:ZS) Shares Rise 11% Over The Past Week

Reviewed by Simply Wall St

Zscaler (NasdaqGS:ZS) saw an 11% rise in its share price over the past week, potentially bolstered by its collaboration with T-Mobile to implement a hybrid zero trust approach completed in 2023. This collaboration underscored the company's strength in cloud security solutions, enhancing T-Mobile’s infrastructure and phasing out traditional VPNs. Meanwhile, broader market trends saw declines with indexes such as the Nasdaq Composite dropping 1% while the S&P 500 fell 0.8%, making Zscaler's move more significant. The company's price move counters the general market downturns, highlighting the impact of its strategic partnerships on investor sentiment.

The recent collaboration between Zscaler and T-Mobile enhances Zscaler's position in the cloud security sector, reinforcing its Zero Trust architecture. This partnership is expected to drive upsell opportunities and attract new customers, potentially increasing revenue and improving net retention rates. Over the past five years, Zscaler's total shareholder returns, including share price and dividends, have increased significantly by 212.07%. However, Zscaler's one-year return exceeded the US Software industry return of 7.6% as its shares outperformed in a challenging market environment.

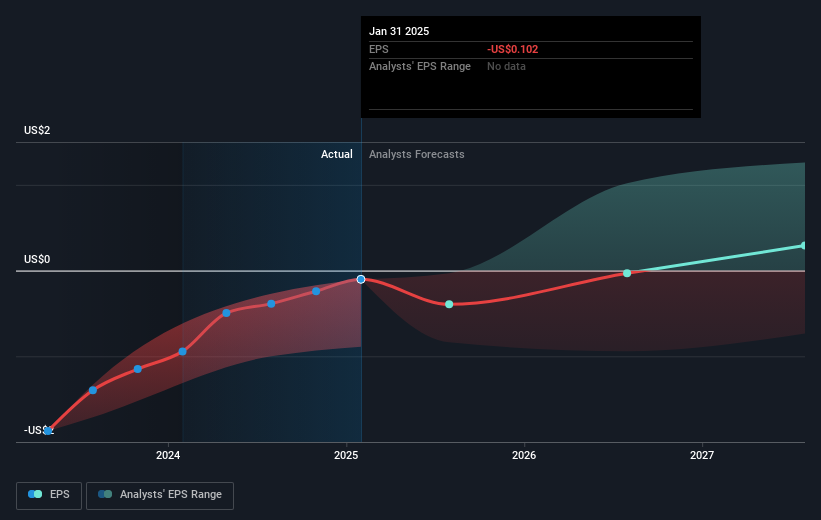

The news of this partnership supports revenue forecasts, as strategic expansions and alliances may bolster Zscaler's market presence and drive sustained revenue growth. While the company's earnings remain negative at US$15.53 million, analysts are optimistic about future profitability, expecting earnings to improve significantly over the coming years, driven by increasing demand for cloud security solutions. However, potential risks could impact these projections, such as macroeconomic pressures and disruptive market conditions.

Zscaler's current share price of US$196.52 presents a 16.7% potential upside compared to the analyst consensus price target of US$235.78. This indicates investor optimism fueled by its robust partnerships and market position. The stock's performance relative to the consensus price target suggests a positive outlook, although investors are encouraged to assess their own investment considerations and assumptions regarding Zscaler's market trajectory and financial outlook.

Our valuation report unveils the possibility Zscaler's shares may be trading at a premium.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives