- United States

- /

- IT

- /

- NasdaqGS:WIX

Wix.com (WIX) Valuation in Focus After Convertible Notes Move to Boost Growth Flexibility

Reviewed by Simply Wall St

Wix.com (WIX) just stirred the pot with news of a $750 million convertible notes offering targeting institutional investors, a move that instantly caught Wall Street’s attention. The company’s motivation is clear, using these zero-interest senior notes to buy back shares and give itself more breathing room for acquisitions or expansion plans down the line. By adding capped call transactions to cushion against dilution, Wix is making a calculated bet on its future while aiming to reassure existing shareholders.

The announcement prompted a 2.1% dip in Wix’s pre-market share price, a sign that investors are still digesting what this means for risk and reward heading into 2030. Looking at the bigger picture, the stock has delivered an 8.7% return over the past year, though its YTD numbers sit nearly 23% in the red. Three-year holders, however, have seen gains of roughly 130%, showing that while short-term sentiment is cautious, the longer-term story is one of meaningful momentum, likely influenced by double-digit revenue and net income growth lately. This combination of recent volatility and the potential for further expansion creates an environment ripe for debate.

With shares under pressure after the deal, the big question is whether this creates a real buying opportunity or if investors risk overestimating Wix's future growth prospects as the company adopts new capital strategies.

Most Popular Narrative: 18.9% Undervalued

The prevailing narrative points to Wix.com trading below its perceived fair value, largely due to strong earnings prospects and ongoing strategic initiatives that could fuel expansion in the next few years.

*Accelerating adoption of AI-powered tools and onboarding funnels is driving a significant increase in new user cohorts and higher conversion to paid subscriptions, which supports expectations for revenue growth in both the near and long term.*

Curious about what is behind this bullish outlook? The engine fueling this valuation is a mix of aggressive profit targets, bold margin improvements, and ambitious forecasts for user monetization. Interested in the full story and the numbers that could redefine expectations? The real details behind this upside narrative will surprise you.

Result: Fair Value of $206.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing declines in website traffic from search engines and rising competition from new AI-powered platforms could quickly change Wix's growth trajectory.

Find out about the key risks to this Wix.com narrative.Another Perspective: Market-Based Comparison

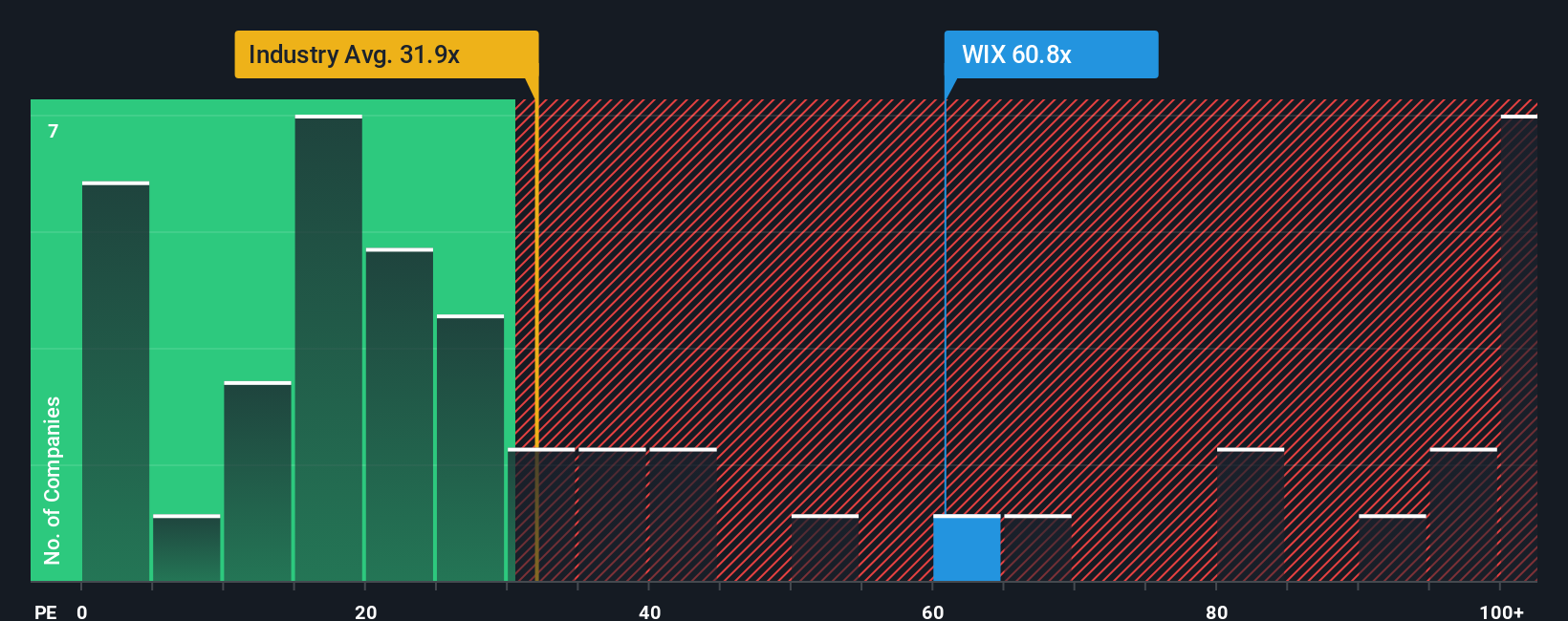

Taking a different approach, a look at Wix.com through the lens of common market ratios paints a less optimistic picture. This method actually suggests the shares are more expensive than industry averages. Could the market be overlooking some key risks, or is underlying growth still being underestimated?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wix.com Narrative

If you want to dive deeper or question these viewpoints, you can easily put together your own take on the numbers in under three minutes. Do it your way.

A great starting point for your Wix.com research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors don’t wait on the sidelines. Power up your portfolio today by finding companies that align with your strategy, using powerful tools built for forward-thinkers.

- Snap up high-yield opportunities and put your cash to work with solid returns by using our dividend stocks with yields > 3%.

- Catch the wave of groundbreaking medical technologies and growth potential with a focus on healthcare AI stocks.

- Jump ahead of market trends and spot undervalued gems backed by robust cash flow metrics through our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wix.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WIX

Wix.com

Operates a cloud-based web development platform for registered users and creators worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives