- United States

- /

- Software

- /

- NasdaqGS:TEAM

3 US Growth Stocks With High Insider Ownership Expecting Up To 57% Earnings Growth

Reviewed by Simply Wall St

As the U.S. stock market rebounds from a sluggish start to 2025, with major indices like the S&P 500 and Nasdaq snapping five-session losing streaks, investors are closely watching for growth opportunities amid ongoing volatility. In this environment, companies with high insider ownership can offer unique insights into potential earnings growth, as insiders often have confidence in their firm's future prospects and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 49% |

| Spotify Technology (NYSE:SPOT) | 17.6% | 29.7% |

| CarGurus (NasdaqGS:CARG) | 17% | 42.4% |

| XPeng (NYSE:XPEV) | 20.7% | 55.5% |

Here's a peek at a few of the choices from the screener.

Atlassian (NasdaqGS:TEAM)

Simply Wall St Growth Rating: ★★★★★☆

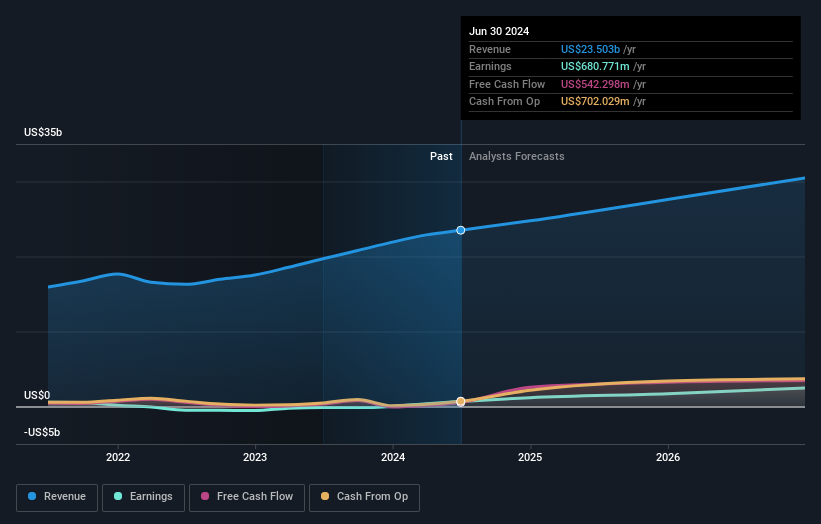

Overview: Atlassian Corporation, with a market cap of approximately $65.18 billion, designs, develops, licenses, and maintains various software products worldwide through its subsidiaries.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated $4.57 billion.

Insider Ownership: 38.4%

Earnings Growth Forecast: 57.9% p.a.

Atlassian, a growth-focused company with significant insider ownership, is undergoing strategic changes to bolster its cloud transformation efforts. Recent board appointments and executive shifts, like the addition of Christian Smith and Brian Duffy, aim to enhance leadership. The company's collaboration with Amazon Web Services seeks to accelerate cloud migration for enterprise customers. Despite reporting a net loss in recent earnings, Atlassian's revenue continues to grow robustly, supported by strong demand for its AI-driven solutions.

- Get an in-depth perspective on Atlassian's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Atlassian's share price might be too pessimistic.

Pinterest (NYSE:PINS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pinterest, Inc. operates as a visual search and discovery platform both in the United States and internationally, with a market cap of approximately $20.91 billion.

Operations: The company's revenue is derived from its role as an Internet Information Provider, generating $3.47 billion.

Insider Ownership: 11.5%

Earnings Growth Forecast: 28.9% p.a.

Pinterest, with substantial insider ownership, has shown strong financial performance recently. The company reported a significant rise in net income for the third quarter of 2024, reaching US$30.56 million from US$6.73 million a year earlier. Pinterest's revenue is forecast to grow faster than the U.S. market at 12.2% annually, and earnings are expected to increase significantly by 28.9% per year over the next three years. A share repurchase program worth US$2 billion further underscores confidence in its growth trajectory.

- Click here and access our complete growth analysis report to understand the dynamics of Pinterest.

- The analysis detailed in our Pinterest valuation report hints at an deflated share price compared to its estimated value.

Block (NYSE:SQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Block, Inc., with a market cap of $57.12 billion, develops ecosystems centered on commerce and financial products and services both in the United States and internationally.

Operations: The company's revenue segments include $7.52 billion from Square and $16.14 billion from Cash App.

Insider Ownership: 10.2%

Earnings Growth Forecast: 23.9% p.a.

Block's insider ownership aligns with its growth narrative, despite recent substantial insider selling. The company's third-quarter results show a turnaround, with net income reaching US$283.75 million from a previous loss. Revenue is expected to grow at 9.6% annually, slightly above the U.S. market average, while earnings are projected to rise significantly by 23.9% per year over three years. Recent strategic initiatives include enhancing Square's product offerings and launching Bitkey's inheritance feature globally in early 2025.

- Click here to discover the nuances of Block with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Block's share price might be too optimistic.

Summing It All Up

- Gain an insight into the universe of 199 Fast Growing US Companies With High Insider Ownership by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TEAM

Atlassian

Through its subsidiaries, designs, develops, licenses, and maintains various software products worldwide.

Flawless balance sheet with high growth potential.