- United States

- /

- Software

- /

- NasdaqGS:VRNS

Investing in Varonis Systems (NASDAQ:VRNS) three years ago would have delivered you a 113% gain

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you buy shares in a really great company, you can more than double your money. To wit, the Varonis Systems, Inc. (NASDAQ:VRNS) share price has flown 113% in the last three years. Most would be happy with that. Also pleasing for shareholders was the 16% gain in the last three months. But this could be related to the strong market, which is up 7.6% in the last three months.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

Because Varonis Systems made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Varonis Systems' revenue trended up 9.1% each year over three years. That's pretty nice growth. It's fair to say that the market has acknowledged the growth by pushing the share price up 29% per year. It's hard to value pre-profit businesses, but it seems like the market has become a lot more optimistic about this one! Some investors like to buy in just after a company becomes profitable, since that can be a powerful inflexion point.

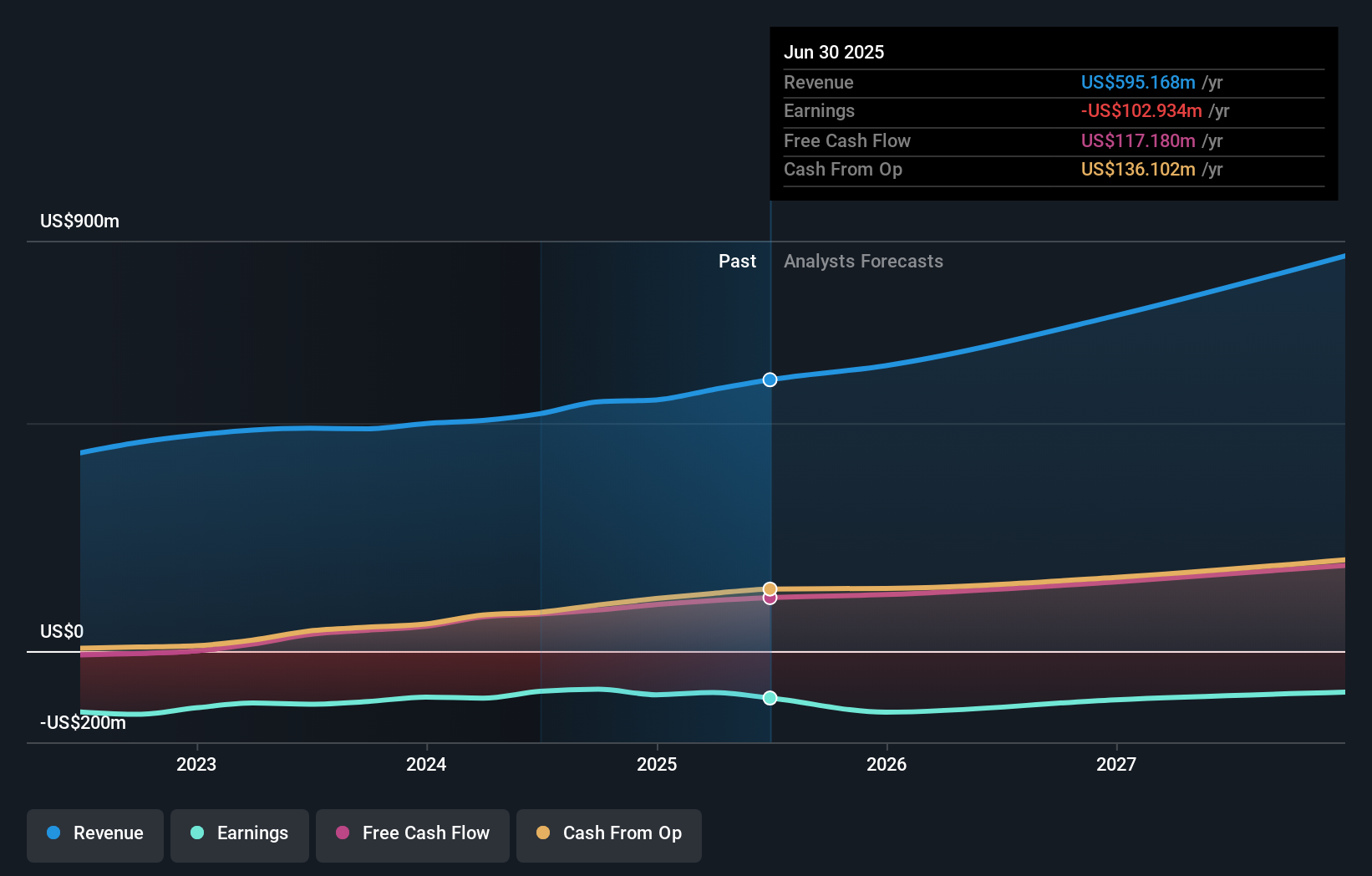

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Varonis Systems is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Varonis Systems in this interactive graph of future profit estimates.

A Different Perspective

Varonis Systems shareholders gained a total return of 7.0% during the year. But that return falls short of the market. If we look back over five years, the returns are even better, coming in at 8% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand Varonis Systems better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Varonis Systems , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VRNS

Varonis Systems

Provides software products and services that continuously discover and classify critical data, remediate exposures, and detect advanced threats with AI-powered technology in North America, Europe, APAC, and rest of world.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives