- United States

- /

- Software

- /

- NasdaqCM:ZENV

Zenvia Inc. (NASDAQ:ZENV) Stock's 29% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Zenvia Inc. (NASDAQ:ZENV) shares have had a horrible month, losing 29% after a relatively good period beforehand. The good news is that in the last year, the stock has shone bright like a diamond, gaining 128%.

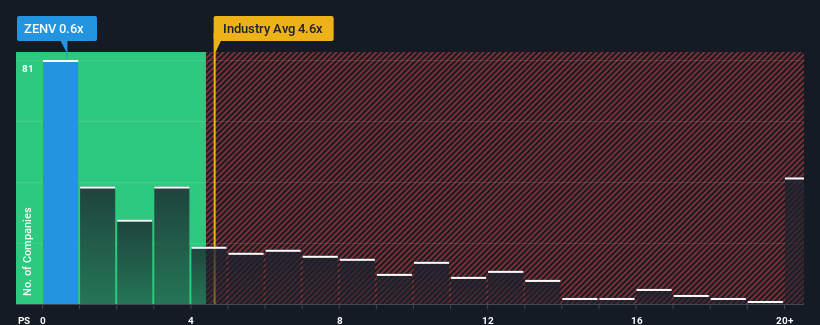

Since its price has dipped substantially, Zenvia's price-to-sales (or "P/S") ratio of 0.6x might make it look like a strong buy right now compared to the wider Software industry in the United States, where around half of the companies have P/S ratios above 4.6x and even P/S above 11x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Zenvia

What Does Zenvia's Recent Performance Look Like?

Zenvia could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Zenvia will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Zenvia?

Zenvia's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. Pleasingly, revenue has also lifted 83% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 17% over the next year. That's shaping up to be materially higher than the 14% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Zenvia's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Shares in Zenvia have plummeted and its P/S has followed suit. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Zenvia's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You need to take note of risks, for example - Zenvia has 4 warning signs (and 2 which are significant) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Zenvia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ZENV

Zenvia

Develops a cloud-based platform that enables organizations to integrate various communication capabilities in Brazil, the United States, Argentina, Mexico, the Netherlands, Malta, Peru, Switzerland, Colombia, Chile, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives