- United States

- /

- Software

- /

- NasdaqCM:WULF

TeraWulf (WULF) Valuation Check After Bitcoin Slide, Share Dilution and AI Data Center Transition Concerns

Reviewed by Simply Wall St

TeraWulf (WULF) just took a hit as Bitcoin slid and the company pushed through a mandatory conversion of preferred shares into common stock, lifting the share count and sharpening investor focus on dilution.

See our latest analysis for TeraWulf.

The latest slide comes after a volatile stretch in which the 30 day share price return of 18.20 percent and year to date share price return of 137.91 percent contrast with a still strong 3 year total shareholder return of 2,136.19 percent. This suggests momentum is cooling, while the long term story remains very much alive.

If TeraWulf has you thinking about what might run next in digital infrastructure and AI, this is a good moment to explore high growth tech and AI stocks for fresh ideas.

With revenue growing fast but profits elusive, dilution rising, and the share price still well below analyst targets, is TeraWulf quietly undervalued here, or is the market already pricing in every watt of future AI powered growth?

Most Popular Narrative Narrative: 39.4% Undervalued

With TeraWulf closing at $12.99 versus a narrative fair value near $21.44, the spread hinges on highly ambitious growth and margin assumptions.

Long term partnerships and investments from marquee players (Google's $1.8B lease backstop and equity stake) signal institutional validation, enhance creditworthiness, and are likely to lower WULF's future cost of capital, directly supporting margin expansion and accelerated infrastructure growth.

Want to see the math behind that gap? The narrative leans on explosive revenue growth, a sharp margin turnaround, and a premium future earnings multiple. Curious which specific profit trajectory and valuation hurdle have to click perfectly to reach that fair value? Dive in to find the assumptions that really move the needle.

Result: Fair Value of $21.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, TeraWulf's capital intensive AI build out and dependence on counterparties like Fluidstack mean any demand hiccup or delay could rapidly undermine this bullish setup.

Find out about the key risks to this TeraWulf narrative.

Another Way to Look at Value

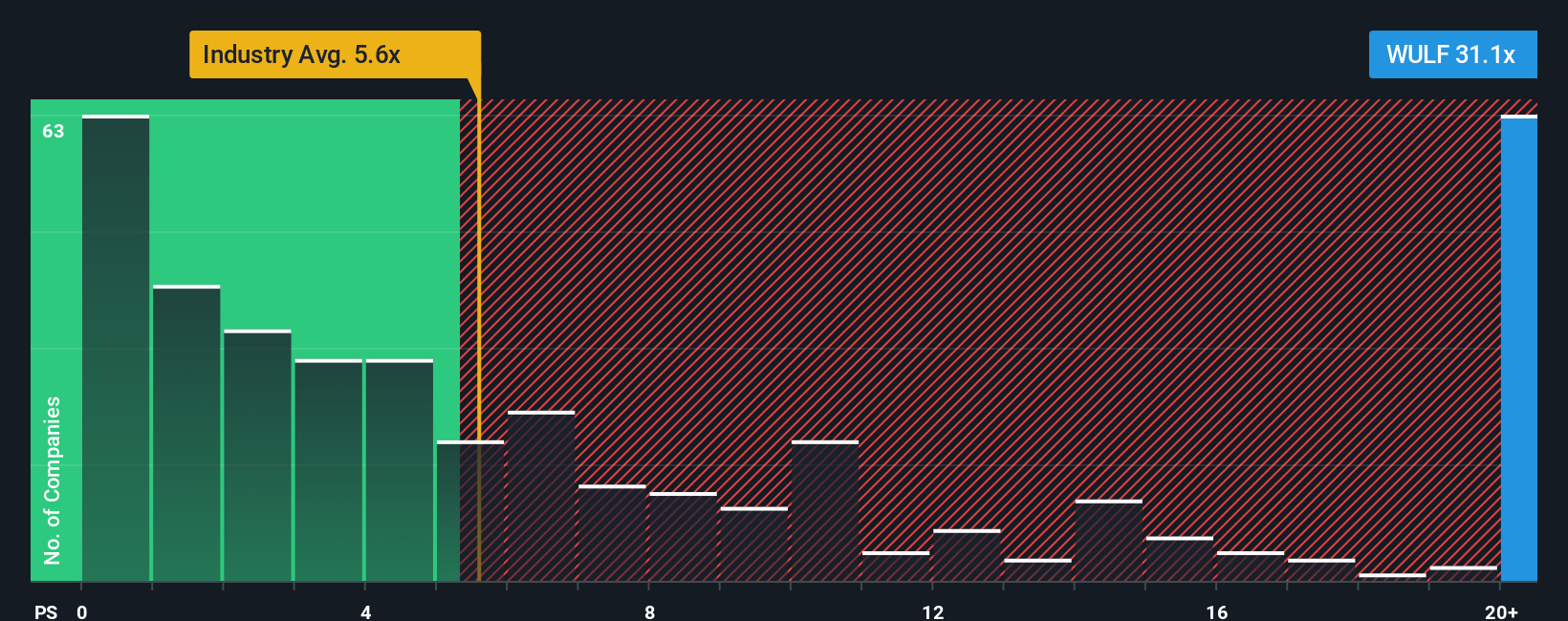

Strip out the narrative models and look at sales, and TeraWulf suddenly screens expensive, trading on a price to sales of 32.4 times versus a peer average of 17.1 times and a fair ratio of 13.1 times. Is this a rare franchise premium or pure valuation risk building?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TeraWulf Narrative

If this view does not quite match your own or you would rather dig into the numbers yourself, build a custom narrative in under three minutes, Do it your way.

A great starting point for your TeraWulf research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you stop at TeraWulf, put your capital to work by scanning fresh opportunities on Simply Wall St that match your style, risk tolerance, and return goals.

- Capture potential mispricings by targeting these 911 undervalued stocks based on cash flows that combine solid fundamentals with attractive entry points.

- Ride structural growth trends by zeroing in on these 30 healthcare AI stocks transforming diagnostics, treatment pathways, and medical efficiency.

- Tap high yield potential by focusing on these 13 dividend stocks with yields > 3% that can support steady income alongside capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TeraWulf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:WULF

TeraWulf

Operates as a digital asset technology company in the United States.

High growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)