- United States

- /

- Software

- /

- NYSE:ORCL

3 US Stocks Estimated To Be Trading Below Fair Value By At Least 32.1%

Reviewed by Simply Wall St

As the U.S. markets continue to reach new heights, with the Dow Jones Industrial Average notching its 39th record close of the year, investors are keenly observing opportunities amidst this robust economic landscape. In such a thriving market environment, identifying stocks that are trading below their fair value can be particularly appealing for those looking to capitalize on potential growth while maintaining a focus on sound investment fundamentals.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hanover Bancorp (NasdaqGS:HNVR) | $19.06 | $37.01 | 48.5% |

| California Resources (NYSE:CRC) | $52.32 | $103.74 | 49.6% |

| Atlanticus Holdings (NasdaqGS:ATLC) | $37.41 | $72.49 | 48.4% |

| Coastal Financial (NasdaqGS:CCB) | $60.74 | $120.88 | 49.8% |

| Avidbank Holdings (OTCPK:AVBH) | $19.60 | $37.86 | 48.2% |

| HealthEquity (NasdaqGS:HQY) | $88.00 | $175.93 | 50% |

| EVERTEC (NYSE:EVTC) | $33.45 | $66.19 | 49.5% |

| Vitesse Energy (NYSE:VTS) | $25.36 | $49.21 | 48.5% |

| AeroVironment (NasdaqGS:AVAV) | $215.63 | $416.80 | 48.3% |

| Reddit (NYSE:RDDT) | $76.29 | $149.28 | 48.9% |

Let's explore several standout options from the results in the screener.

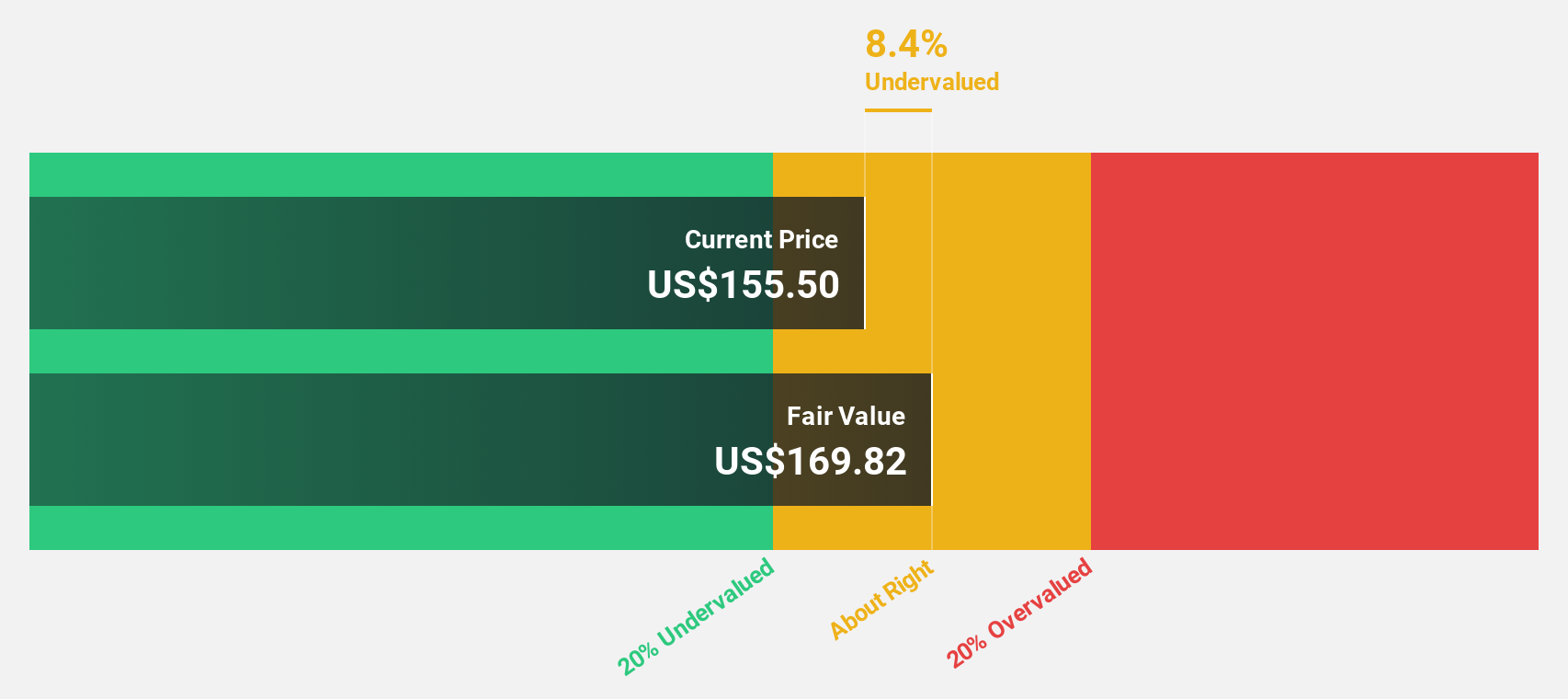

Wix.com (NasdaqGS:WIX)

Overview: Wix.com Ltd. operates as a cloud-based web development platform serving registered users and creators globally, with a market cap of approximately $9.61 billion.

