- United States

- /

- Software

- /

- NasdaqGS:ZS

3 Growth Companies With High Insider Ownership Achieving Up To 26% Return On Equity

Reviewed by Simply Wall St

As the U.S. market aims to extend its rally, with the S&P 500 and Nasdaq showing positive momentum, investors are keenly observing stocks that combine growth potential with solid insider ownership. In such a climate, companies demonstrating high returns on equity can be particularly appealing, as they often indicate strong management confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.1% | 38.4% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| FTC Solar (NasdaqCM:FTCI) | 32.2% | 61.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Astera Labs (NasdaqGS:ALAB) | 15.3% | 44.8% |

| Red Cat Holdings (NasdaqCM:RCAT) | 14.8% | 123% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| BBB Foods (NYSE:TBBB) | 16.2% | 30.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.5% | 102.6% |

| CoreWeave (NasdaqGS:CRWV) | 38.3% | 69.9% |

Let's explore several standout options from the results in the screener.

Duolingo (NasdaqGS:DUOL)

Simply Wall St Growth Rating: ★★★★★★

Overview: Duolingo, Inc. operates as a mobile learning platform in the United States, the United Kingdom, and internationally with a market cap of approximately $23.54 billion.

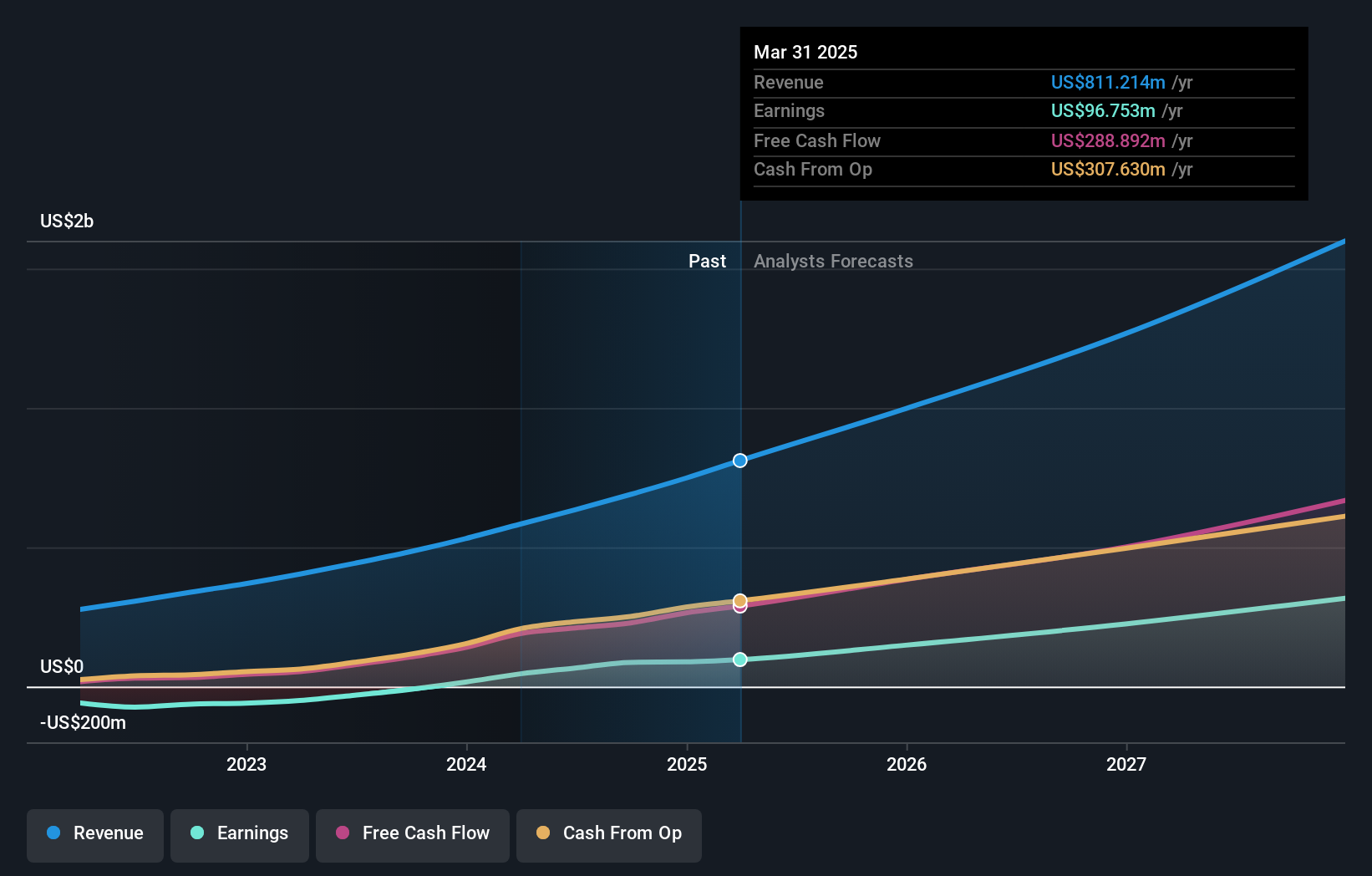

Operations: Duolingo generates its revenue primarily from its educational software segment, which amounts to $811.21 million.

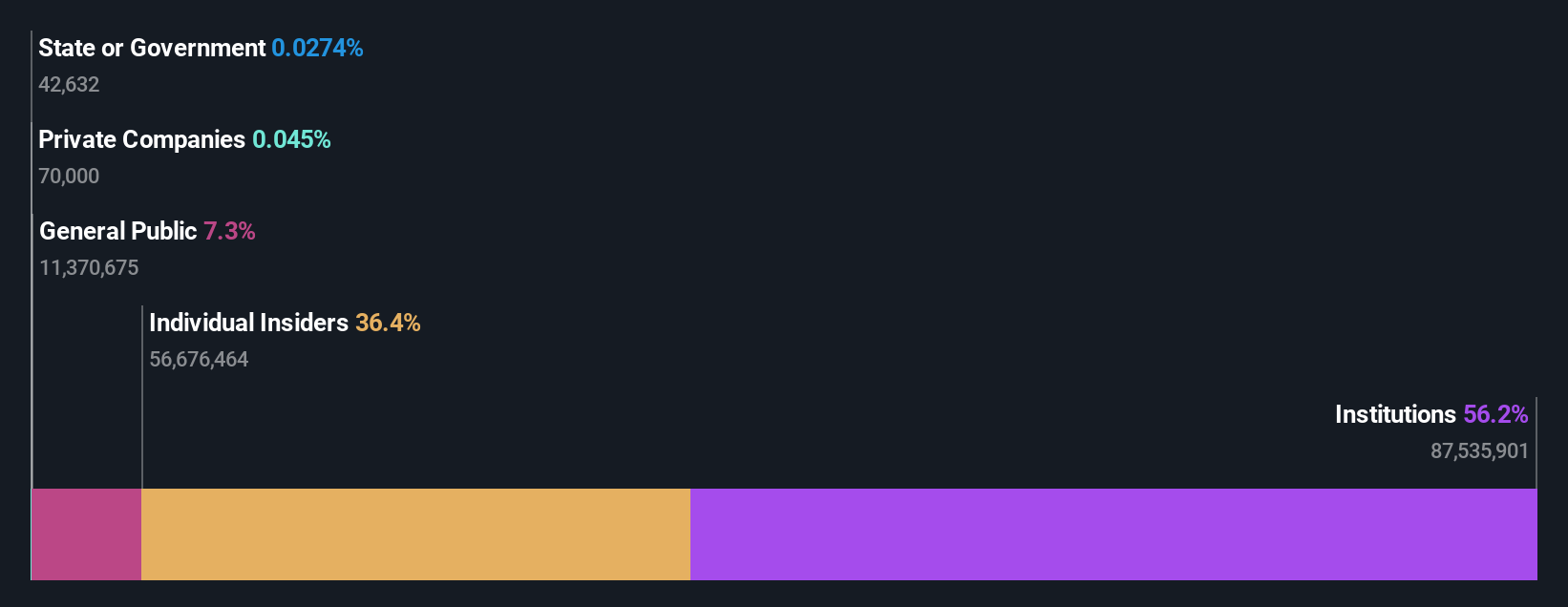

Insider Ownership: 14.3%

Return On Equity Forecast: 23% (2028 estimate)

Duolingo demonstrates strong growth potential, with earnings forecasted to increase significantly over the next three years. Despite recent insider selling, its revenue and earnings are expected to grow at rates surpassing market averages. Recent expansions include launching 148 new language courses using generative AI, enhancing its global reach. The first quarter of 2025 saw sales rise to US$230.74 million from US$167.55 million a year ago, reflecting robust demand and strategic product development.

- Take a closer look at Duolingo's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Duolingo's share price might be too optimistic.

Workday (NasdaqGS:WDAY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Workday, Inc. offers enterprise cloud applications globally, with a market cap of approximately $72.23 billion.

Operations: The company generates revenue primarily from its cloud applications, totaling $8.45 billion.

Insider Ownership: 19.5%

Return On Equity Forecast: 21% (2028 estimate)

Workday's earnings are projected to grow significantly, outpacing the US market, despite a recent decline in profit margins. The company's revenue growth is expected to surpass market averages, supported by strategic partnerships like those with Incorta and Prudential Financial. Recent expansions include a lease at the Empire State Building and enhancements in AI-driven contract management. Trading below estimated fair value, Workday continues to innovate with over 350 new product features aimed at streamlining operations and enhancing agility.

- Click here to discover the nuances of Workday with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Workday is priced higher than what may be justified by its financials.

Zscaler (NasdaqGS:ZS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. is a global cloud security company with a market cap of approximately $37.36 billion.

Operations: Zscaler generates revenue primarily through sales of subscription services to its cloud platform and related support services, amounting to $2.42 billion.

Insider Ownership: 19.6%

Return On Equity Forecast: 27% (2028 estimate)

Zscaler's revenue is forecast to grow at 16.6% annually, outpacing the broader US market. The company recently collaborated with T-Mobile to enhance cybersecurity through its Zero Trust Exchange platform, replacing traditional VPNs and improving access security. Despite trading slightly below its estimated fair value and experiencing substantial insider selling in recent months, Zscaler is expected to achieve profitability within three years, supported by a projected 40.38% annual earnings growth.

- Unlock comprehensive insights into our analysis of Zscaler stock in this growth report.

- Our valuation report here indicates Zscaler may be overvalued.

Make It Happen

- Dive into all 196 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Curious About Other Options? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives