- United States

- /

- Software

- /

- NasdaqGM:RZLV

Stablecoin Tie-Up, Visual Search Launch, and Leadership Hire Might Change the Case for Investing in Rezolve AI (RZLV)

Reviewed by Simply Wall St

- Rezolve AI has announced several major developments, including the launch of its Visual Search capability, a collaboration with Tether around USAT stablecoin integration, and the appointment of Crispin Lowery, formerly of Microsoft and Google, as Executive Vice President, Growth.

- These moves reinforce Rezolve AI’s leadership in combining proprietary AI-driven commerce solutions with regulated crypto payments, while attracting top talent to support its global expansion.

- We'll examine how alignment with US stablecoin regulation is strengthening Rezolve AI's investment narrative at a critical growth phase.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Rezolve AI's Investment Narrative?

To be a shareholder in Rezolve AI right now, you’d need to see a credible path for its blend of proprietary AI commerce solutions and embedded regulated crypto payments to unlock substantial value in the $30 trillion global retail market. The company’s recent rollouts, like Visual Search and the partnership with Tether to leverage USAT stablecoin rails, look well-timed, and the hire of ex-Microsoft and Google executive Crispin Lowery signals ambition for serious global expansion. These developments might shift the needle, especially as regulatory alignment on stablecoins in the US could open revenue channels that were previously off-limits. Despite these advances, Rezolve remains far from profitability, has negative equity, and is facing a civil complaint, all while operating with significant share price volatility and past shareholder dilution. If the latest product and leadership moves accelerate top-line adoption or ease regulatory risk, they could enhance near-term momentum. But the big risks, continued cash burn and legal uncertainty, still loom large, even as short-term enthusiasm builds around new technology and leadership depth.

But with dilution and profitability still unresolved, there’s more you need to know before making any decisions. Rezolve AI's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

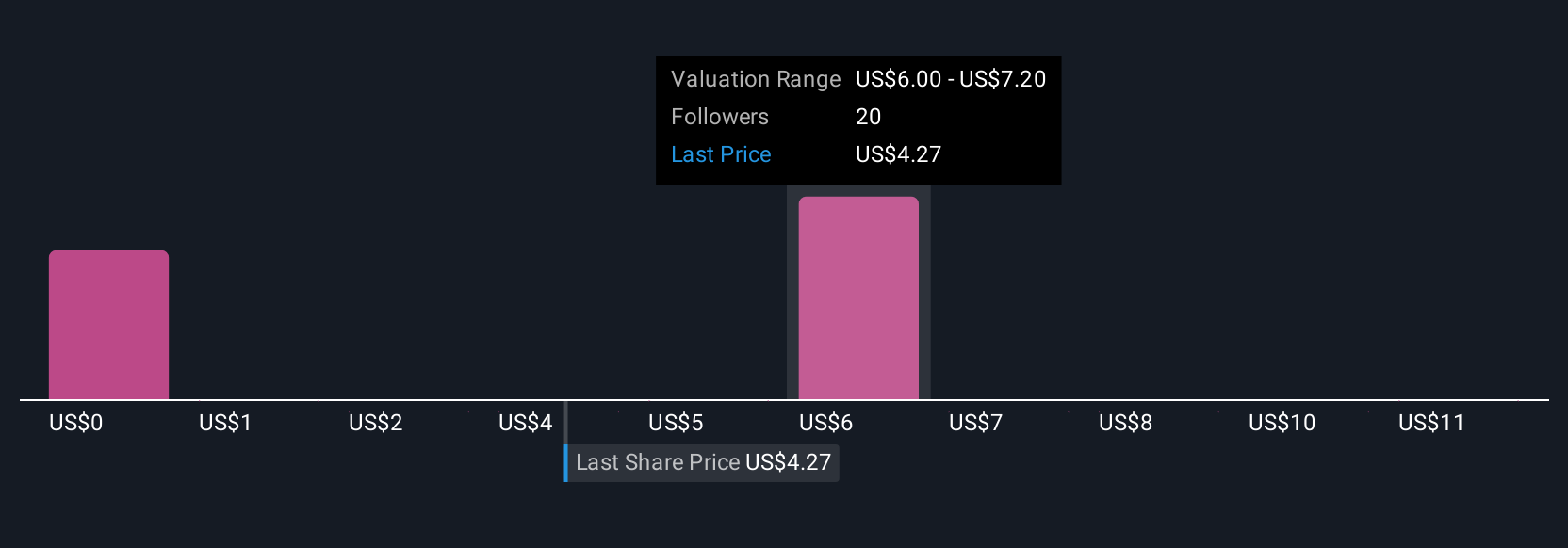

Explore 11 other fair value estimates on Rezolve AI - why the stock might be worth as much as $6.96!

Build Your Own Rezolve AI Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rezolve AI research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Rezolve AI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rezolve AI's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RZLV

Rezolve AI

Provides generative AI solutions for the retail and e-commerce sectors.

Moderate risk with limited growth.

Market Insights

Community Narratives