- United States

- /

- Software

- /

- NasdaqGS:SNPS

Synopsys (NasdaqGS:SNPS) Advances AI Chip Design With TSMC Collaborations

Reviewed by Simply Wall St

Synopsys (NasdaqGS:SNPS) experienced a 1.58% price increase over the last week amidst its partnership with TSMC, aimed at advancing semiconductor innovations in AI and RF technologies. While improvements like enhanced EDA and IP solutions may have added positive sentiment, the broader market context saw a 2.3% rise, driven by a tech rally, particularly among chipmakers. Although Synopsys's move aligned with the general market uptrend, the detailed collaboration announcements likely reinforced investor confidence in the company's growth trajectory amid favorable sector conditions. The increase fits well within the broader tech sector gains, notably led by semiconductor advancements.

Buy, Hold or Sell Synopsys? View our complete analysis and fair value estimate and you decide.

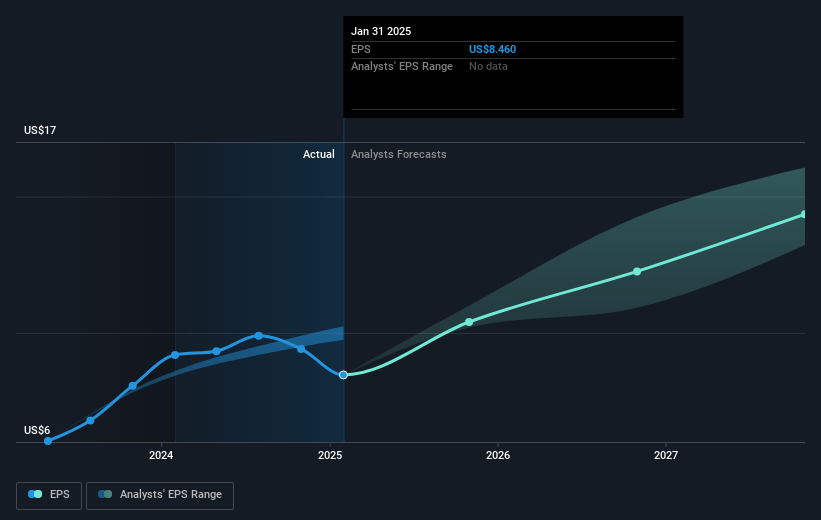

The recent partnership between Synopsys and TSMC has the potential to significantly shape the company's outlook by bolstering its reputation in semiconductor innovation, particularly in AI and RF technologies. With a 167.22% total return over the past five years, Synopsys' long-term performance remains robust. This return starkly contrasts with its performance over the last year, where it underperformed the US Software industry, which saw a 2.2% gain. The current partnership might invigorate the company's trajectory, potentially enhancing future revenue and earnings forecasts as analysts anticipate influential advancements through their collaboration.

While the company's strong five-year performance reflects its solid market positioning, the news aligns with Synopsys' growth narrative around the integration of AI-powered solutions. The partnership's potential to increase demand for Synopsys' products could improve revenue and earnings forecasts, supporting analysts' expectations of $2.3 billion in earnings by 2028. This development bears relevance to the company's market valuation, where its recent price of US$413.40 marks an approximately 30% discount to the consensus analyst price target of US$598.25, suggesting potential for price appreciation as the collaboration with TSMC unfolds.

Review our growth performance report to gain insights into Synopsys' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNPS

Synopsys

Provides electronic design automation software products used to design and test integrated circuits.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)