- United States

- /

- Software

- /

- NasdaqGS:VRNT

Verint Systems (VRNT): Reassessing Valuation After Recent Market Movements Without Major News

Reviewed by Simply Wall St

Most Popular Narrative: 0.8% Undervalued

The prevailing narrative sees Verint Systems as trading just below its fair value, with the current share price closely aligned with analysts’ long-term expectations.

The company's differentiated approach, using a hybrid cloud model, allows customers to implement AI solutions without disrupting existing operations. This can enhance net margins through more efficient processes. Verint has successfully seeded many large customers with initial AI deployments and expects these customers to expand their AI consumption, boosting earnings as they increase ARR significantly.

Curious what’s fueling this almost perfect match between price and potential? The narrative hinges on future growth, stronger margins and ambitious profit forecasts. Wonder which numbers are quietly working behind the scenes to justify that next-level valuation? The building blocks of Verint’s fair value might surprise you.

Result: Fair Value of $20.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, unpredictable customer adoption rates and fierce competition in AI could easily derail Verint’s expected growth trajectory. This may put analyst forecasts at risk.

Find out about the key risks to this Verint Systems narrative.Another View: Discounted Cash Flow Perspective

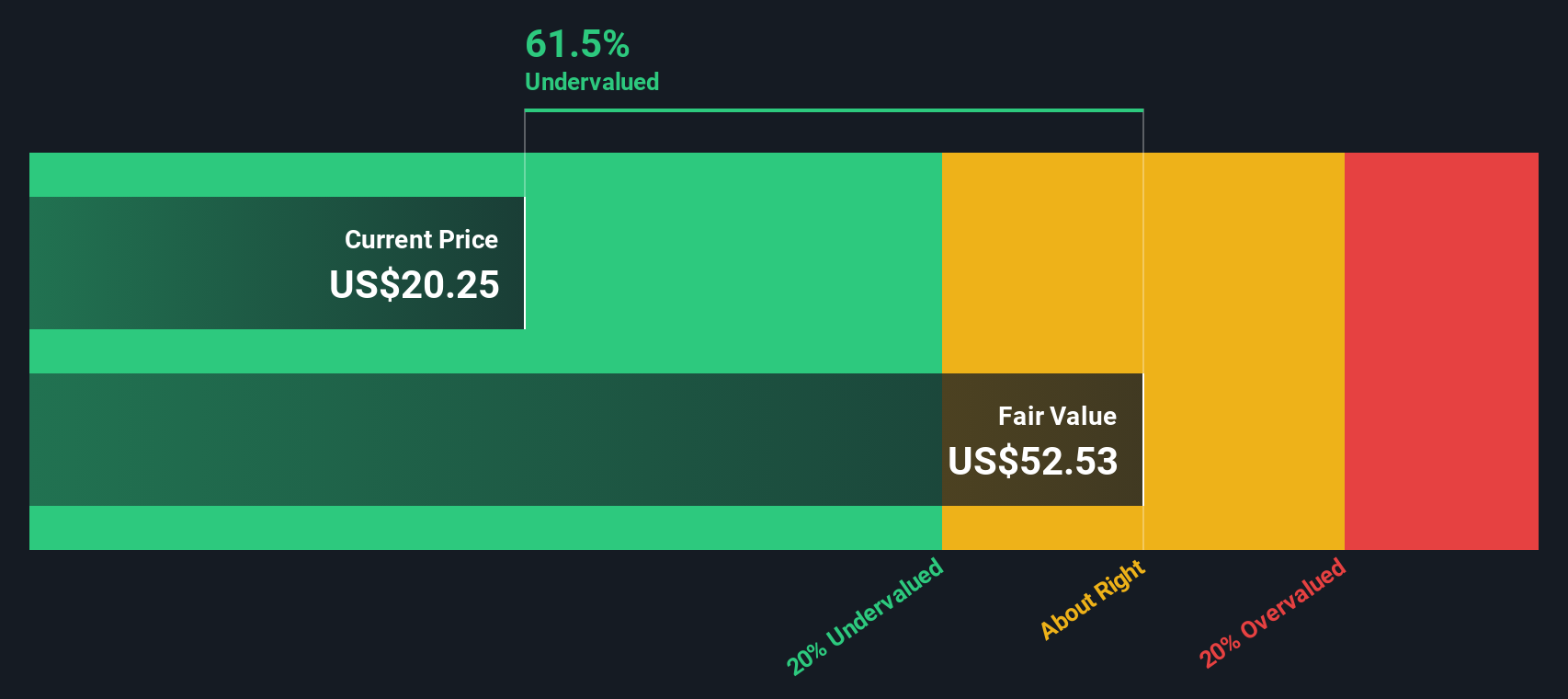

While the analyst consensus relies on earnings projections, our SWS DCF model uses a different approach and suggests Verint Systems is trading well below its calculated fair value. Which method do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Verint Systems Narrative

If you see things differently or want to dig deeper into the numbers yourself, it only takes a few minutes to build a custom narrative. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Verint Systems.

Looking for More Smart Investment Ideas?

Why settle for just one opportunity? Turbo-charge your strategy by searching for handpicked stocks making headlines in their fields, using our favorite investment idea screens below.

- Spot high-flyers with robust financial health when you check out our selection of penny stocks with strong financials making waves in the market.

- Secure cash flow confidence by tapping into undervalued stocks based on cash flows and find companies trading at compelling value today.

- Stay ahead of tomorrow’s breakthroughs by browsing quantum computing stocks, your shortcut to innovators at the forefront of quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:VRNT

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)