- United States

- /

- Software

- /

- NasdaqGM:VERI

Veritone (VERI): Assessing Valuation After New AI Partnerships in Digital Evidence and Edge-to-Enterprise Data Workflows

Reviewed by Simply Wall St

Veritone (VERI) has been on traders radar after a flurry of AI focused deals, from powering Strategic Communications JPS TRUST modernization program to teaming with Armada on edge to enterprise data workflows.

See our latest analysis for Veritone.

Despite a sharp pullback in the latest session, with a 1 day share price return of minus 8.79 percent and the stock closing at 5.19 dollars, Veritone still shows strong positive momentum. This is supported by a 30 day share price return of 20.70 percent and a year to date share price return of 62.19 percent, while its 1 year total shareholder return of 118.99 percent contrasts with a more mixed 3 and 5 year total shareholder return record.

If Veritone’s recent AI deals have caught your attention, this could be a good moment to see what else is gaining traction across high growth tech and AI names using our high growth tech and AI stocks.

With analysts setting price targets more than double the current share price and Veritone still burning cash even as revenue climbs, investors face a key question: Is this a genuine value opportunity, or is future AI growth already priced in?

Most Popular Narrative Narrative: 53.7% Undervalued

With Veritone last closing at 5.19 dollars versus a most popular narrative fair value of 11.20 dollars, the spread hinges on how fast high margin aiWARE demand can scale and when profitability finally turns the corner.

Substantial pipeline momentum in the Commercial Data Refinery (VDR) product line, including deepening relationships and partnership negotiations with the world's largest hyperscalers and AI companies, creates visibility for continued step changes in growth. As margins on VDR improve with scale and content mix evolution, this is expected to enhance gross margin and eventually net margin performance.

Want to see what turns those fast growing data pipelines into a sharply higher valuation multiple? The narrative leans on bold revenue, margin, and earnings step ups over the next few years, all run through a discounted cash flow lens using a single, precise hurdle rate. Curious how far those assumptions stretch to justify more than double today’s price? Explore the details to unpack the full playbook behind that 11.20 dollar fair value target.

Result: Fair Value of $11.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained net losses and heavy cash burn, along with customer concentration in VDR, could quickly undermine the optimistic growth and valuation narrative around Veritone.

Find out about the key risks to this Veritone narrative.

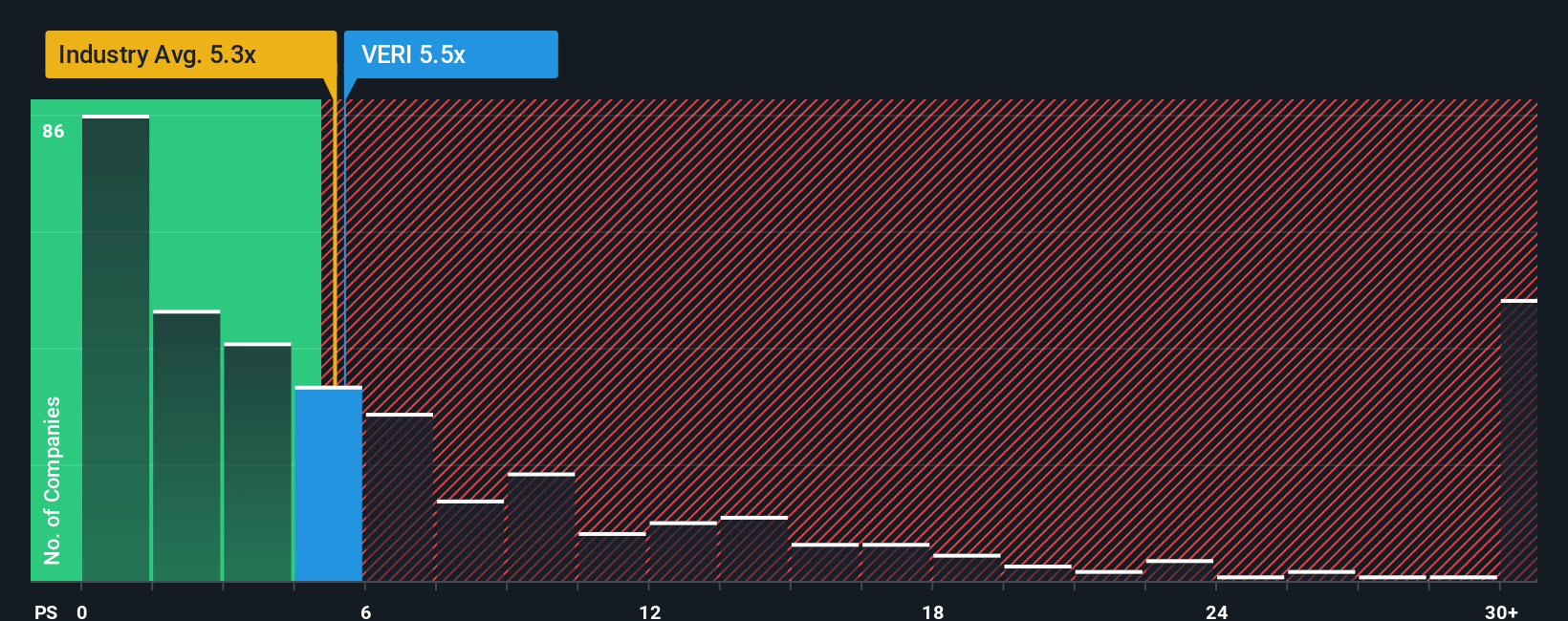

Another View: What the Price to Sales Says

Step away from the narrative fair value and the current 4.9 times Price to Sales looks far less generous. It is slightly richer than the US software average of 4.8 times and well above a 4.1 times fair ratio, which hints at limited margin for execution stumbles. If growth wobbles, does this premium quickly vanish?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veritone Narrative

If this perspective does not quite align with your own, or you would rather dig into the numbers yourself, you can build a personalized Veritone story in just a few minutes, Do it your way.

A great starting point for your Veritone research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, seize the chance to uncover fresh opportunities that match your strategy using the Simply Wall St Screener, so potential winners do not slip past you.

- Capitalize on emerging market leaders by reviewing these 903 undervalued stocks based on cash flows that combine attractive prices with solid fundamentals and strong cash flow profiles.

- Target cutting edge innovation by scanning these 26 AI penny stocks positioned at the forefront of artificial intelligence breakthroughs and scalable digital platforms.

- Strengthen your income stream by evaluating these 13 dividend stocks with yields > 3% built to deliver reliable yields and help balance your portfolio through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VERI

Veritone

Engages in the provision of artificial intelligence (AI) computing solutions and services in the United States, the United Kingdom, France, Australia, Israel, and India.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)