- United States

- /

- Software

- /

- NasdaqGS:VRNT

These 4 Measures Indicate That Verint Systems (NASDAQ:VRNT) Is Using Debt Reasonably Well

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Verint Systems Inc. (NASDAQ:VRNT) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Verint Systems

What Is Verint Systems's Debt?

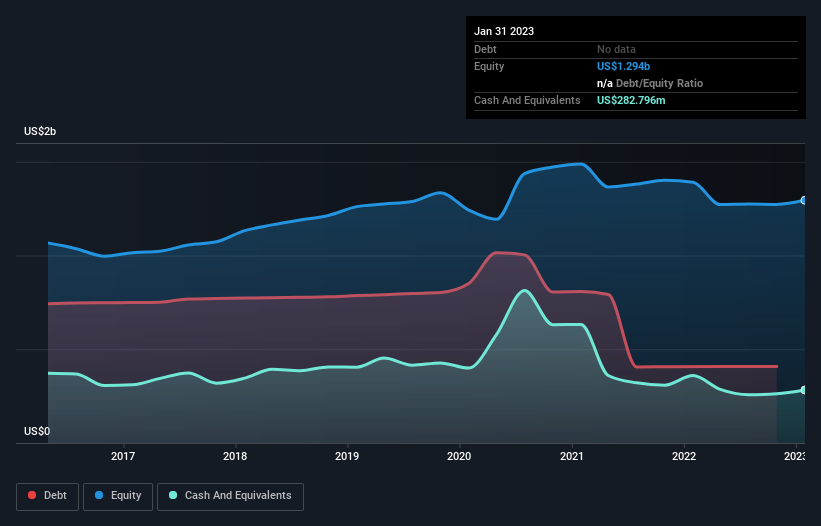

As you can see below, Verint Systems had US$408.4m of debt, at January 2023, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of US$282.8m, its net debt is less, at about US$125.6m.

How Healthy Is Verint Systems' Balance Sheet?

According to the last reported balance sheet, Verint Systems had liabilities of US$471.1m due within 12 months, and liabilities of US$548.1m due beyond 12 months. Offsetting these obligations, it had cash of US$282.8m as well as receivables valued at US$215.0m due within 12 months. So its liabilities total US$521.3m more than the combination of its cash and short-term receivables.

Verint Systems has a market capitalization of US$2.32b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Verint Systems has a low net debt to EBITDA ratio of only 1.3. And its EBIT easily covers its interest expense, being 10.8 times the size. So we're pretty relaxed about its super-conservative use of debt. The modesty of its debt load may become crucial for Verint Systems if management cannot prevent a repeat of the 25% cut to EBIT over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Verint Systems's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Verint Systems actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Verint Systems's EBIT growth rate was a real negative on this analysis, although the other factors we considered were considerably better. In particular, we are dazzled with its conversion of EBIT to free cash flow. Considering this range of data points, we think Verint Systems is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. We'd be motivated to research the stock further if we found out that Verint Systems insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VRNT

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)