- United States

- /

- IT

- /

- NasdaqGS:WIX

Wix.com (WIX) Expands Equity Buyback Plan by US$200 Million

Reviewed by Simply Wall St

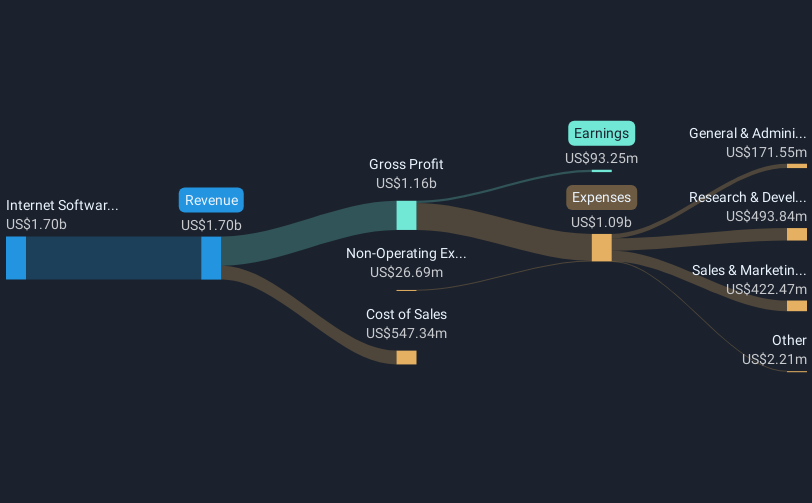

Wix.com (WIX) experienced a notable rise in its share price with a 36% increase over the past month, coinciding with significant developments within the company. The launch of the CookieYes app on the Wix App Market on August 19, focusing on compliance with global privacy regulations, highlighted Wix's ongoing efforts to enhance its platform's offerings. Furthermore, the company's decision to boost its equity buyback plan by $200 million indicates a strong commitment to rewarding shareholders. These initiatives complemented broader market movements, as major indices like the S&P 500 and Nasdaq reached all-time highs, suggesting a synergistic effect on Wix's recent stock performance.

You should learn about the 2 risks we've spotted with Wix.com.

Wix.com's recent initiatives, such as the CookieYes app launch and an enhanced equity buyback plan, could play a substantial role in shaping the company's narrative. These developments align with the company's goal of boosting user growth and retention through AI-driven enhancements, which could potentially lead to better monetization and margin expansion. Over the past three years, Wix's total return surged 129.99%, which highlights its robust performance in the period.

In comparison to the broader market over the past year, Wix underperformed the US IT industry, which presents a competitive challenge moving forward. However, the company's strategic moves, such as AI adoption and Base44 integration, may offer pathways to enhanced revenue growth and margin improvement, supporting the positive future analyst expectations. As of now, Wix's current share price of $167.04, while impressive, remains below the consensus analyst price target of $206.09 by approximately 23.38%, suggesting room for potential upside if the company's strategies effectively increase earnings and revenue growth as anticipated by analysts.

Click here to discover the nuances of Wix.com with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wix.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WIX

Wix.com

Operates a cloud-based web development platform for registered users and creators worldwide.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion