- United States

- /

- Software

- /

- NasdaqGS:WDAY

The Bull Case For Workday (WDAY) Could Change Following Paradox AI Acquisition Integration - Learn Why

Reviewed by Sasha Jovanovic

- Workday recently completed its acquisition of Paradox, an AI conversational agent designed to enhance the candidate experience and streamline talent acquisition across frontline industries.

- This move enables Workday to deliver a unified, AI-powered recruitment platform that accelerates hiring, improves recruiter efficiency, and modernizes the candidate journey through automation and 24/7 support.

- We'll now explore how integrating Paradox's conversational AI into Workday's suite could impact its long-term growth narrative and expansion plans.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Workday Investment Narrative Recap

To be a shareholder in Workday, you need to believe in the company’s ability to lead the transition to AI-powered enterprise software as organizations accelerate digital transformation and cloud adoption. The acquisition of Paradox appears to strengthen Workday’s position in AI-driven HR automation, though it doesn't fundamentally change the short-term catalyst: the pace of uptake for its AI-enabled suites. The main risk remains the emergence of agile, AI-native SaaS competitors that could erode Workday’s pricing power and customer loyalty; the impact from Paradox on this risk seems limited for now.

Among recent developments, the launch of Workday Illuminate™ agents for HR and finance is especially relevant, reinforcing Workday’s focus on embedding scalable AI across its platform. This innovation aligns closely with the expected benefits from integrating Paradox’s AI, and together these moves could accelerate cross-sell activity and deepen customer stickiness if adoption rates hold up.

However, with heightened competition from both established players and fast-moving start-ups, investors should not overlook the risk that ...

Read the full narrative on Workday (it's free!)

Workday's narrative projects $12.9 billion revenue and $1.8 billion earnings by 2028. This requires 13.0% yearly revenue growth and a $1.22 billion earnings increase from $583.0 million today.

Uncover how Workday's forecasts yield a $282.05 fair value, a 19% upside to its current price.

Exploring Other Perspectives

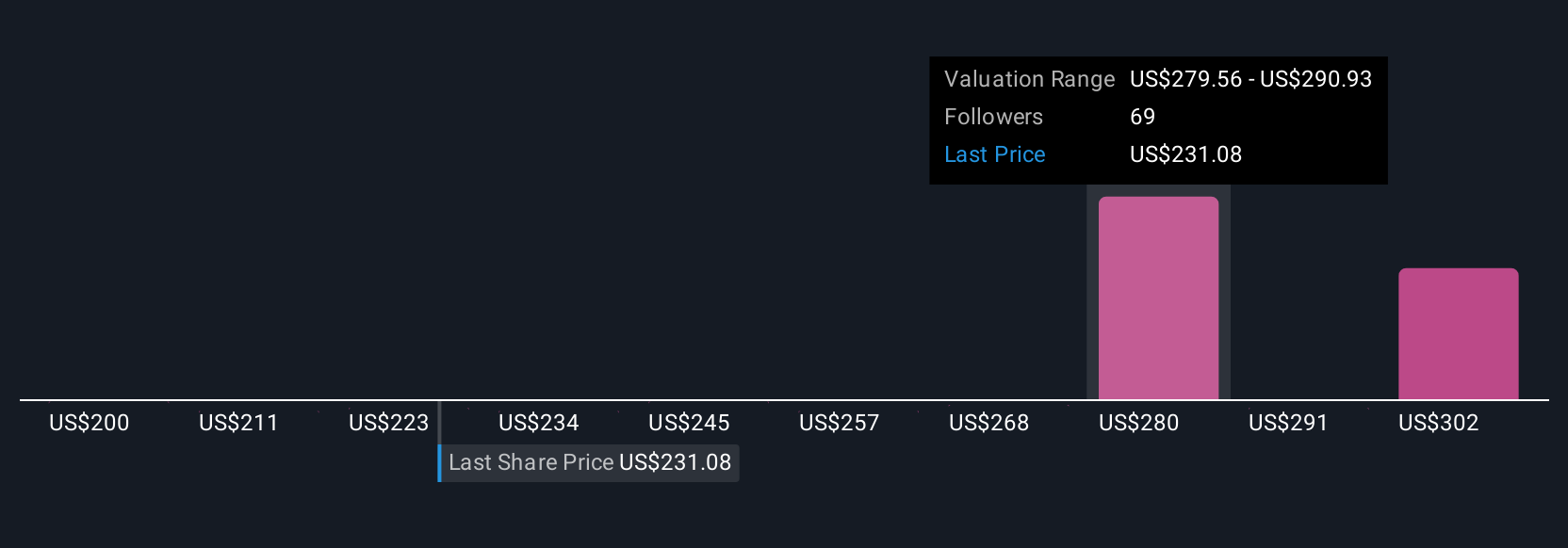

Simply Wall St Community members provided 13 different fair value estimates on Workday ranging from US$200 to US$329, reflecting substantial variation in outlook. This diversity of views is especially relevant as the uptake of Workday’s new AI offerings will likely determine whether the company meets or exceeds growth expectations, explore several alternative viewpoints to see the wider picture.

Explore 13 other fair value estimates on Workday - why the stock might be worth as much as 39% more than the current price!

Build Your Own Workday Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Workday research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Workday research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Workday's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026