- United States

- /

- Software

- /

- NasdaqGS:TEAM

Exploring Three High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

In the last week, the United States market has been flat, but it is up 11% over the past year with earnings expected to grow by 14% per annum over the next few years. In this context, identifying high growth tech stocks involves looking for companies that not only demonstrate strong innovation and scalability but also have solid financial health to capitalize on these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.63% | 66.57% | ★★★★★★ |

| Ardelyx | 20.78% | 59.46% | ★★★★★★ |

| Travere Therapeutics | 26.41% | 64.47% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.28% | 60.66% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.64% | 61.12% | ★★★★★★ |

| Ascendis Pharma | 35.15% | 60.20% | ★★★★★★ |

| Lumentum Holdings | 22.53% | 112.10% | ★★★★★★ |

Click here to see the full list of 226 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Scholar Rock Holding (SRRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Scholar Rock Holding Corporation is a biopharmaceutical company dedicated to discovering, developing, and delivering medicines targeting serious diseases influenced by protein growth factor signaling, with a market cap of $3.25 billion.

Operations: Scholar Rock Holding Corporation specializes in creating therapeutics for diseases impacted by protein growth factor signaling. The company operates within the biopharmaceutical sector, focusing on innovative drug development and delivery.

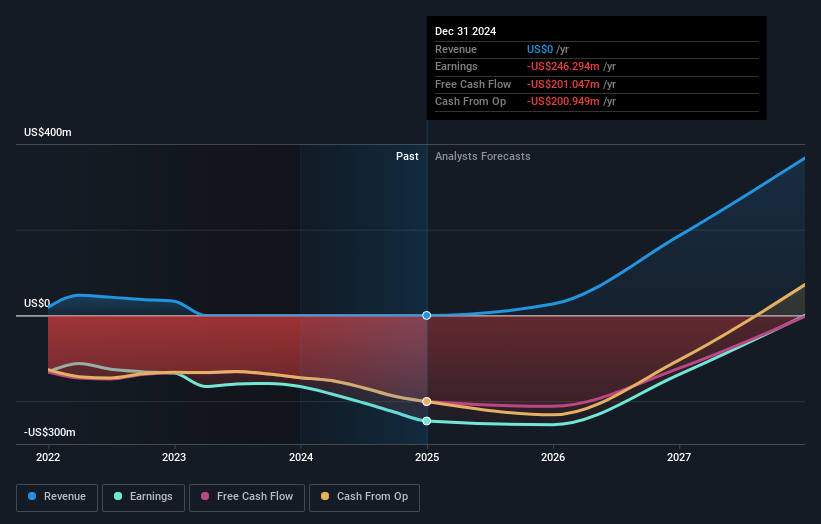

Scholar Rock Holding's recent appointment of Rebecca McLeod as Chief Brand Officer ahead of the U.S. commercial launch of apitegromab signals a strategic push into new markets, underscoring its commitment to expanding its global footprint. This move, coupled with robust annualized revenue growth at 56.5% and an anticipated shift to profitability within three years, reflects a dynamic adaptation in response to evolving market demands in biotechnology. Moreover, the firm’s R&D focus is evident from its significant investment in developing apitegromab, highlighted by promising results from the pivotal Phase 3 SAPPHIRE trial. These developments suggest Scholar Rock is strategically positioning itself at the forefront of innovation in treatments for spinal muscular atrophy, despite recent financial challenges indicated by a net loss increase to $74.72 million from $56.85 million year-over-year.

- Dive into the specifics of Scholar Rock Holding here with our thorough health report.

Gain insights into Scholar Rock Holding's past trends and performance with our Past report.

Atlassian (TEAM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atlassian Corporation, with a market cap of $55.37 billion, operates globally by designing, developing, licensing, and maintaining a variety of software products through its subsidiaries.