Operations: The company's revenue primarily comes from its Internet Software & Services segment, totaling $1.65 billion.

Estimated Discount To Fair Value: 32.1%

Wix.com is trading at US$177.24, significantly below its estimated fair value of US$261.06, suggesting it may be undervalued based on cash flows. The company has become profitable this year and forecasts indicate earnings growth of 32% annually over the next three years, outpacing the broader U.S. market's growth rate. Despite a high level of debt, Wix's revenue is expected to grow faster than the market average at 11.4% per year.

- Our growth report here indicates Wix.com may be poised for an improving outlook.

- Take a closer look at Wix.com's balance sheet health here in our report.

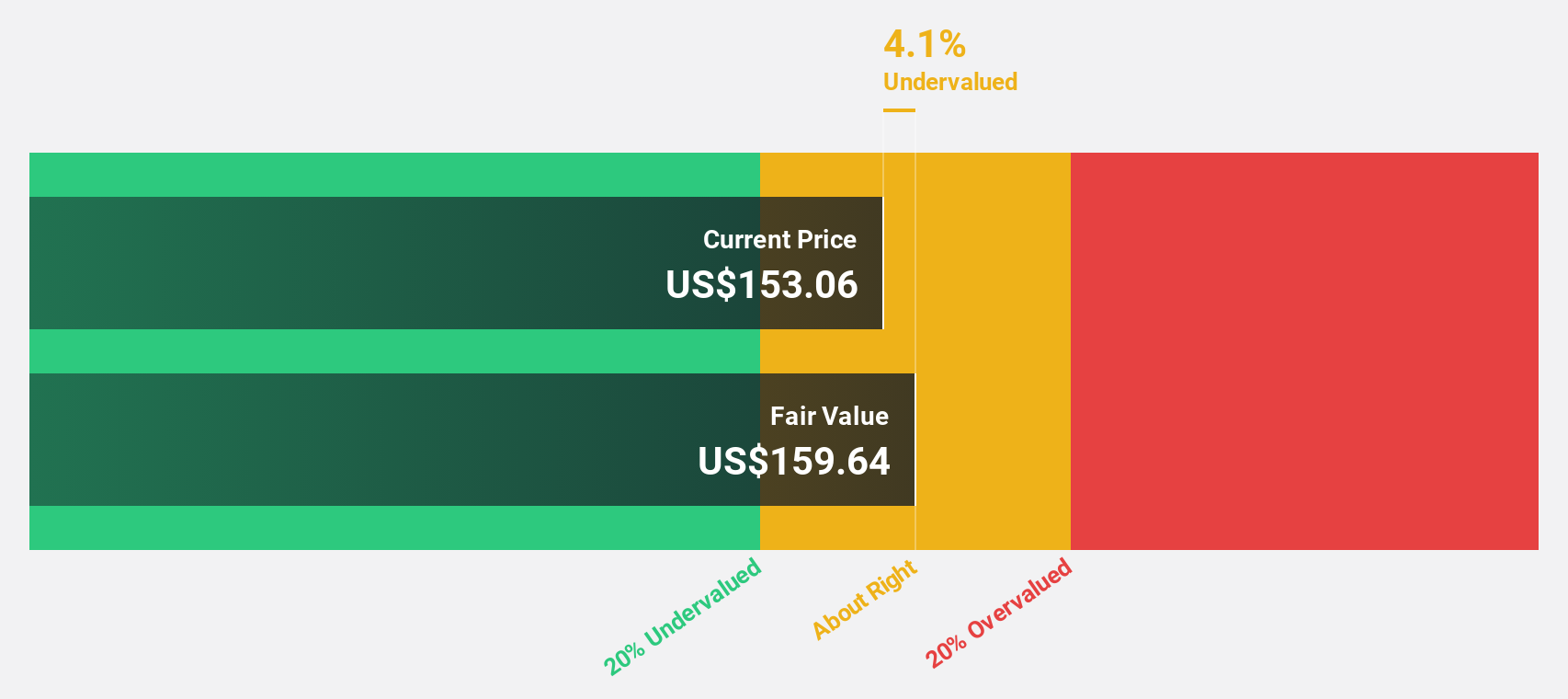

Live Nation Entertainment (NYSE:LYV)

Overview: Live Nation Entertainment, Inc. is a global live entertainment company with a market cap of approximately $26.35 billion.

Operations: The company's revenue is primarily derived from its Concerts segment at $19.72 billion, followed by Ticketing at $3.03 billion, and Sponsorship & Advertising contributing $1.15 billion.

Estimated Discount To Fair Value: 39.5%

Live Nation Entertainment, trading at US$115.21, is valued 39.5% below its fair value estimate of US$190.32, indicating potential undervaluation based on cash flows. Earnings are projected to grow significantly at 28.8% annually over the next three years, surpassing the U.S. market average growth rate of 15.2%. Despite slower revenue growth compared to the market and recent earnings showing mixed results, strong future earnings prospects highlight its potential value opportunity.

- According our earnings growth report, there's an indication that Live Nation Entertainment might be ready to expand.

- Unlock comprehensive insights into our analysis of Live Nation Entertainment stock in this financial health report.

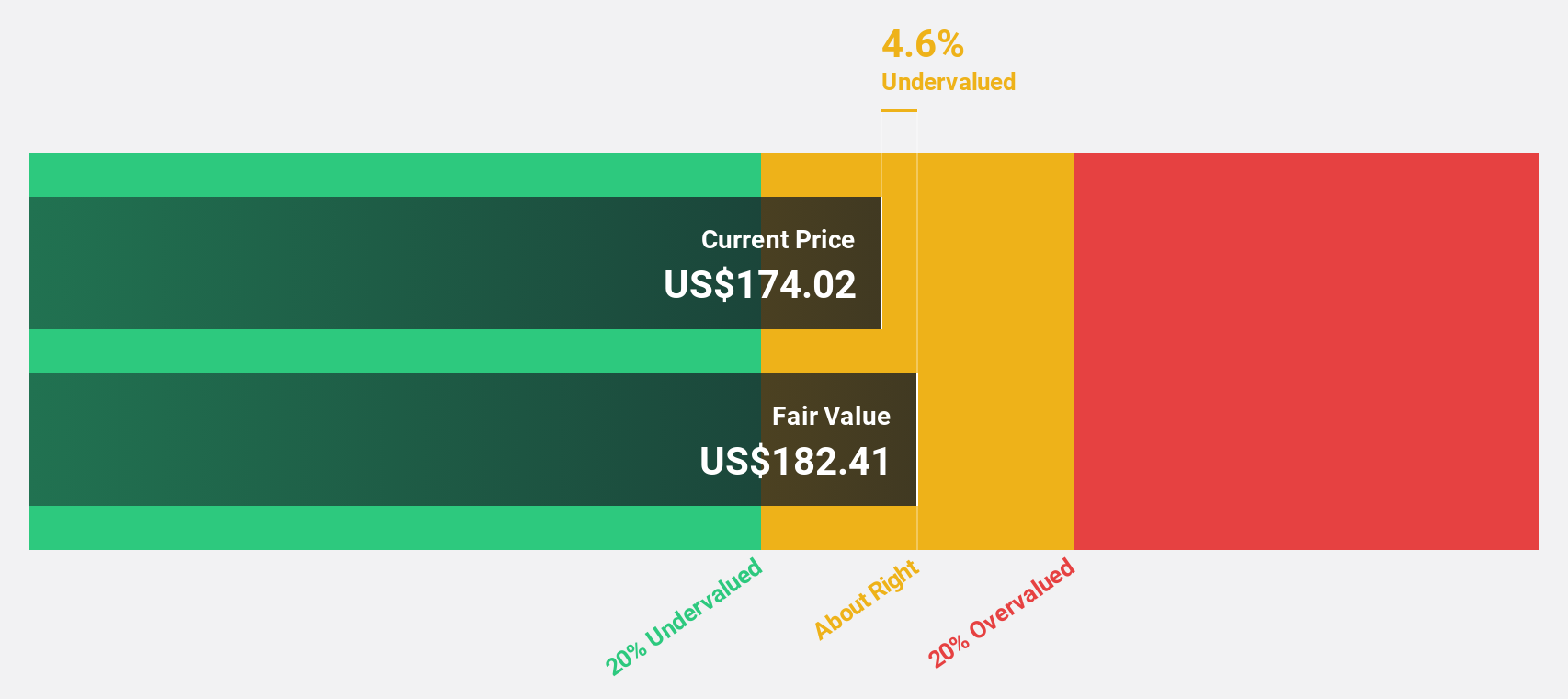

Oracle (NYSE:ORCL)

Overview: Oracle Corporation provides products and services for enterprise information technology environments globally, with a market cap of approximately $484.30 billion.

Operations: Oracle's revenue is primarily generated from three segments: Cloud and License ($45.50 billion), Services ($5.31 billion), and Hardware ($3.01 billion).

Estimated Discount To Fair Value: 34.8%

Oracle, currently priced at US$175.68, is trading 34.8% below its fair value estimate of US$269.33, suggesting it may be undervalued based on cash flows. With earnings expected to grow at 16.3% annually—above the U.S. market average—and a very high forecasted return on equity of 47.4%, Oracle's strong cash flow position underscores its potential value opportunity despite a high level of debt and slower revenue growth projections compared to the broader market.

- The growth report we've compiled suggests that Oracle's future prospects could be on the up.

- Get an in-depth perspective on Oracle's balance sheet by reading our health report here.

Seize The Opportunity

- Delve into our full catalog of 197 Undervalued US Stocks Based On Cash Flows here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Good value with reasonable growth potential and pays a dividend.