- United States

- /

- Software

- /

- NasdaqCM:SLNH

Soluna Holdings (SLNH) Secures $100M Credit and New Partnerships Is Its Bitcoin Pivot a Game Changer?

Reviewed by Sasha Jovanovic

- Soluna Holdings recently secured a US$100 million credit facility from Generate Capital, refinanced its green data center projects, resolved issues with former lender NYDIG, and entered new agreements with KULR Technology Group and Canaan Inc. to enhance its Bitcoin mining capabilities and broaden its customer base.

- The new hosting partnership with KULR marks Soluna’s first direct engagement with a Bitcoin treasury-focused company, expanding its reach beyond traditional Bitcoin miners and providing a template for innovative service models in the industry.

- We’ll explore how the US$100 million credit facility and pivot toward Bitcoin+ partnerships is shaping Soluna’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Soluna Holdings' Investment Narrative?

For someone considering Soluna Holdings, the investment story increasingly revolves around its ability to unlock value from renewable-powered computing and Bitcoin mining services. The recently secured US$100 million credit facility from Generate Capital and new partnerships, most notably with KULR Technology Group, signal a potential shift in both growth catalysts and risk profile. Previously, capital constraints and lender disputes were major hurdles; with the refinancing and new credit facility, those concerns look less acute. Instead, the focus may turn to how rapidly Soluna can translate expanded capacity and a broader customer base into stronger revenue after a period of contracting sales. However, the move to increase authorized shares and a history of shareholder dilution also remain front of mind. The KULR partnership, while promising as a proof-of-concept for diversification, is still early stage and puts execution and profitability under the spotlight. But with new share issuance potentially on the horizon, dilution risk is something investors should watch closely.

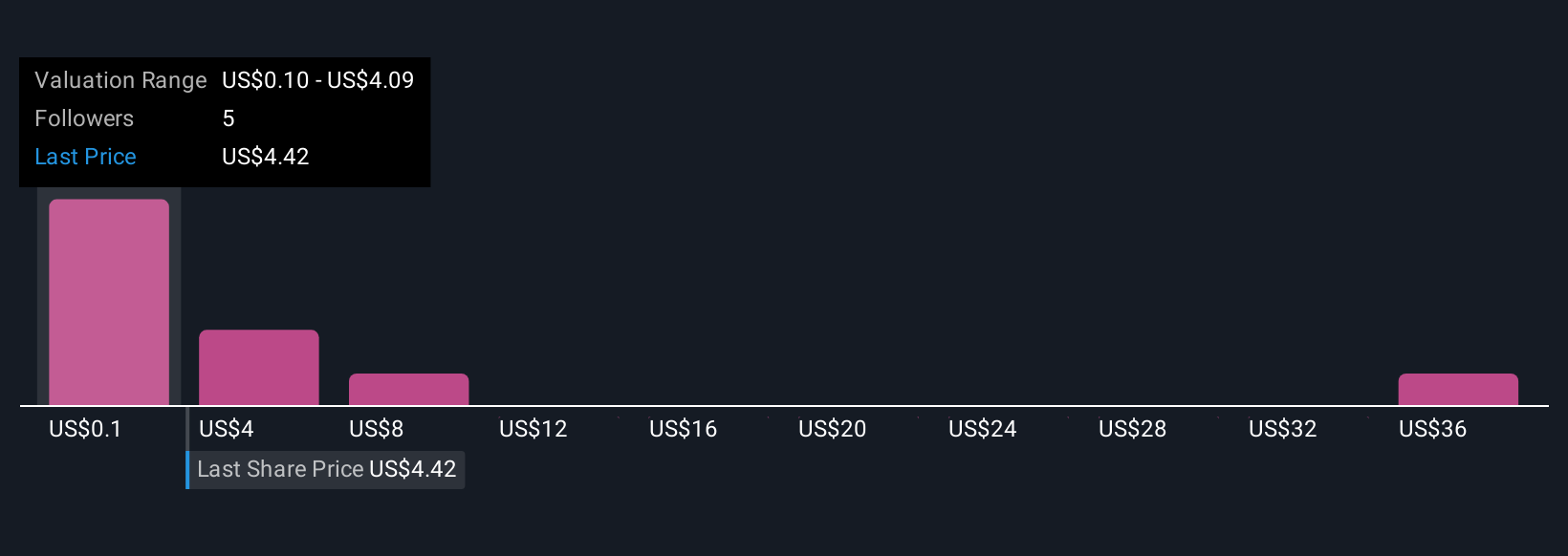

Insights from our recent valuation report point to the potential overvaluation of Soluna Holdings shares in the market.Exploring Other Perspectives

Explore 8 other fair value estimates on Soluna Holdings - why the stock might be worth less than half the current price!

Build Your Own Soluna Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Soluna Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Soluna Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Soluna Holdings' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SLNH

Soluna Holdings

Engages in the mining of cryptocurrency through data centres.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)