- United States

- /

- Software

- /

- NasdaqGM:SOUN

SoundHound AI (NasdaqGM:SOUN) Sees 44% Price Increase Over Last Quarter

Reviewed by Simply Wall St

SoundHound AI (NasdaqGM:SOUN) recently experienced a notable 43% increase in its share price over the last quarter, despite its removal from multiple key indices on June 30, 2025, indicating potential challenges in its market positioning. Interestingly, the company's quarterly earnings report in May showed solid financial improvements, while strategic collaborations, such as its partnership with Allina Health and collaboration with Tencent Intelligent Mobility, likely bolstered investor confidence. In a market that has largely remained flat amid macroeconomic uncertainties, these developments may have countered the broader trend, contributing significantly to its significant price movement.

Be aware that SoundHound AI is showing 3 risks in our investment analysis.

SoundHound AI's recent sheet price surge of 43% in a flat market underscores investor optimism following its strategic partnerships and solid earnings report. Despite being removed from major indices, SoundHound's proactive collaborations with companies like Allina Health and Tencent Intelligent Mobility appear to have renewed investor confidence. The integration of the Polaris model to fortify its leadership in voice AI, coupled with its expansion into voice commerce, is expected to bolster revenue through new partnerships and higher royalties.

Over the past three years, SoundHound AI has generated a total return of 263.14%, offering investors a substantial longer-term gain. This performance stands in contrast to its one-year return, which surpassed both the US market and the US Software industry returns of 12.6% and 20.2%, respectively. However, challenges remain with its high R&D expenses and dependency on partners, which could affect net margins and revenue predictability.

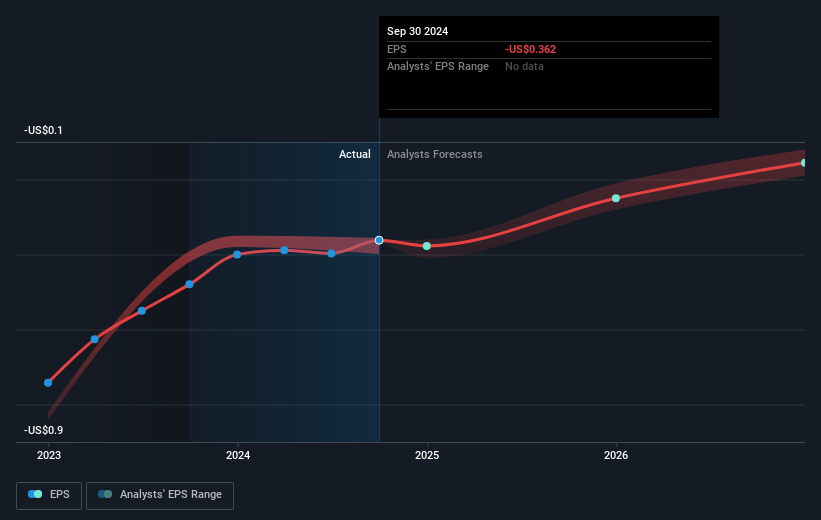

With future earnings not forecasted to turn profitable within the next three years, the latest initiatives, like the introduction of a voice commerce ecosystem, are critical for future revenue streams. The company's elevated price relative to market expectations poses a valuation challenge, with its current share price slightly discounted compared to the analyst consensus price target of US$13.93. This discount indicates that while investor sentiment is strong, there are apparent risks and volatilities that need to be traversed for long-term gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SOUN

SoundHound AI

Develops independent voice artificial intelligence (AI) solutions that enables businesses across automotive, TV, and IoT, and to customer service industries to deliver high-quality conversational experiences to their customers in the United States, Korea, France, Japan, Germany, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives