- United States

- /

- Software

- /

- NasdaqGS:WDAY

Workday (NasdaqGS:WDAY) Partners With Randstad To Enhance AI-Driven Talent Recruitment

Reviewed by Simply Wall St

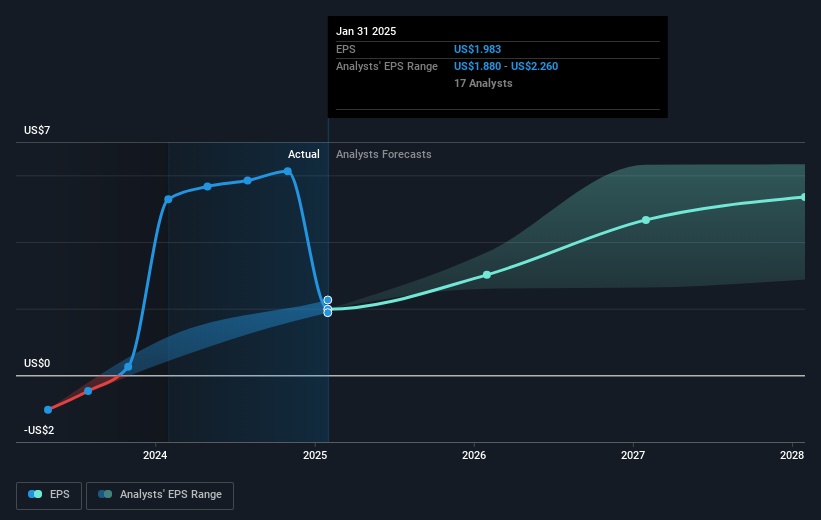

Workday (NasdaqGS:WDAY) experienced a 7% price increase over the last quarter, partially fueled by its strategic partnership with Randstad, which integrates Workday's AI-driven Recruiting Agent with Randstad's talent network, promising improved talent acquisition efficiencies. This development comes amidst a backdrop of Workday's recently announced fiscal results, where the company reported a YoY revenue increase to $2,211 million, despite a decline in net income and earnings per share. The market has shown mixed results, with the Nasdaq Composite down 6% in recent trading sessions. However, Workday's focus on expanding AI capabilities aligns with growing investor interest in tech innovations. Additionally, the company's repurchase of 363,090 shares under its buyback program signifies confidence in its market positioning. The broader market saw Dow Jones up 1%, while S&P 500 and other tech-heavy indices faced declines, underscoring Workday's standout performance amid economic uncertainties.

Navigate through the intricacies of Workday with our comprehensive report here.

Workday's shares delivered a total return of 58.63% over the past five years. This impressive return reflects the company’s initiatives and developments during this period. In recent years, Workday has made significant strategic partnerships, such as its collaboration with Randstad to enhance talent acquisition with AI innovations. Additionally, the introduction of the Workday Agent System of Record represents a push towards optimizing digital workforce management. Workday’s alliances, notably with companies like Zuora and Nayya, have further complemented its product offerings and market reach. Despite challenges like a declining net profit margin and underperformance relative to the US software industry over the past year, these partnerships and product advancements have been pivotal.

The company’s focus on optimizing shareholder value is evidenced by an active share buyback program, repurchasing over 1 million shares since November 2024. Leadership changes, with Gerrit Kazmaier’s appointment, indicate a dedication to future innovation. While Workday has underperformed the broader US market in the past year, its revenue and potential earnings growth forecast reflects strong growth prospects compared to the market average, indicating a focus on long-term expansion.

- See whether Workday's current market price aligns with its intrinsic value in our detailed report

- Understand the uncertainties surrounding Workday's market positioning with our detailed risk analysis report.

- Shareholder in Workday? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives