- United States

- /

- IT

- /

- NasdaqGS:WIX

Exploring Three High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 28% over the past year with earnings expected to grow by 15% per annum in the coming years. In this context of robust growth potential, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and scalability within this dynamic market environment.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 23.98% | 42.48% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 240 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Alvotech (NasdaqGM:ALVO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alvotech, with a market cap of $3.56 billion, develops and manufactures biosimilar medicines through its subsidiaries for patients worldwide.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to $393.92 million.

Alvotech's recent strides in the biotech industry underscore its commitment to innovation, particularly in the biosimilar market. The company has seen a significant reduction in its net loss to $164.9 million from $275.17 million year-over-year, showcasing effective management and promising developments like the FDA's approval of SELARSDI for psoriatic conditions and anticipated launches aligning with U.S. market demands by Q1 2025. These efforts are complemented by a robust R&D focus, where Alvotech invests heavily; this is evident from their pipeline updates at various global healthcare conferences and strategic expansions with Teva Pharmaceutical Industries. This strategy not only bolsters their portfolio but also enhances patient access to essential treatments, potentially reshaping sector dynamics as they move towards profitability forecasted with an impressive growth rate of 99% annually.

- Take a closer look at Alvotech's potential here in our health report.

Gain insights into Alvotech's historical performance by reviewing our past performance report.

Wix.com (NasdaqGS:WIX)

Simply Wall St Growth Rating: ★★★★★☆

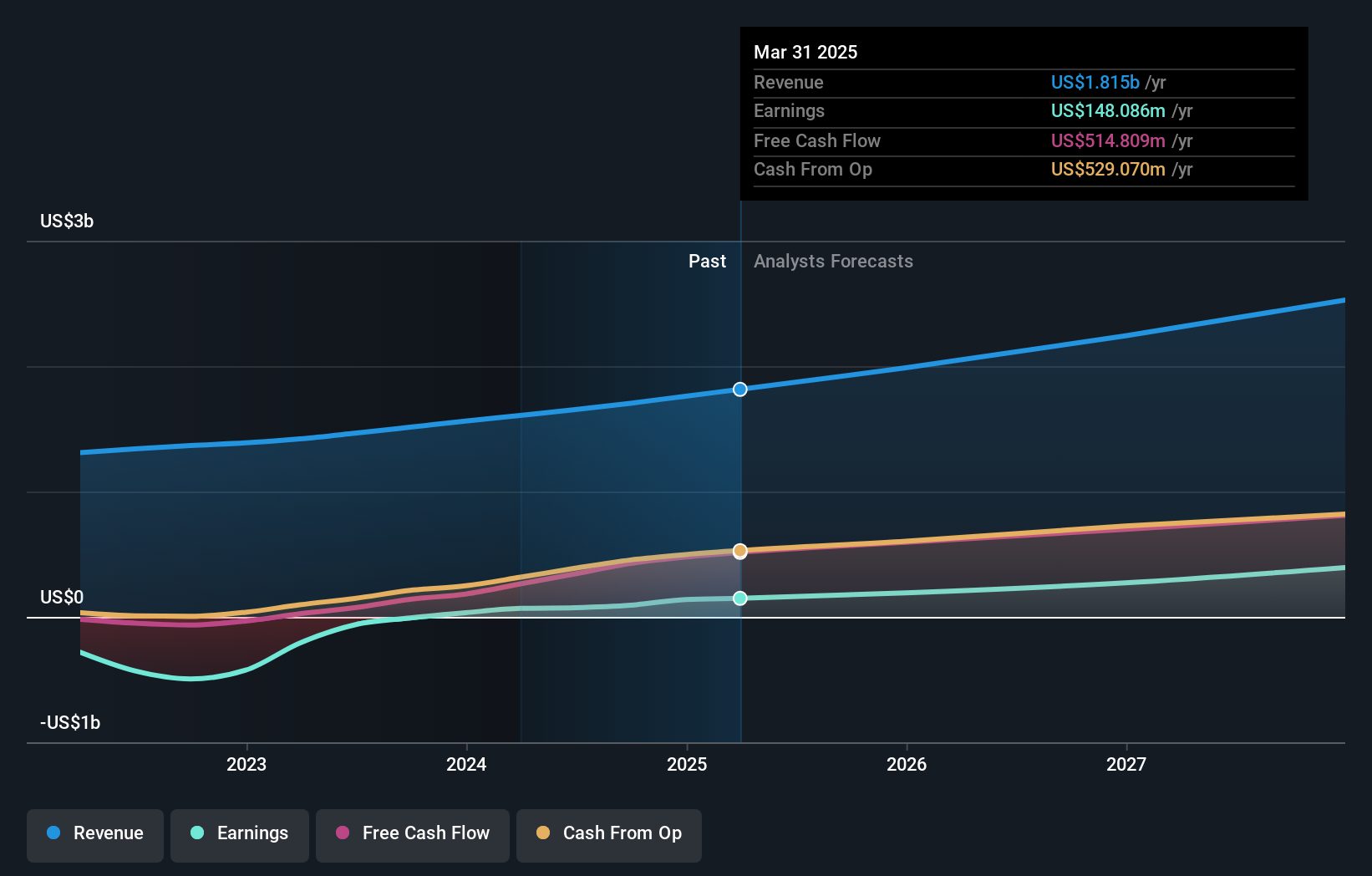

Overview: Wix.com Ltd. is a cloud-based web development platform that serves registered users and creators globally, with a market cap of approximately $12.29 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $1.70 billion. Its operations focus on providing web development solutions to a global user base.

Wix.com's recent performance and strategic initiatives underscore its adaptability and foresight in the tech landscape. With a robust 36.4% forecasted annual earnings growth, Wix has transitioned into profitability this year, reflecting effective strategy execution amidst challenging market conditions. The company's commitment to innovation is evident from its R&D spending, which significantly bolsters its product offerings like the AI Site-Chat, enhancing customer engagement and operational efficiency. This focus on advanced tech solutions not only caters to immediate business needs but also positions Wix favorably for sustained growth in a competitive sector.

Clearwater Analytics Holdings (NYSE:CWAN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Clearwater Analytics Holdings, Inc. offers a SaaS solution for automated investment data services to various clients globally and has a market cap of $6.76 billion.

Operations: Clearwater Analytics Holdings generates revenue primarily from its SaaS solution, which provides automated investment data aggregation, reconciliation, accounting, and reporting services to a diverse clientele including insurers and institutional investors. The company reported revenue of $424.36 million from this segment.

Clearwater Analytics Holdings has recently demonstrated robust growth, with revenue forecasted to expand by 18.6% annually, outpacing the US market's 9.1%. This growth trajectory is complemented by an impressive projected annual earnings increase of 101.7%, signaling strong operational efficiency and market demand for its services. The firm's strategic focus on R&D is evident from its significant investment in this area, which supports ongoing innovation and enhances its competitive edge in providing comprehensive investment data solutions. Recently, Clearwater was selected by ACERA to enhance data accuracy and operational decision-making using its AI-driven platform, showcasing trust and reliability among high-caliber clients. This alignment with substantial clients not only solidifies its market position but also underscores the scalability of Clearwater’s offerings in a dynamic financial landscape.

Turning Ideas Into Actions

- Gain an insight into the universe of 240 US High Growth Tech and AI Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wix.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WIX

Wix.com

Operates as a cloud-based web development platform for registered users and creators worldwide.

High growth potential low.