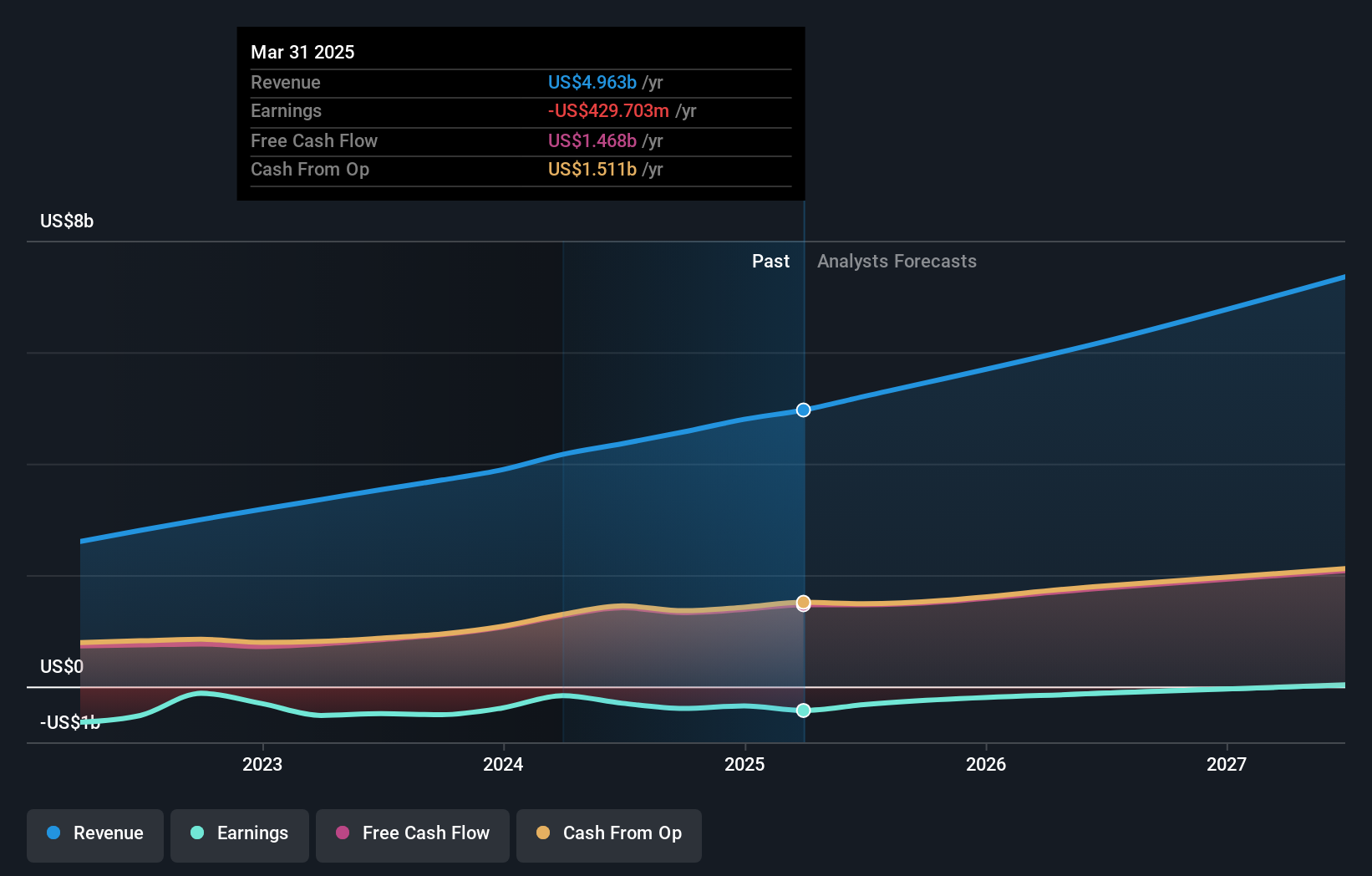

Operations: Atlassian generates revenue primarily from its software and programming segment, amounting to $4.96 billion. The company's operations focus on designing, developing, and licensing a range of software products worldwide.

Atlassian, amidst a challenging fiscal landscape marked by a net loss shift from $103.6 million to $232.78 million year-over-year, continues to demonstrate robust engagement within the tech community through multiple high-profile presentations across global conferences. Notably, the firm's commitment to innovation is underscored by its aggressive share repurchase strategy, having reacquired shares worth approximately $939.68 million since early 2023. This strategic financial maneuvering coincides with an expected surge in revenue growth, projected at 15.7% annually, which outpaces the broader U.S market forecast of 8.6%. Moreover, Atlassian's anticipated transition to profitability within three years highlights its potential resilience and adaptability in navigating software industry dynamics effectively.

- Take a closer look at Atlassian's potential here in our health report.

Explore historical data to track Atlassian's performance over time in our Past section.

HubSpot (HUBS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: HubSpot, Inc. offers a cloud-based customer relationship management platform for businesses across the Americas, Europe, and the Asia Pacific, with a market cap of approximately $31.61 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling approximately $2.72 billion.

HubSpot's strategic integration with AI, specifically the launch of a deep research connector with ChatGPT, marks a significant enhancement in CRM capabilities, directly impacting go-to-market teams across various departments. This innovation not only streamlines operations but also personalizes customer interactions by leveraging advanced analytics directly within the HubSpot platform. Financially, HubSpot is navigating through unprofitability with an ambitious outlook; its revenue is expected to climb by 14% annually, outperforming the U.S market projection of 8.6%. Moreover, with a robust forecast for earnings growth at 44% per year and R&D expenses strategically allocated to fuel these advancements, HubSpot is positioning itself as a formidable player in high-tech solutions despite current financial pressures.

- Click here and access our complete health analysis report to understand the dynamics of HubSpot.

Assess HubSpot's past performance with our detailed historical performance reports.

Summing It All Up

- Gain an insight into the universe of 226 US High Growth Tech and AI Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEAM

Atlassian

Provides a collaboration software that enables organizations to connect all teams through a system of work that unlocks productivity at scale worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion